If you have debt—and let's be honest, who doesn't?—it can feel overwhelming and maybe even impossible to pay it off. With a debt management app, you can help take control of your finances and come up with a plan that works for you to pay off your debts smarter and faster.

Here are seven of the best debt management apps for Android and iOS that you can download right now to get you back on track.

1. Debt Payoff Planner

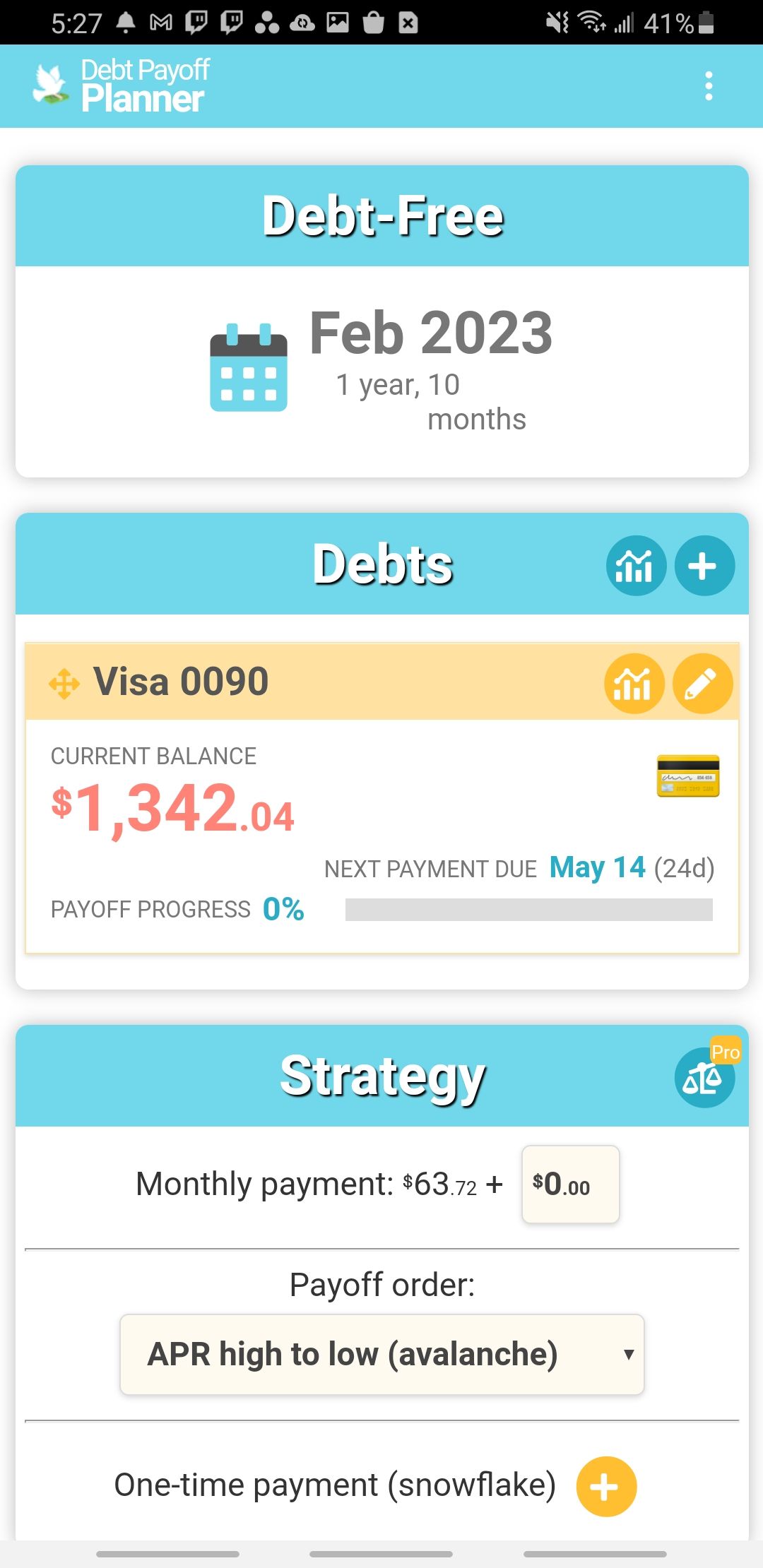

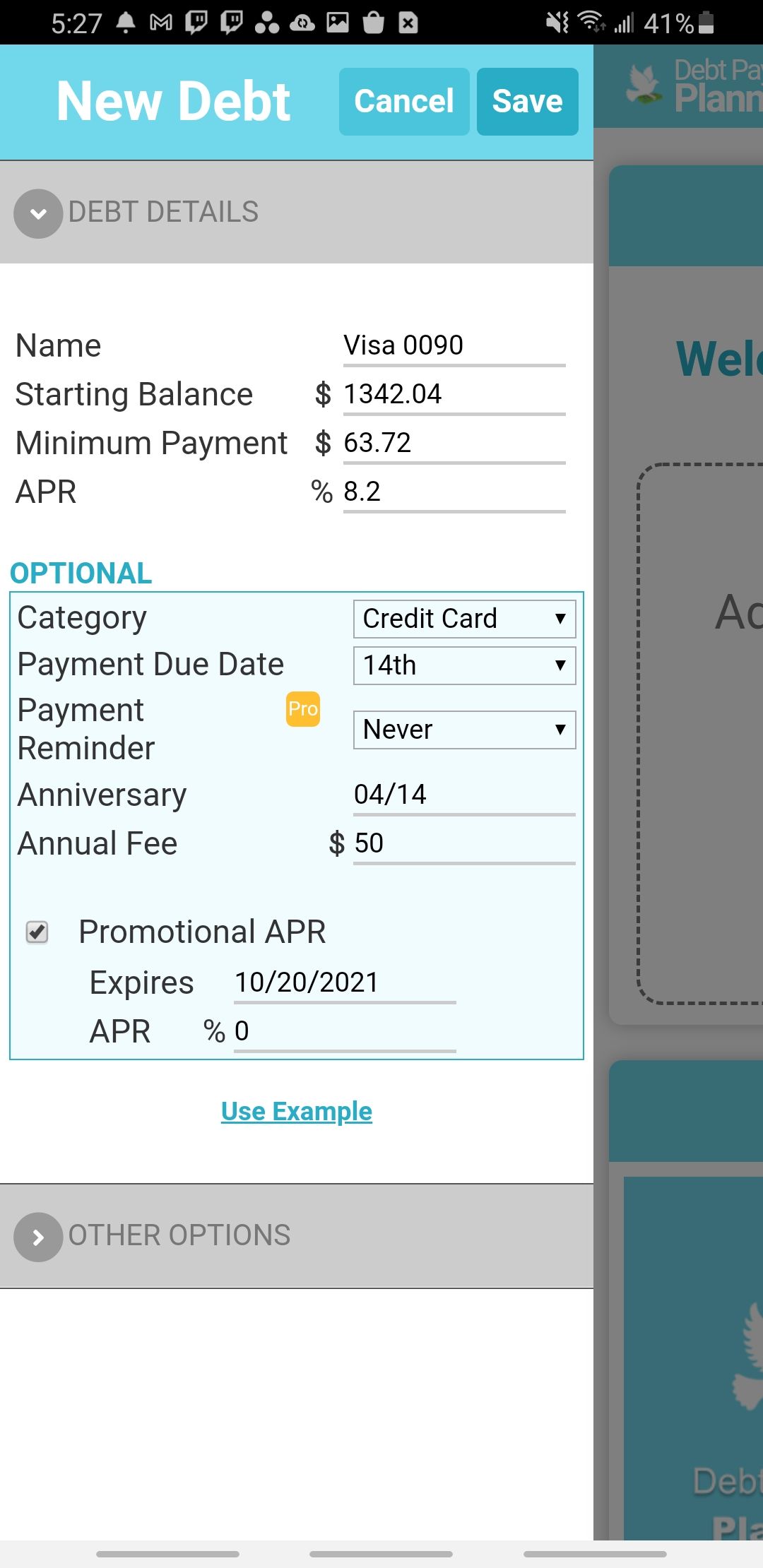

The Debt Payoff Planner app is a great way to manage all of your debt and pay it off with a few different methods. The app recommends using Dave Ramsey's Debt Snowball method and paying off your lowest debts first, but there are other options to choose from.

You enter your debts one by one, listing the amount, your annual percentage rate (APR), minimum payment, and some other optional information.

Once you've entered all your debts, the app will recommend which to start paying off first and when it estimates you will be debt free. This date changes as you play around with different payoff methods or a greater monthly payment, so figure out what works best for you.

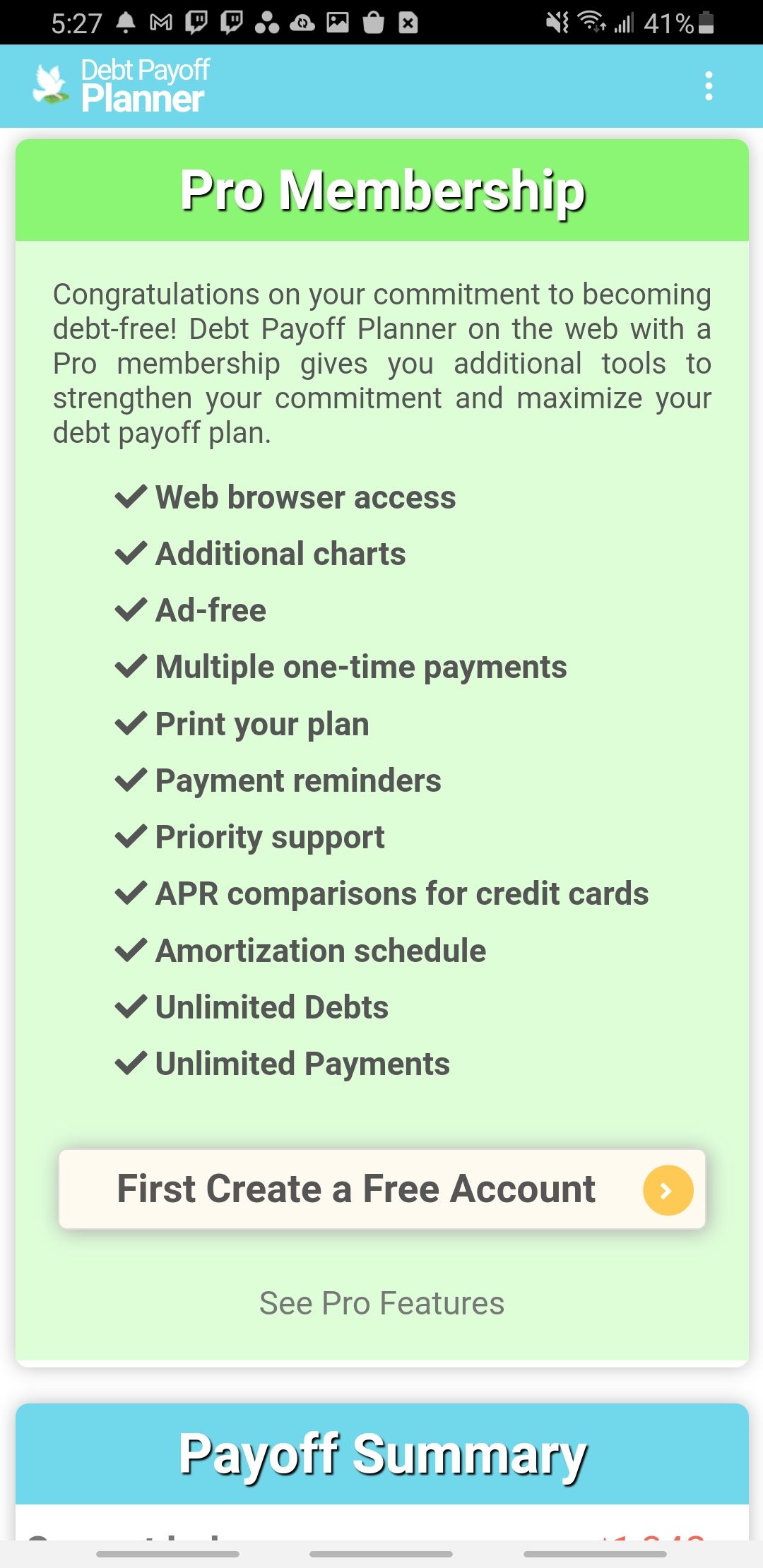

If you find that you like the app and want more out of it, there's a Pro version you can pay for monthly. The Pro version gives you access to print out a hard copy of your plan, detailed charts, payment reminders, and an ad-free version of the app.

Download: Debt Payoff Planner for Android | iOS (Free, subscription available)

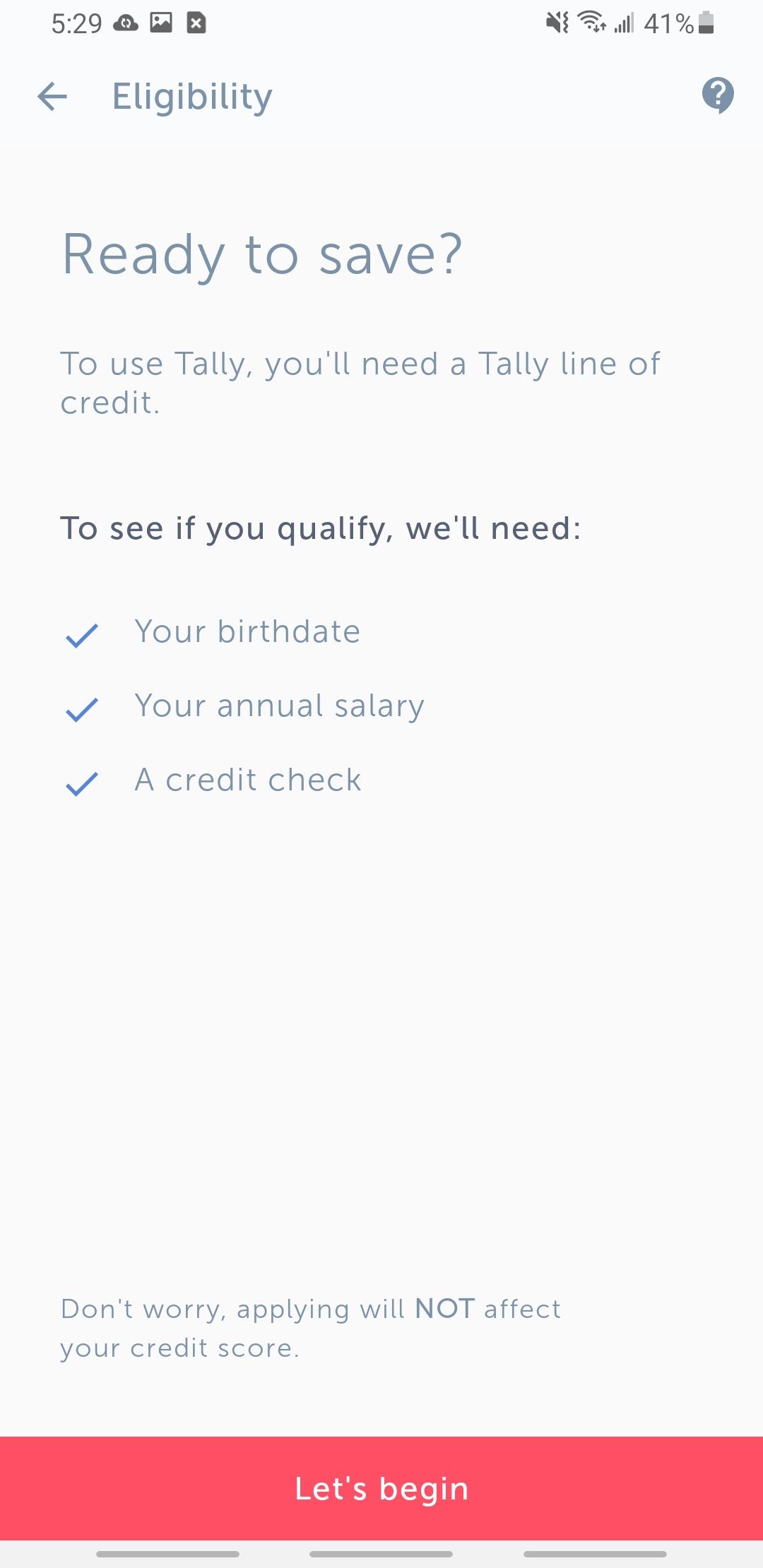

2. Tally

Tally is an automated debt manager that not just everyone can get. You can only qualify for a Tally account by applying and you need a FICO score of 660 or higher in order to qualify. It won't hurt your credit score to apply, but Tally does have to check your credit score before you're able to use the app.

Tally securely analyzes your credit cards to figure out what's best for you. Then, Tally opens up a line of credit for you with a lower APR than most of your credit cards and other debts probably have. Tally uses that line of credit to pay off your debts each month and you just make one payment to Tally instead of multiple payments to all your different debts.

Tally will give you an estimate on when you can expect to be debt free. Of course, this date is not set in stone as you might accumulate more debt or be able to pay off your debts faster than you expected. Either way, Tally helps you automate everything so you don't have to worry about missing payment due dates, getting charged late fees, or paying ridiculously high APRs.

Download: Tally for Android | iOS (Free)

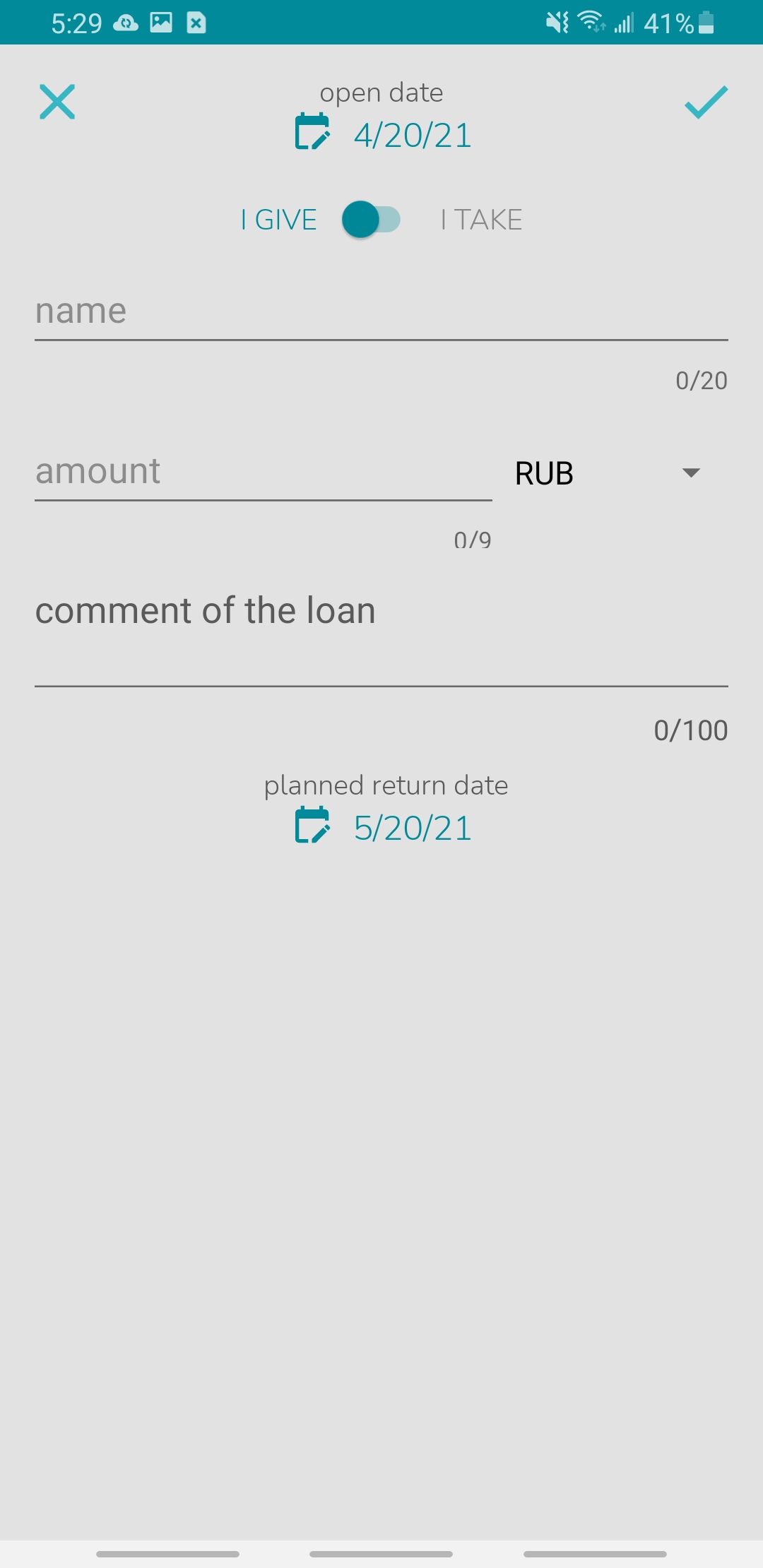

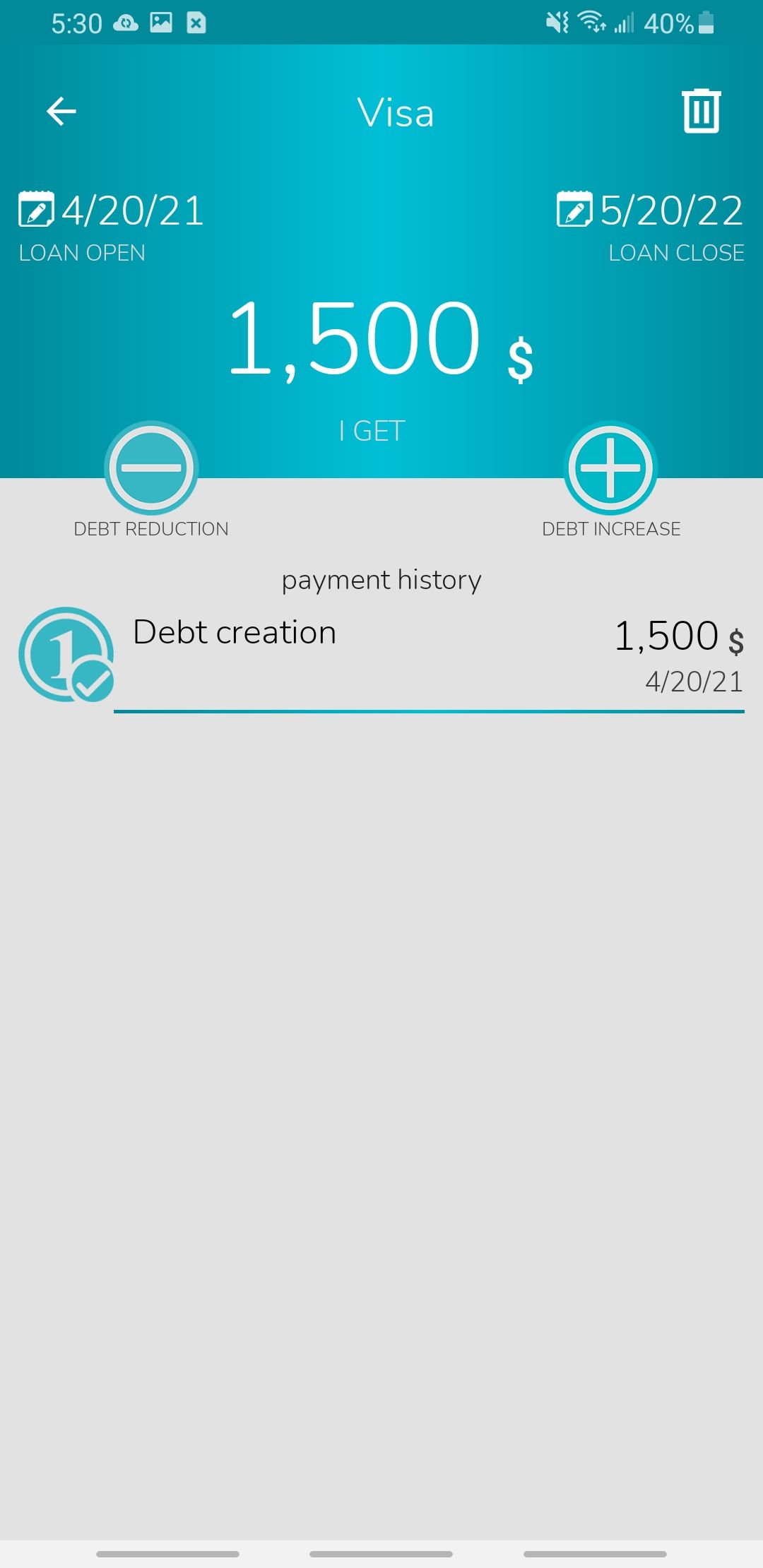

3. Debts

The Debts app has a simpler interface for people who just want to list their debts out to see them all in one place. When you enter a loan, you can enter in a name, an amount, any additional comments, and set a planned payment date for the entire loan.

This app doesn't have the ability to calculate APRs on credit cards or loans, so it'll be up to you to keep the total amounts updated. When you pay a credit card down, you can enter the payment and it'll automatically deduct it from your total.

Although your main reason for using this app will be to keep track of who you owe money to, the Debts app can also keep track of who owes you money as well.

Download: Debts for Android (Free, in-app purchases available)

4. Digit

Digit is highly praised and has great reviews on app stores for good reason. Digit gets to know your personal spending habits and starts to save money here and there when it thinks you have money to spare.

And before you worry about your checking account potentially becoming overdrawn, you should know that Digit has an Overdraft Prevention feature. This feature makes sure to move money back into your checking account to avoid overdraft fees if it knows something is going to come out and you don't have enough money in there to cover it.

It can be hard for you to remember to save money so Digit does it automatically. And you can transfer the money you've saved in Digit to your bank account to pay down your credit cards or loans and get rid of your debt even faster.

Download: Digit for Android | iOS (Free)

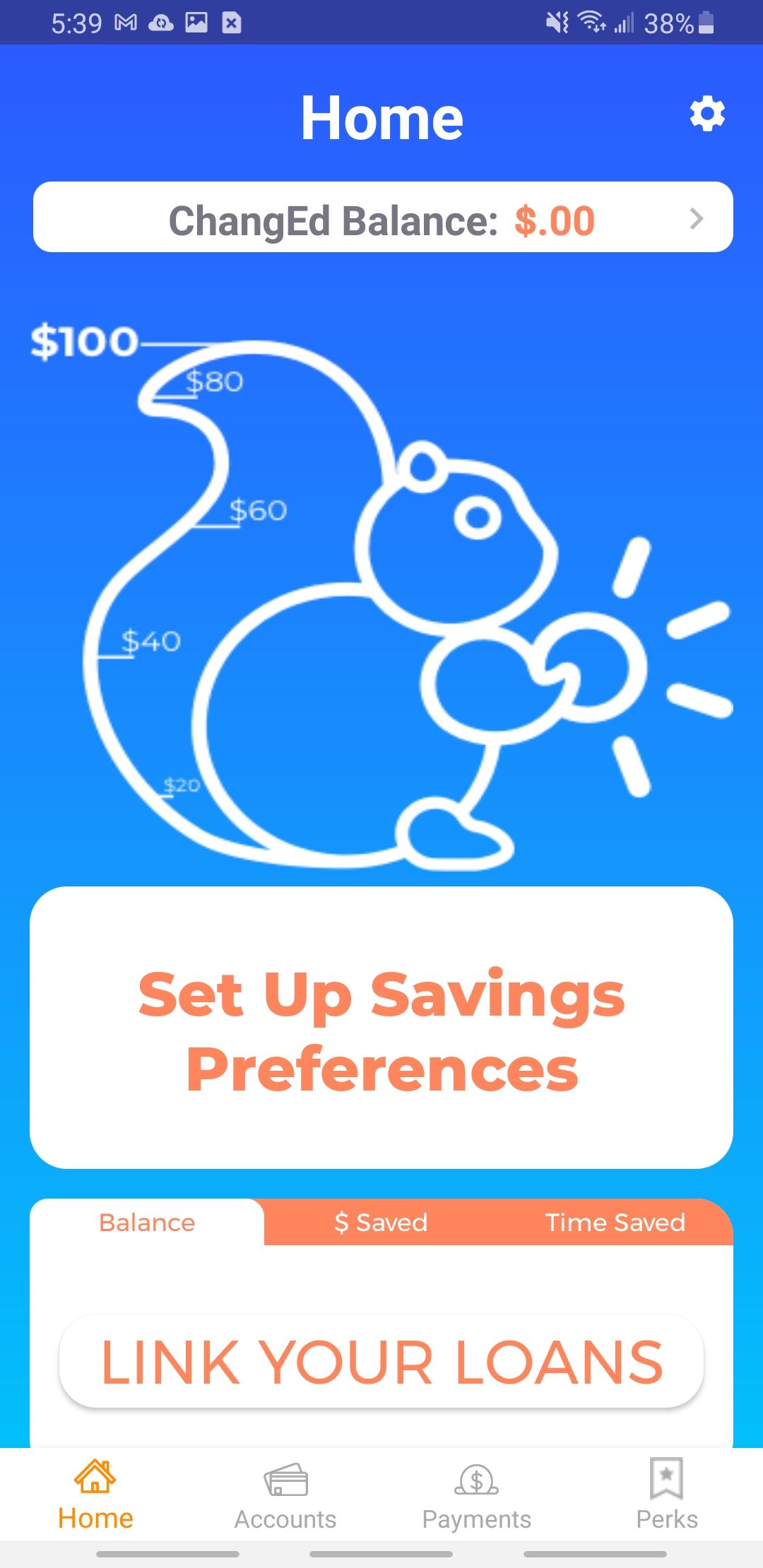

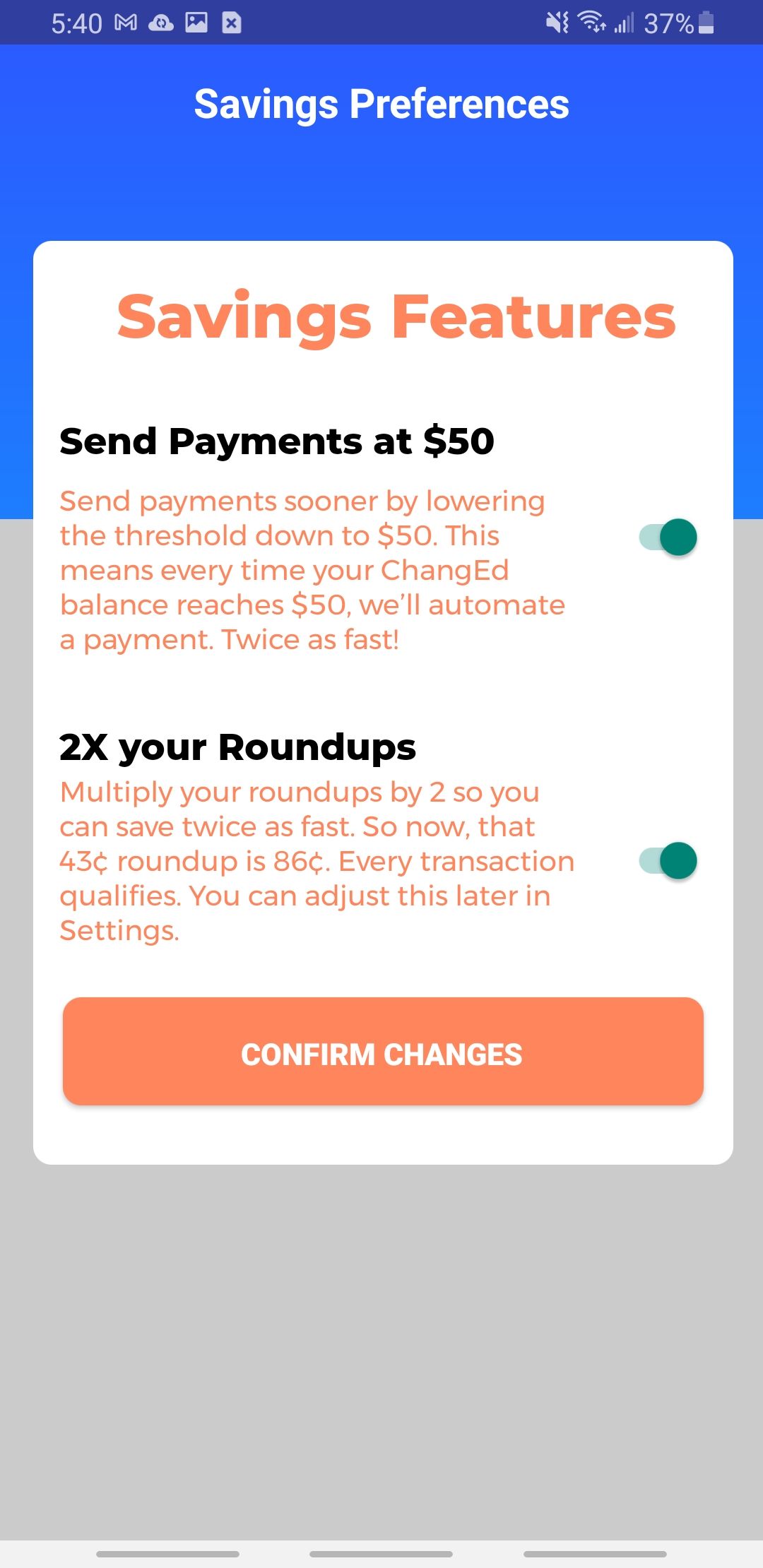

5. ChangEd

If you mainly have student loan debt that you just can't seem to pay off, the ChangEd app is the one for you. ChangEd works similarly to other spare change programs like Bank of America's Keep the Change program. It saves your extra change and lets it accumulate in your account.

Once you hit a certain threshold that you set, ChangEd will automatically send it as an extra payment towards your student loans. They work with most major student loan servicers, like Navient, Great Lakes, AES, and more.

You can add one or multiple student loans to your account. And you can add more than one credit or debit card for ChangEd to pull rounded up change from.

Download: ChangEd for Android | iOS (Free to download, $3 monthly fee from your ChangEd balance)

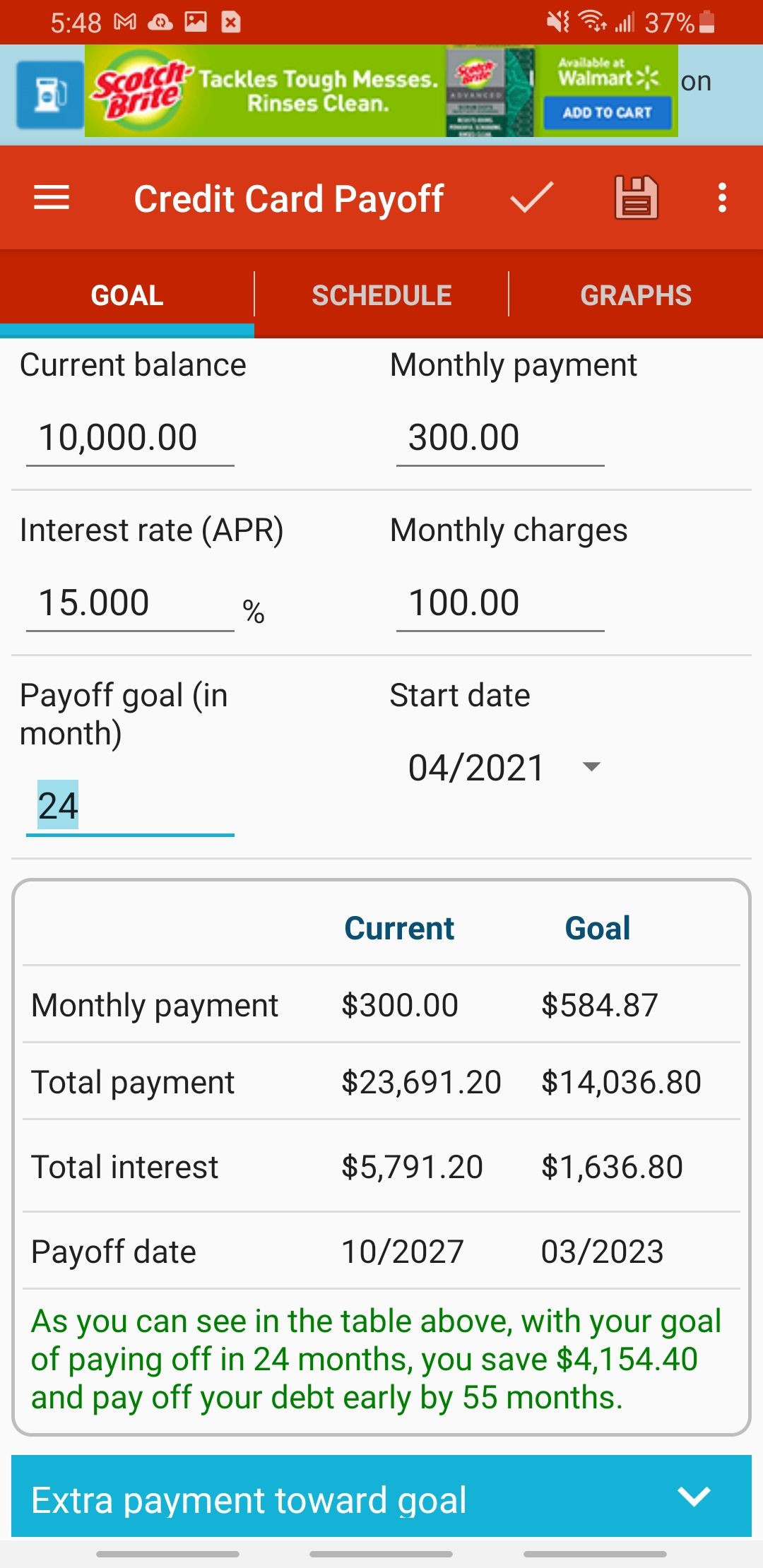

6. Credit Card Payoff

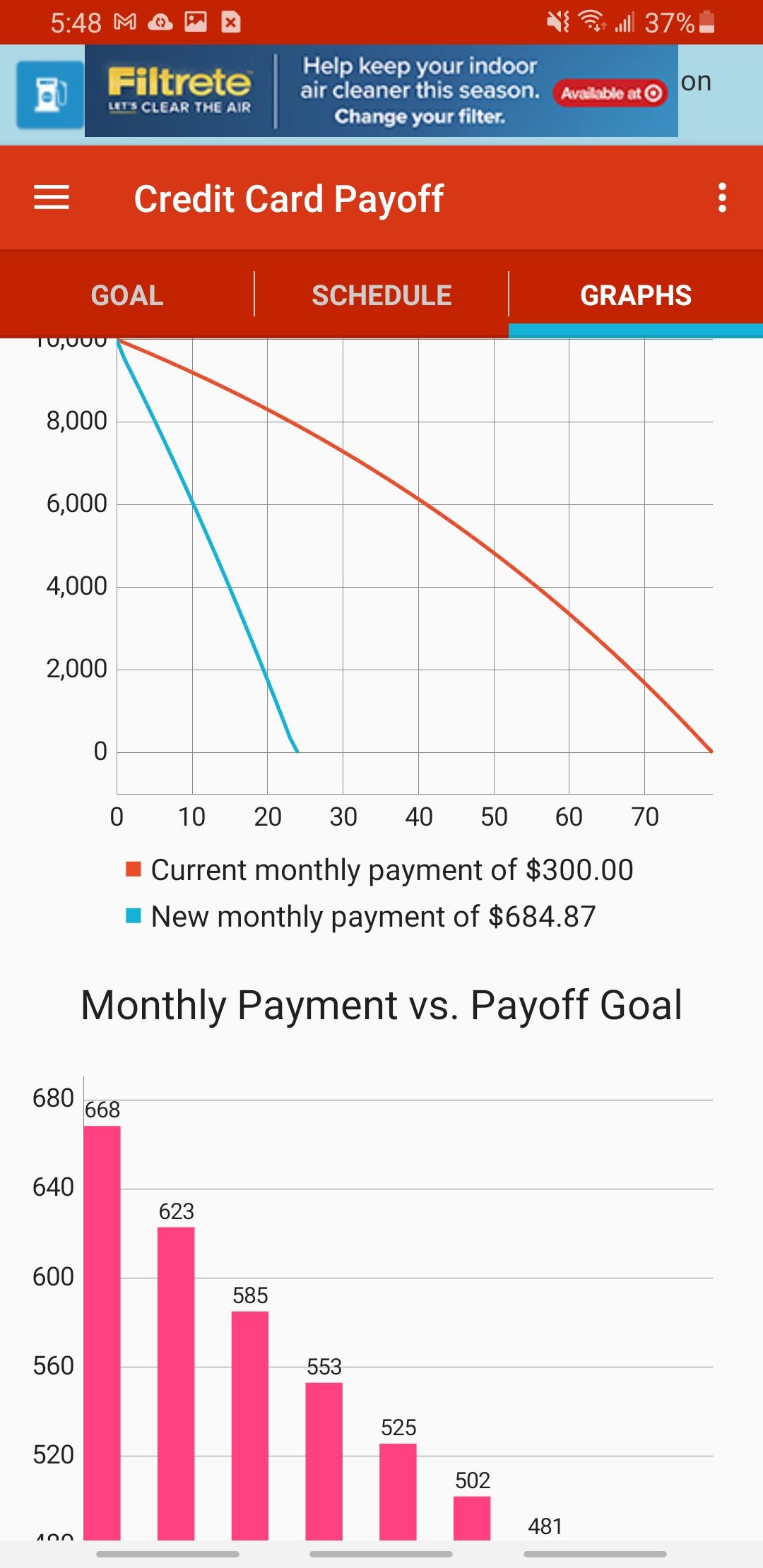

If you have a lot of credit card debt specifically, this app is a great tool to help you get rid of it. It's so easy to mess with your monthly payment and see how it will affect you in the long run in terms of how much money you'll save in interest.

You can enter your balance, monthly payment, the APR, and how many months you want to pay it off in. The app takes all that information and breaks it down for you to see in multiple ways.

What's great about this app is how differently it presents the information. It gives you an estimated stretch goal and tells you how much of a difference it'll make. Then you can see all of your payments mapped out over each year and how each payment is split between principal and interest. You can also see your debt payoff plan in a bar graph or a line graph too if you're more of a visual person.

The only in-app purchase is to upgrade to an ad-free version.

Download: Credit Card Payoff for Android (Free)

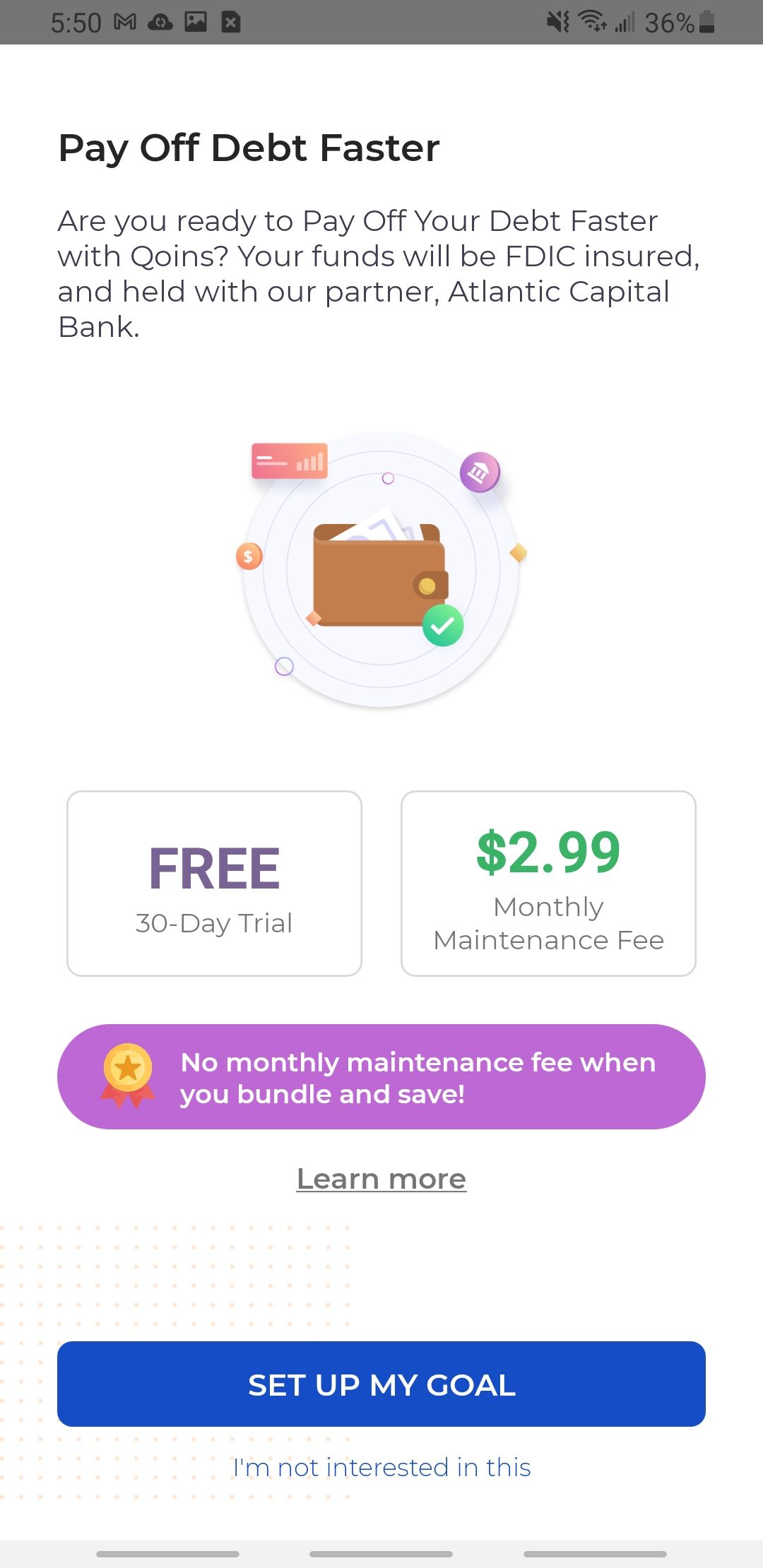

7. Qoins

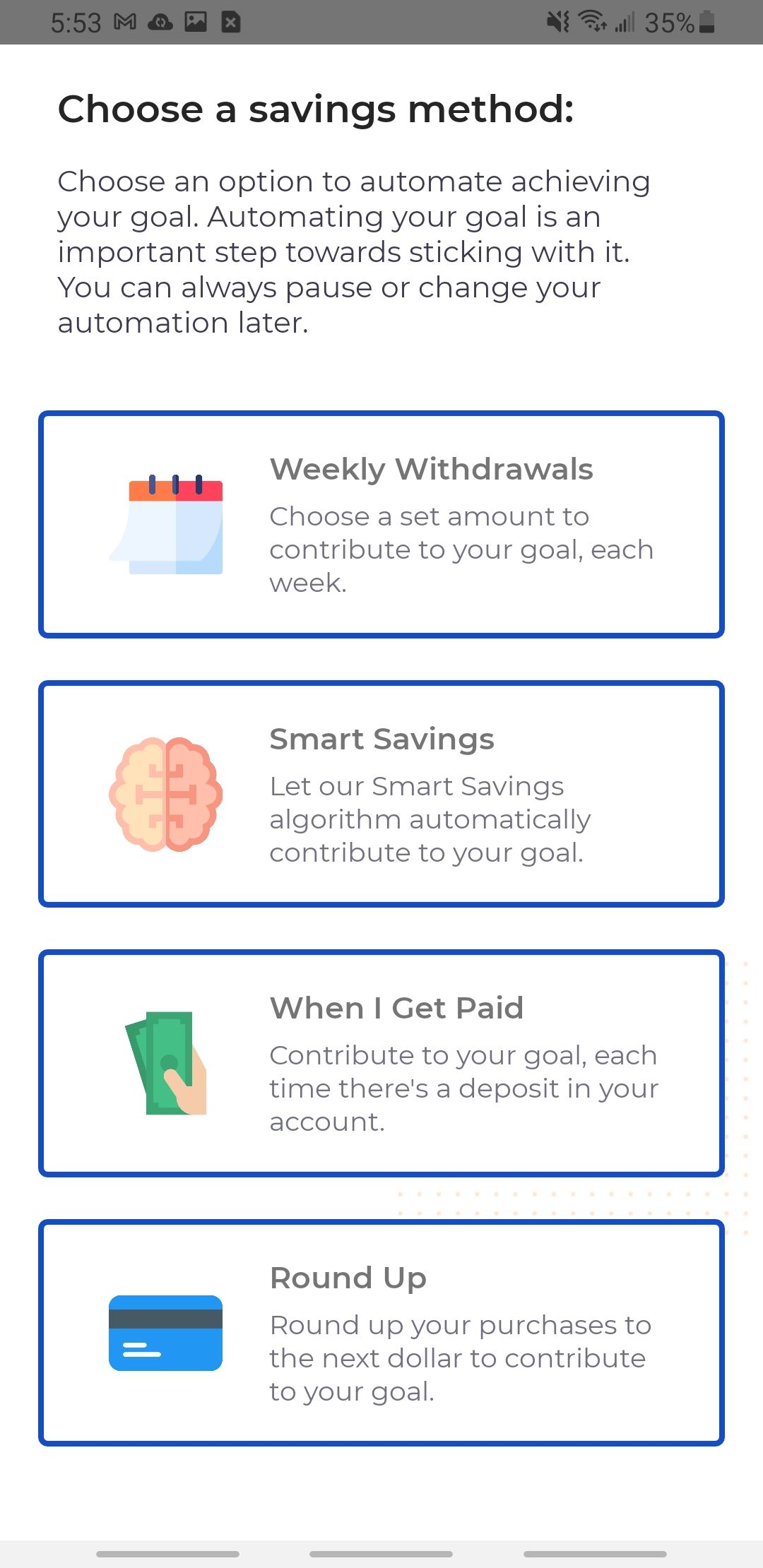

The Qoins app is similar to the ChangEd app, only your spare change doesn't go towards student loans. Qoins is linked to your bank account and it saves based on your preferences.

There are a few different savings methods you can take advantage of. You can choose to withdraw a certain amount each week, let the app take out however much it thinks you have to spare using an algorithm, or take out a certain amount when you get a direct deposit. Or, you can also choose to round up your purchases to the next dollar.

Whichever saving method you choose, you'll be saving more easily without thinking about it. At the end of the month, pay that extra money towards your debts and they'll be paid off sooner.

Download: Qoins for Android | iOS (Free to download, $3 monthly fee from your Qoins balance)

Make Sure You Have a Strong Budget Too

All of these apps will help you pay down your debts faster. It's just a matter of which one works best for you based on the kinds of debts you have.

And in addition to keeping track of your debt and making sure you're paying regularly and smartly on it, make sure you have strong budgeting skills too. Excel and Google Sheets are both great tools for keeping budgets and keeping track of expenses.