If you're considering buying or leasing an EV, you want to know the entire cost of ownership—not just the upfront cost.

This means you'll have to shop around for insurance. As a general rule, the more a car costs to purchase, the more expensive it is to replace and repair, and the more expensive it is to insure.

While it probably doesn't strike you as surprising that a Porsche is more expensive to insure than a Hyundai, EV insurance differs in several ways.

The good news is there are affordable options if you know where to look.

What Makes EV Insurance Different?

While factors such as where you live, how much you drive, age, gender, military affiliation, and deductible limits will impact your annual premium regardless of your vehicle's powertrain, EV insurance is different in three major ways.

1. Lack of Qualified Technicians = Higher Repair Costs

If your EV is in an accident, the repair process involves not only a body shop to assess and fix the cosmetic and structural damage, but often a technician to examine the vehicle to ensure it is operating as intended.

Right now, it's hard to find any automotive technicians—those qualified to work on EVs are even rarer. This scarcity equates to high labor rates.

2. Battery

Even if EVs have fewer parts, many of those parts are expensive. If you're wondering how much a Tesla replacement battery costs, you might be taken aback by the five-figure price tag.

Batteries also present safety issues. Knowing someone whose shop (and the neighbors) was reduced to ashes after a tech applied heat too close to a Prius battery, I can personally attest that one needs to take extreme caution when working with lithium-ion batteries.

3. Weight

Recall Newton's second law from high school physics, and you'll understand why a heavier object can cause more damage in a collision. Even if kinematics wasn't your strong suit: Which would you prefer to have accidentally run into you? An elephant or a squirrel?

Batteries add weight to EVs, and this additional force factor is weighed into risk calculations by insurance actuaries.

Is EV Insurance Pricing Fair?

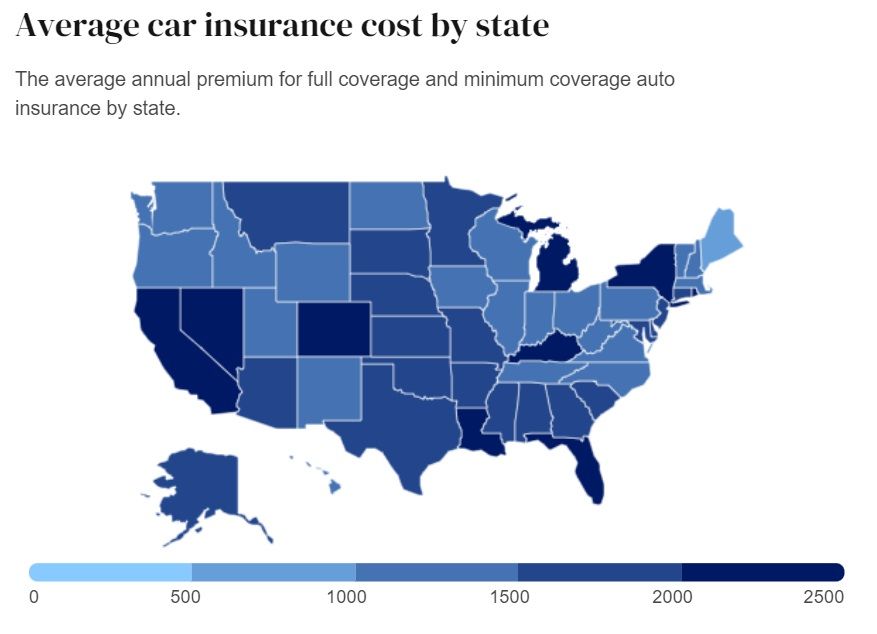

Fair or not, much of what determines your EV's insurance premium is beyond one's control or questionable. For example, where you live can make a huge difference. Bankrate's interactive map allows you to see how premiums vary throughout the country. If you live in a state like Michigan with expensive insurance premiums, expect to pay over two times as much for any kind of vehicle as you would in a state like Maine that has lower insurance requirements.

Tesla says: "Many providers base your premium on information that has little to do with your driving."

That's why Tesla created its own insurance company with premiums based on your Safety Score. Improving your Tesla Safety Score could lower your premiums

Which EVs Are Cheapest to Insure

It turns out that the most affordable EVs you can buy are also the cheapest ones to insure. As per Forbes, the cheapest EVs to insure are:

- Mini Cooper SE: $1,479 annual premium

- Hyundai Kona SEL: $1,498

- Hyundai Kona Limited: $1,534

- Kia Niro EV EX: $1,577

- Kia Niro EV EX Premium: $1,687

- Nissan Leaf S: $1,756

- Chevrolet Bolt EV LT: $1,777

- Ford F-150 Lightning Pro: $1,792

- Ford F-150 Lightning Platinum: $1,792

- Ford F-150 Lightning Lariat: $1,792

Total Cost of EV Ownership

Insurance is just one factor you'll need to figure out to accurately calculate your budget.

If you're looking at pre-owned EVs, you'll want to know which ones qualify for the EV tax credit. If you're shopping new, there are manufacturing restrictions, though these EVs qualify for the credit.

Along with insurance and tax credit, maintenance is another essential factor to consider. According to Yale Climate Connections, EVs can be up to 40% less expensive to maintain than ICEs. And, of course, you won't be paying for fuel but rather for charging.

Though calculating the total cost of EV ownership involves accounting for all these factors, it might make sense for you.

The Future of EV Insurance

For insurers, all policies are a trade-off between profitability and market competition. EVs occupy a precarious position in the marketplace. Though they carry certain risks, only time will tell if certain models are truly at higher risk. In the meantime, the best thing to do is to shop around and carefully compare the coverage between providers.