If you're going to trade crypto, you must conduct technical analysis to achieve consistent results.

You need to do some calculations to predict price movement when trading. Trading becomes a gamble if all you do is place a buy or sell order based on intuition or guesswork, and one of the important things traders do to get information about what is happening in the market is technical analysis.

So, what is technical analysis, and what tools and indicators do you need to carry it out?

What Is Technical Analysis?

Technical analysis involves using mathematical indicators to evaluate statistical trends to predict price direction in the crypto market. This is done by looking at past price changes and volume data to determine how the market works and predict how it will affect future price changes.

Technical analysis methods evaluate crypto markets and identify trading opportunities through price trends and patterns seen on charts. They are based on the belief that a crypto's past trading activity and price changes are valuable indicators in determining future price and activity.

Three Basic Assumptions Behind Technical Analysis

Technical analysis is based on three assumptions, and we will look at them briefly in this section.

1. The Market Discounts Itself

This assumption holds that everything in the market that could affect the price of crypto is reflected in its price. The price shows you everything you need to know about a crypto asset. You don't have to consider the fundamental factors that affect a crypto asset to determine its price movements.

Say, for example, you notice that a crypto asset's price is decreasing. You can use the information in the chart, like the candlestick pattern, the extent of the price fall, and other technical information to know if it is best to invest in such a coin at such a time.

2. Price Moves In a Trend

Price action always exhibits trends, even in random market movements, regardless of the timeframe you use. The green and red candlesticks show the trend pattern and direction of the price.

Prices are believed to follow a trend. A future price movement is more likely to follow an established trend. The price trend could be upward, downward, or sideways (to the right).

3. History Repeats Itself

The repetitive nature of the crypto market means that analyzing previous patterns can help you predict future market movements.

Market participants usually exhibit consistent reactions to market happenings over time. Even though some chart patterns formed a long time ago, they are still considered important as they could happen again.

Six Basic Technical Analysis Tools and Indicators

The following six tools and indicators are usually used to conduct technical analysis when trading cryptocurrencies.

1. Candlestick Chart

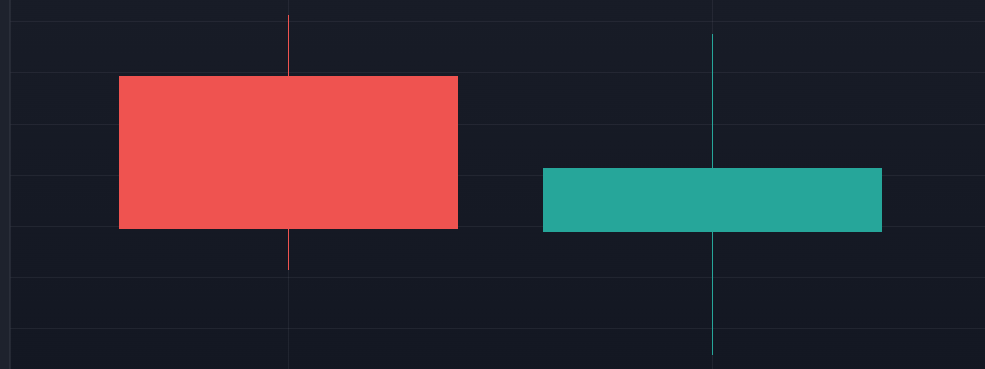

Traders prefer candlestick charts because they show more information about price movement. Each candlestick represents the activity around the timeframe you choose for trade analysis. So, if you're working within a four-hour timeframe, each candlestick will represent the price movement every four hours.

Candlesticks consist of a body and wicks. The body can either be green (increase) or red (declines).

Green candlesticks indicate that a trade closed higher than its opening price. The base shows the opening price while the top shows the closing price. On the other hand, the red candlesticks show that the trade closed lower than the opening price. The candlestick's wick shows how high and low the price was within the timeframe—the peak of the top wick shows the highest price, while the tip of the base wick shows the lowest transaction price.

2. Support and Resistance

Understanding support and resistance levels will help you interpret key chart levels easily. They are specific price levels that the market finds difficult to exceed. A support level is a point where prices stop moving lower, while resistance is the point where the market price can't increase further.

The support level seems like the bouncing spot for asset prices; once the market falls to that point, it picks up again. On the other hand, once the price rises to the resistance level, which acts as an upper barrier, it drops back.

Once you identify these levels, you can use them to form your market price predictions. The resistance is a point where a bullish pressure will most likely stop, and the price will start to drop again, while the support is the point where there is likely to be a bullish reversal (for a price rise).

3. Trend Lines

These are used to draw out potential trends in the market, and they take different forms. Traders also draw out multiple trend lines to draw out more complex patterns. A trend line is a single line that connects different high and low price points. The more the price point connects to the line, the stronger the trend.

4. Moving Average

The indicator helps you track the price trend by taking the average of past prices of a crypto asset over a defined period. You can adjust the period to a suitable timeframe to generate reliable signals in a real-time trading chart. Moving averages offer insights into the market direction and help determine a good trade entry price.

There are two common types of moving average: the simple moving average, which indicates the average of total prices over a particular period, and the exponential moving average, which prefers the most recent prices without really considering previous price movements. The most commonly used moving averages are the 10,20, 30,50, 100, and 200-day moving averages.

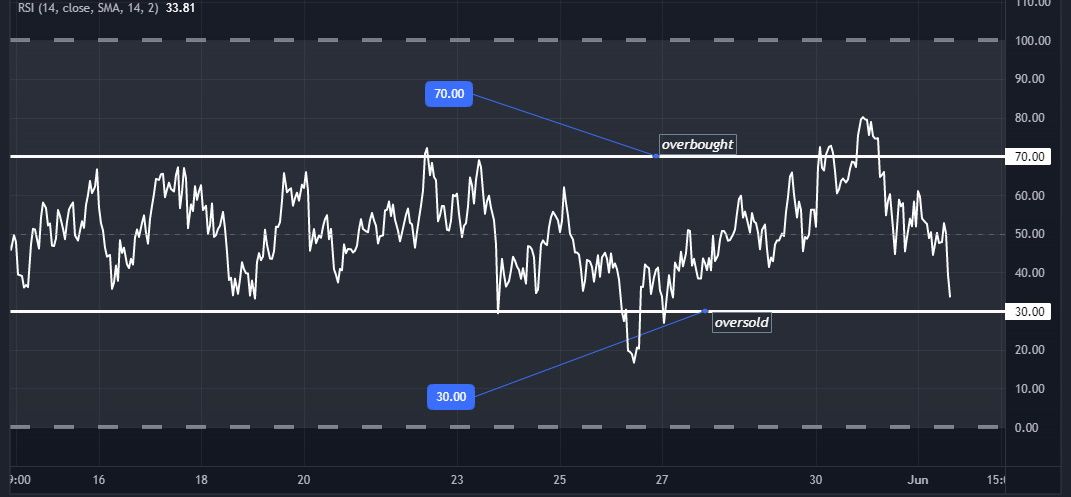

5. Relative Strength Index (RSI)

The RSI is an oscillatory indicator that shows whether an asset is overbought or oversold. It measures in the range of 0 to 100. Once the RSI value of a crypto asset is below 30, it is oversold, and when the RSI value moves above 70, it indicates an overbought asset price. An overbought state is a potential sell signal, while an oversold state indicates a potential buy opportunity.

6. Bollinger Bands

This indicator also helps you measure the price movement of assets. The band is typically measured using a 20-day simple moving average by adding and subtracting a standard deviation from the moving average. Once the market price is above the upper Bollinger band, it indicates overbought, and if it is below the lower band, it is taken to be oversold.

Limitations of Technical Analysis

One of the main criticisms against technical analysis is that history doesn't repeat itself in the exact same way, making technical analysis inaccurate. These critics believe price patterns are not very useful.

Another criticism against technical analysis is that it works only in some cases and produces inconsistent results.

Technical analysis is also limited to studying chart patterns and market trends. It neglects the aspect of studying the way a crypto community works or other fundamental factors that affect the price.

Technical analyses become relevant and insightful only when the market moves a certain way. It cannot predict movement that needs a fundamental background analysis.

Technical Analysis Is Not Enough

The above-mentioned technical tools and indicators will be useful additions to your crypto trading strategy. Many traders rely on technical analysis to make trade decisions. In fact, some believe only in technical analysis. However, combining technical and fundamental analysis is considered a more rational approach to trading.

Technical analysis gives information about market trends, especially short-term trends, while fundamental analysis usually gives information that can guide your long-term investment strategies. Doing fundamental analysis will also make you aware of short-term market sentiments. A combination of technical and fundamental analysis will give better trading results.