The first step to saving money and living a financially sound life is to set a budget. These free apps and tools make it easy for anyone to plan their personal finances with different types of budget methods.

There isn't any budget technique that works for everyone. Some people prefer a monthly budget, others track it by week, while a few focus only on savings. You can choose mobile apps, keep a secure password-protected desktop file, or go old-school with pen and paper. No matter the method or the tool, this article will help you find the right budget mechanism for you.

1. Go Budget (Android, iOS): Simple and Free Budget Planning App

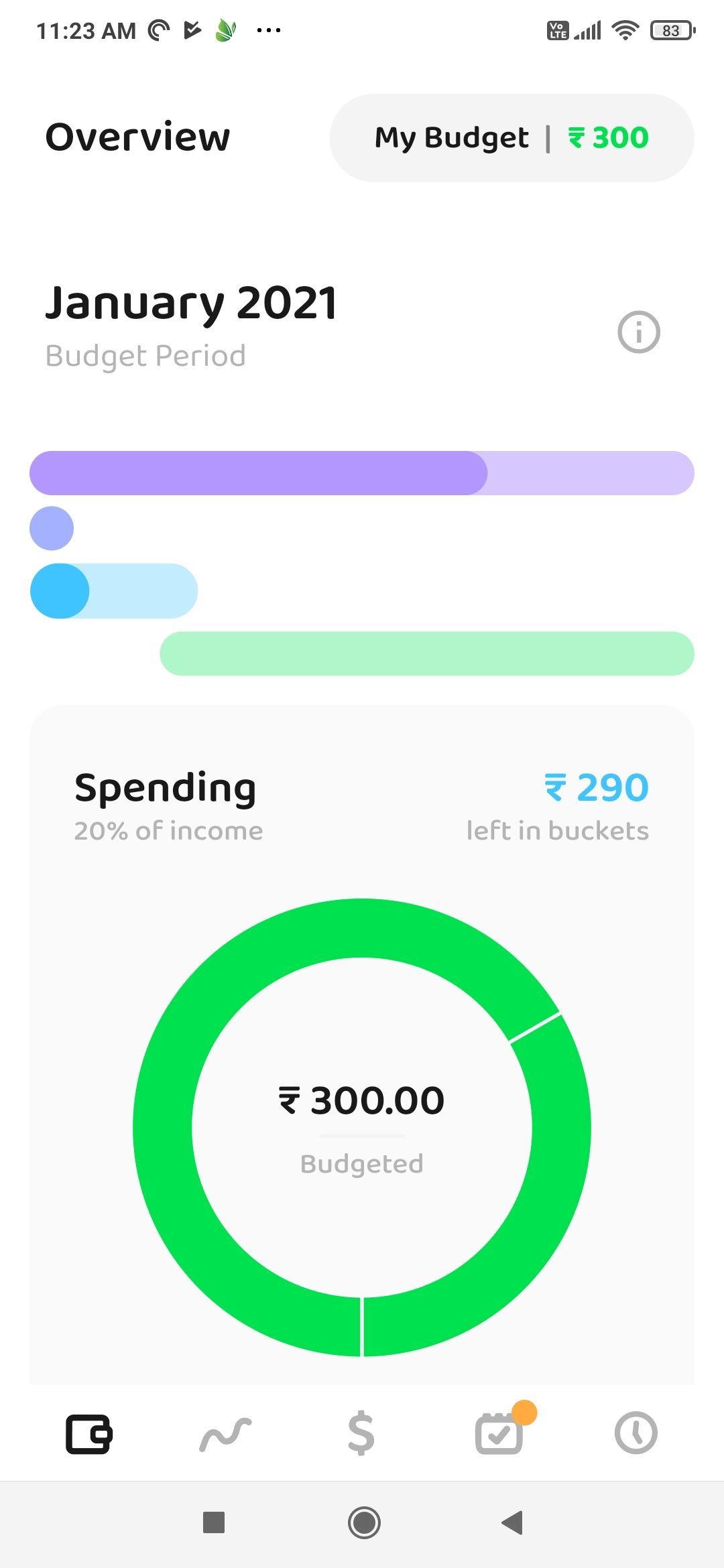

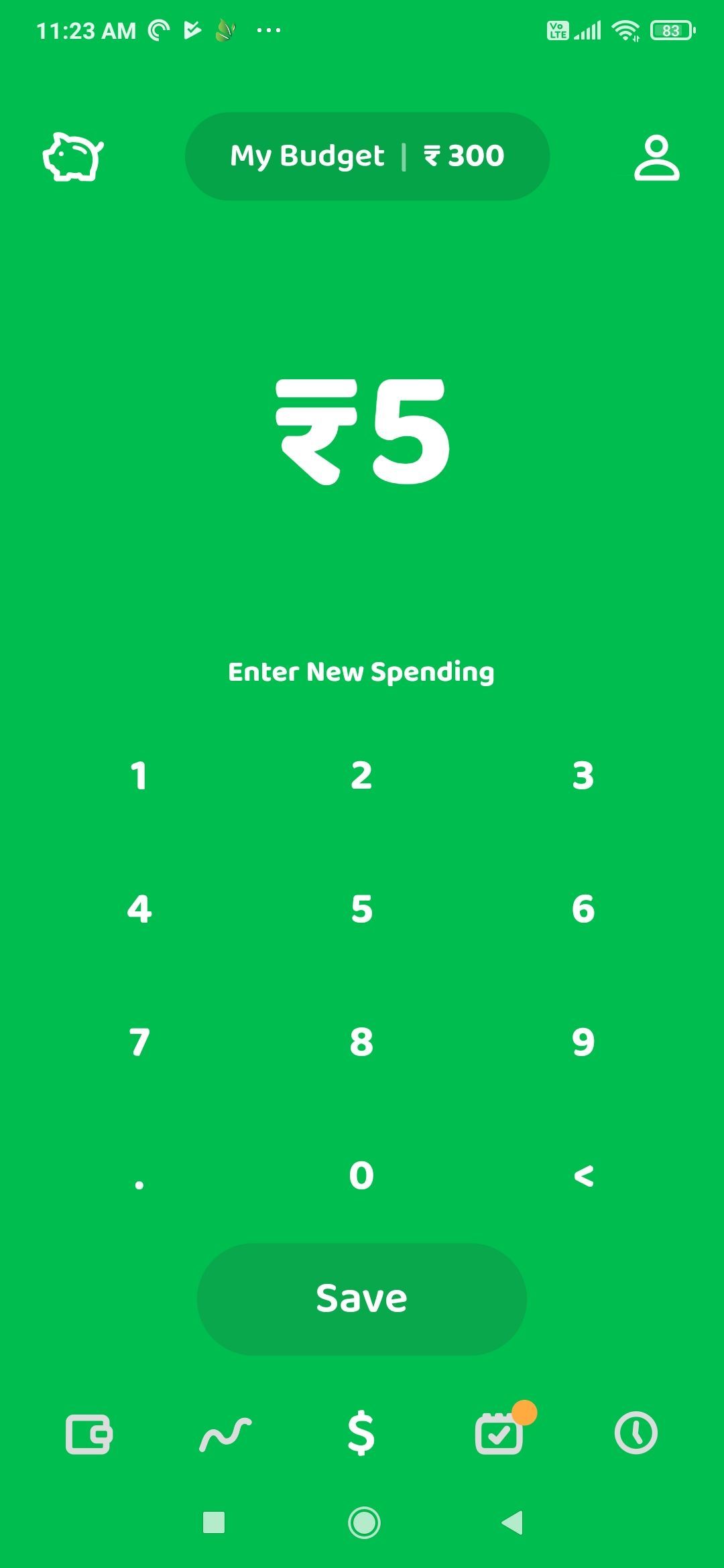

Go Budget is a completely free budgeting app with a focus on ease of setup and ease of use. You don't need to register for it, and all the data is stored locally.

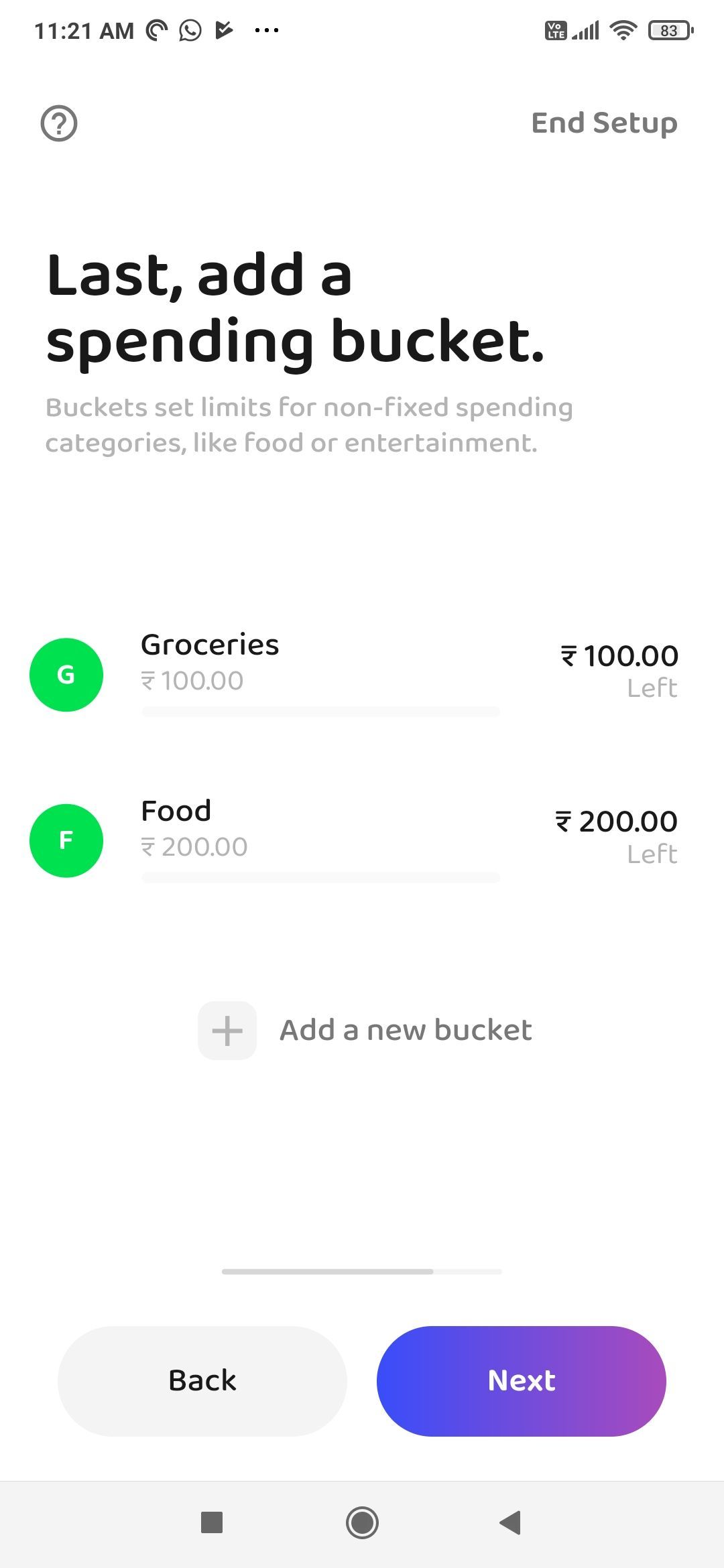

During the setup, Go Budget asks you to first key in your income sources and what date you expect to get them. Next, add your recurring monthly expenditures. And finally, from the remaining amount, set budget "buckets" for other expenses like going out, gas, groceries, etc.

Go Budget makes it really simple to track your expenses. Every time you spend on anything, fire up the app, tap the amount, and save it to a bucket. Slowly, you'll see the amount being deducted from the bucket so you know how much you have left. It's similar to the age-old envelope budget method, only done digitally.

The app also encourages you to set multiple buckets to save money, whether for an emergency fund, a vacation, or so on. And of course, everything is collected in neat charts to view a breakdown of your finances in an understandable way.

Download: Go Budget for Android | iOS (Free)

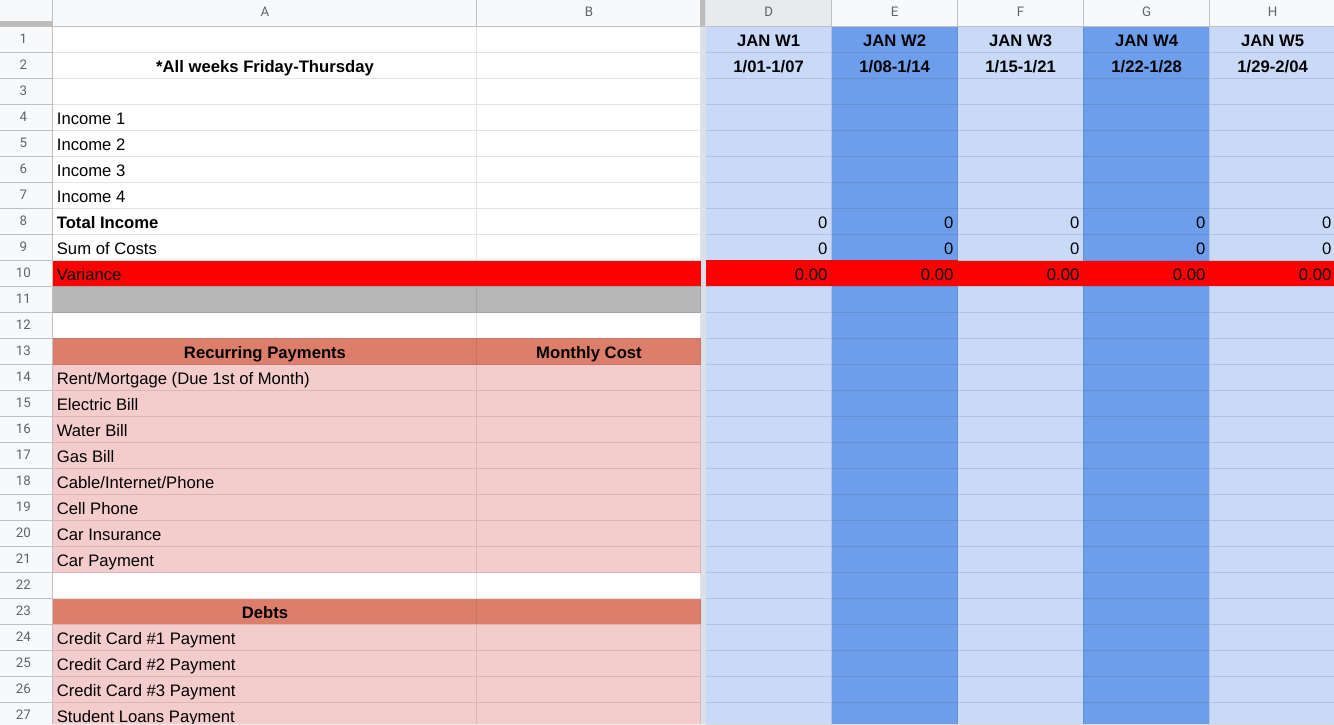

2. 2021 Weekly Budgeting Spreadsheet (Google Sheets): Easy Budgeting for Beginners

If this is the first time you are setting a budget, wait before spending money on premium apps like YNAB or Mint. A simple spreadsheet is often the best place to start, especially using free templates like this Google Sheet shared by a Redditor, made for those who like to set a budget by week.

The 2021 Weekly Budgeting Spreadsheet is ideal for those who get paid on a weekly or fortnightly basis, but it can also be used by those on a monthly salary who want to budget by week. Each month is divided into four or five weeks, taking into account turnover dates for this calendar year. Make a copy to save it to your Google account and you're ready to use it.

The sheet has clear instructions on how and what to put in each cell, so go through that carefully. There are slots for your incomes, recurring bills, debts, and other expenses. Once you fill the whole thing, the idea is to check these figures against your bank account. If you stuck to it, you'll be saving money, as the Weekly Budgeting Spreadsheet assumes you want to save 20% of your earnings for debts, emergency funds, or other savings.

Download: 2021 Weekly Budgeting Spreadsheet for Google Sheets (Free)

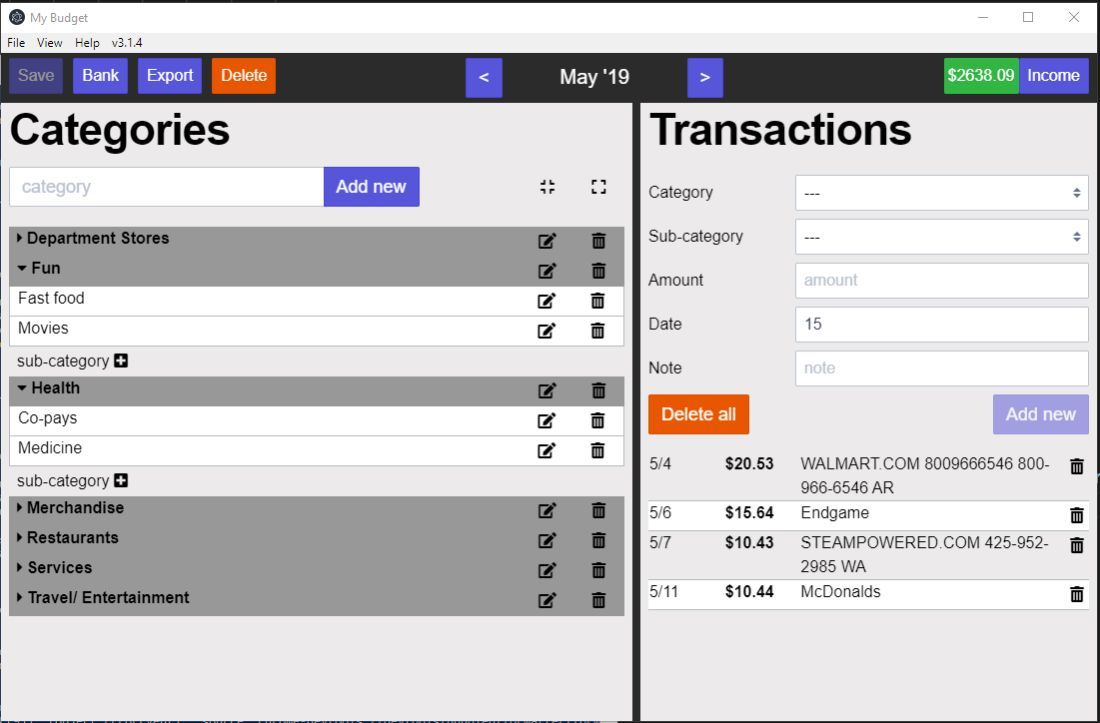

3. my-budget (Windows, macOS, Linux): Private, Offline, Open-Source Budgeting Software

When you're dealing with your personal finances, you need to be vigilant about privacy and security. How much data is that app you installed sending back to its servers, and where is that data going from then on? If you will be handling your budget on your computer, consider installing my-budget, an open-source budgeting software.

my-budget is completely offline and stores all the information locally on your hard drive. While it has limited support to import transactions from some bank accounts, you can skip that and manually make the entries. You can export the data as a CSV file. You can also set a passphrase so that only you can access these records.

The program itself is quite simple and includes the basics anyone would need to set up a budget. Set your income, add categories and sub-categories, track every expense, write notes if needed, and see your entire budget come together. Check out the New User's guide to get started, but it's a simple enough interface that you probably won't need it.

Download: my-budget for Windows | macOS | Linux (Free)

4. The 80/20 Budget (Web): For Those Who Don't Save for the Future

Most people are bad at saving money. It's a tendency to overlook savings at the start of the month when you get the salary and set your budget. By the end, when you're on budget or going over it, you take a piece out of the potential savings to treat yourself. If this sounds like you, the 80/20 Budget might be tailored to your financial outlook.

Now, the 80/20 Budget isn't the same as the Pareto Principle, which is often applied to personal finance. The Simple Dollar advises how to use the Pareto Principle in money-saving, but that's a different philosophy for another day. The 80/20 Budget has a simple rule: Pay yourself first.

What this means is that you need to find 20% of savings first, and then set the rest of the budget. Lifehacker's Lisa Rowan dives into the intricacies of how this budget principle works, and why it's ideal for both high earners and low earners. It takes the focus away from tracking all your expenses and puts it on tracking your savings, which might be a simpler and more realistic goal to meet.

If you're ready to be a little more ambitious, you can try the 50-30-20 Plan or other popular ways to set a budget and avoid overspending.

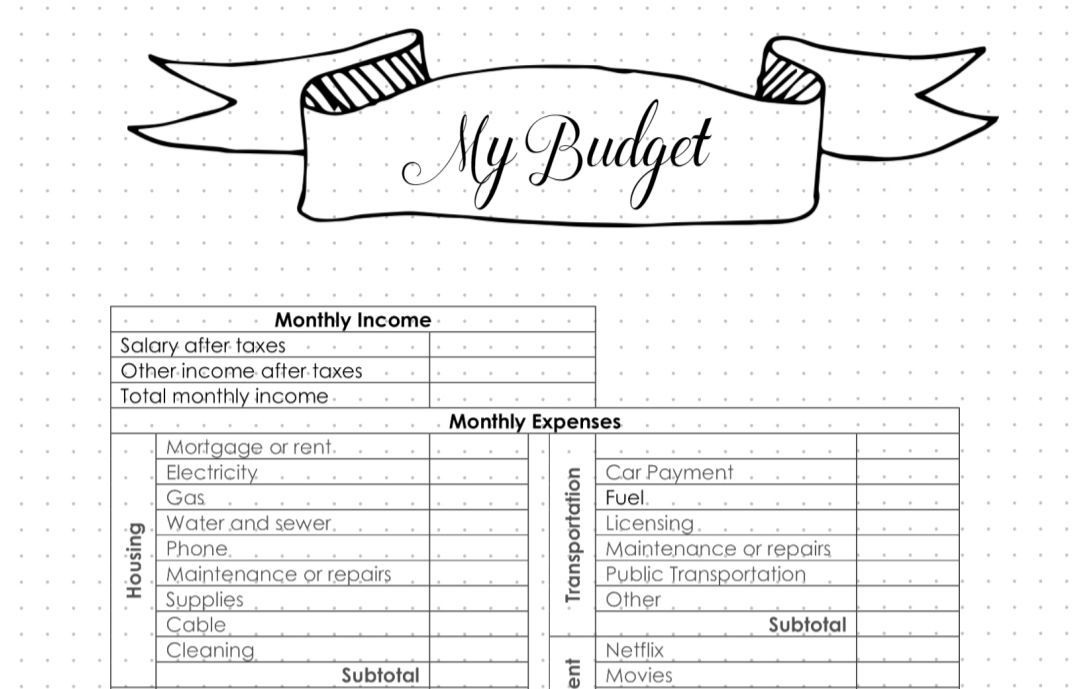

5. Budget Planner Book (PDF): Free Printable 24-Page Budget Planner

If you prefer to track your budget with a pen and paper, 101 Planners has a free printable Budget Planner Book. Over 24 pages, it accounts for most of the best advice about setting a budget, tracking expenses, and sticking to goals. Plus, you can download extra copies of any page individually too.

At its core is a master budget sheet, where you figure out your monthly income, expenses, and balance. Based on how you fill this, you can turn to set a weekly budget, which includes savings goals and how much you actually managed to put away. An easy Bills checklist will ensure you don't miss out on any major recurring expense.

The Budget Planner Book also has a few money challenges and money motivators that financial experts often recommend. For example, the book starts by making you write down why you want to set a budget, and what you would do with the saved money. There's a sheet for the No-Spend Challenge, including motivations and exceptions. And a savings jar that you can fill as you get towards your goal.

Think of Budgeting as a Habit, Not a Tedious Task

If you're new to the world of creating budgets and sticking to them, you're going to find it to be a tedious chore initially. It doesn't feel natural to count every penny and track it, nor will you remember to do it diligently every time. The trick is to start thinking of budgets as a habit.

As personal finance guru, Kristin Wong points out, treating a budget as a habit makes you check in regularly. Like exercising. Miss a day? No problem, just go the next day and catch up. The longer you stay away from budgeting, the more problems it's going to create. And like any habit, if you do it regularly for a while, it becomes a part of daily life.