Decentralized finance (DeFi) is now a major part of the crypto space, following the DeFi boom that started in 2020. If you're an investor in DeFi tokens, you must know which decentralized exchanges (DEX) to use for buying and selling tokens.

Some DEXs support tokens from different blockchains, while some support tokens from only one blockchain. Whichever you prefer, the following are the best DEXs to use for trading DeFi tokens.

1. PancakeSwap

PancakeSwap is a decentralized exchange built on Binance Smart Chain (BSC). It was built primarily for trading DeFi tokens on Binance Smart Chain but now supports tokens on the Ethereum network, as well as Aptos. This means you can switch between BSC, Ethereum, and Aptos to trade tokens, depending on the blockchain they're built on.

PancakeSwap has a token, CAKE, which powers the exchange and is currently the 67th largest cryptocurrency by market cap. Once you connect your wallet to it, you can use it to trade not just tokens but also non-fungible tokens (NFTs). You can also earn cryptocurrencies through liquidity pools and yield farming.

Since it is a DEX, no registration is required to use the exchange; you only need to connect your wallet. At the time of writing, PancakeSwap has a total value locked (TVL) of $4.2 billion in staked funds, the highest of any DeFi exchange.

With GoSwapp mobile app, you can also experience PancakeSwap on your mobile phone for trading and tracking your favorite DeFi tokens.

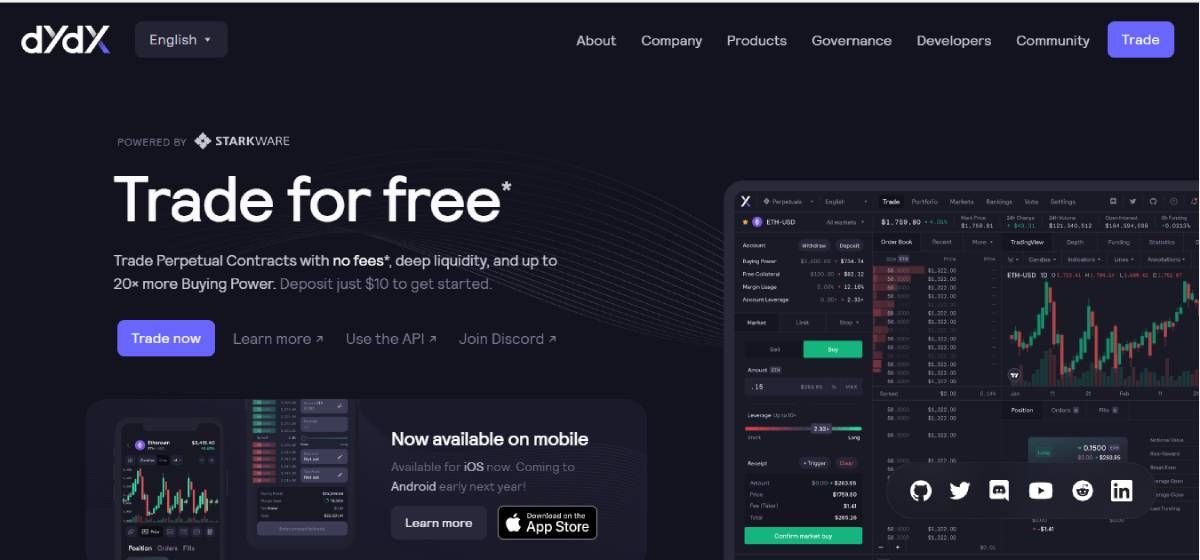

2. dYdX

Wish to trade perpetual contracts? dYdX is the DEX for you. You can trade perpetual contracts on the DEX with zero fees and up to 20X leverage. Trades can begin with as little as $10 for over 35 top cryptocurrencies, including Cardano, Ethereum, and Dogecoin.

dYdX is one of the largest DEXs in the space, having one of the highest trading volumes and market share, mainly due to its ease of use and flexibility. Built on Ethereum, dYdX also has an NFT collection that facilitates community building.

Apart from trading tokens, you can also use dYdX to trade NFTs for governance and staking to generate passive income from your crypto portfolio. The DEX's DYDX token allows holders to vote for important governance proposals.

There have been three versions of dYdX. The fourth version is due to be rolled out by the end of 2022 and is expected to bring the exchange into full decentralization and eliminate components such as centralized order books. You can use dYdX on your web browser and on your mobile device using the app,

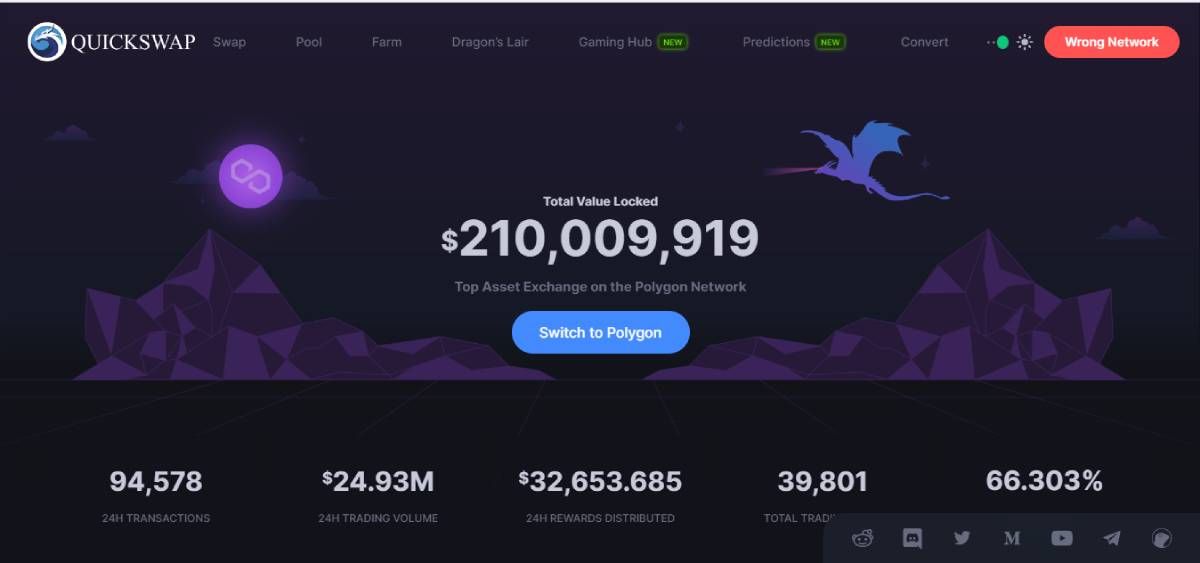

3. QuickSwap

QuickSwap is a next-gen layer-2 DEX and also an automated market maker (AMM). A fork of Uniswap, the DEX works primarily with Polygon rather than Ethereum. This may explain why You can swap tokens on it speedily and at almost zero gas fees,

Being an AMM, QuickSwap does not use order books but instead creates liquidity pools of tokens that users can use for swapping tokens. QuickSwap also has an Ethereum-based utility token known as QUICK, which powers the QuickSwap exchange.

Transaction fees on the exchange are paid using MATIC, the native token for the Polygon network. This explains why the gas fees are very low, as Polygon is a Layer-2 scaling solution built to support Ethereum. It also has a mobile app in addition to the browser version.

4. Uniswap

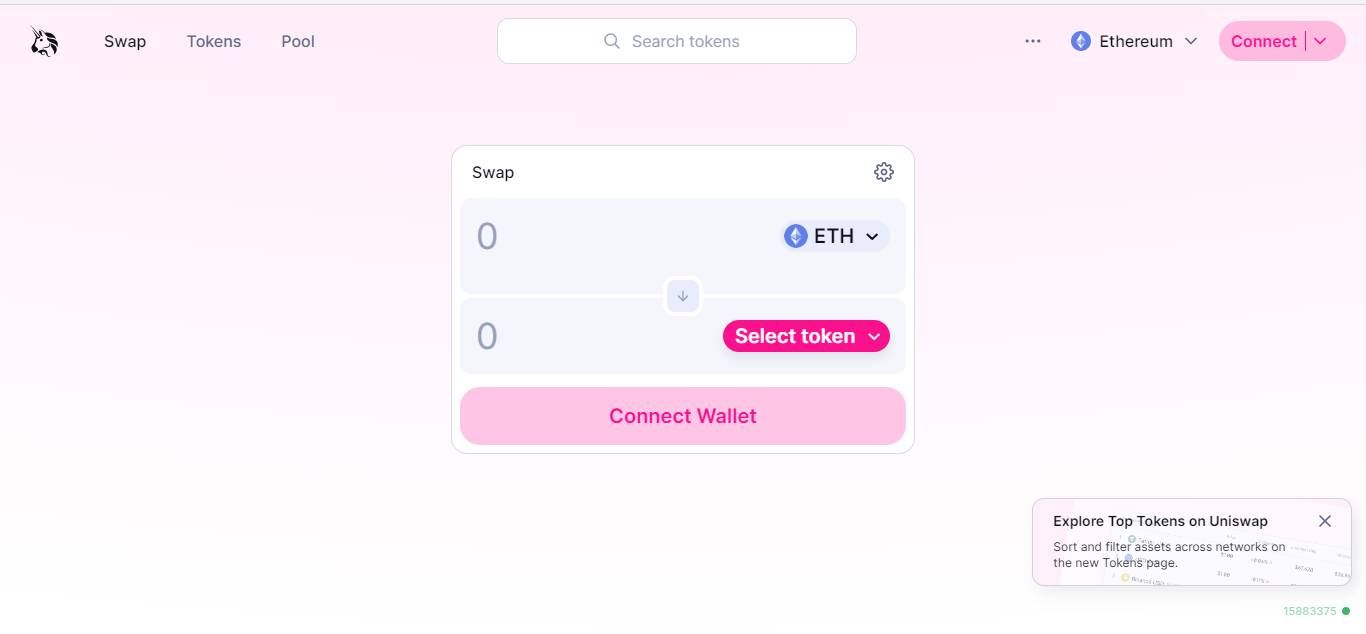

Uniswap is reputed as one of the oldest decentralized exchanges. Indeed, it is a whole suite of DeFi Apps, developers, traders, and liquidity providers working together in a growing DeFi network. It is the largest DEX built on the Ethereum blockchain and one that grew rapidly to become a giant in the DeFi space.

Like Quickswap, Uniswap uses an AMM model that provides token liquidity pools for swapping rather than using order books. It also uses a community governance model that lets the community of users decide on developmental ideas that get implemented.

Using the native token UNI, they can vote on key governance proposals and decide on major changes. The exchange is built on Ethereum, and fees were initially paid using ETH as the only option. However, it has grown to now support five blockchains, including Polygon, Optimism, Arbitrum, and Celo.

You can also access Uniswap on your mobile devices using the Goswapp app.

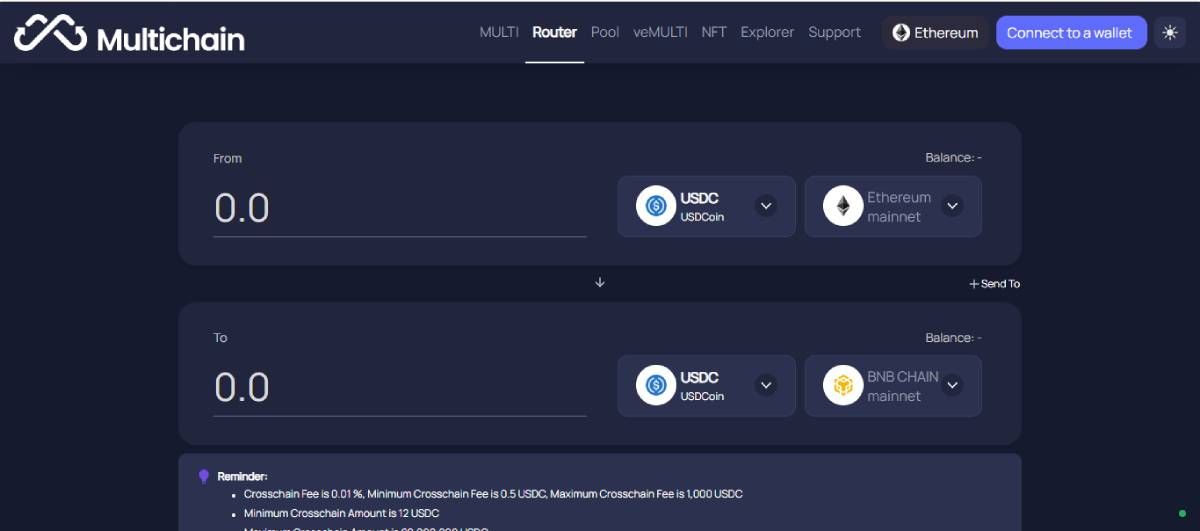

5. Multichain

Multichain, as the name implies, is a decentralized exchange that supports multiple blockchains. It features a significantly higher number of blockchains than any other DEX and facilitates cross-chain transactions. The exchange, formerly known as Anyswap, uses the cross-chain router protocol to allow users to bridge between 70 chains using pegged tokens or liquidity pools.

With Multichain, you get a 1:1 trade ratio, which makes a zero slippage swap possible and takes care of hidden transaction costs that characterize AMMs. The Multichain Router also ensures that allows you to swap between any two chains seamlessly at very low fees, making it easy to move between chains.

With almost 3,000 supported tokens, the possibilities are endless for this DEX, which is seen as the platform to lead web3 innovation in the DeFi space. Unfortunately, there is currently no mobile app for the platform, so it is only accessible on the web.

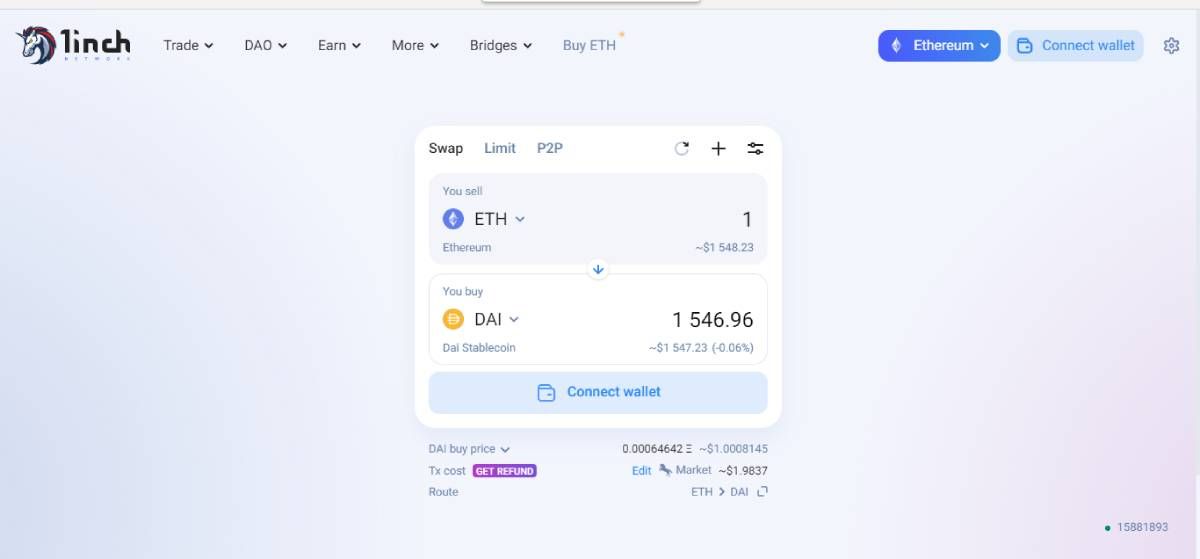

6. 1inch

1inch is one of the most advanced DEXs and is also a DeFi/ DEX aggregator. DEX aggregators help investors make the best investment decisions by providing them with information on the best DEX to use at any time.

1inch claims to have the most liquidity on Ethereum, Binance Smart Chain, and the many other blockchains it supports. You can use 1inch for regular DeFi trading, limit orders, and even peer-to-peer (P2P) deals. It also has a decentralized autonomous organization (DAO) that allows staking and other functions.

With bridges for nine blockchains, you can easily bridge crypto assets from such blockchains to other blockchains on 1inch. If you're interested in earning extra income, you can contribute to the liquidity pool or yield farming.

Are You Ready To Trade DeFi Tokens?

These are the best DEXs, with their features and unique characteristics. Whatever your DeFi investing or trading goals are, one of these DEXs will certainly meet your needs, especially those that support multiple blockchains.

Even if you're new to the crypto space, you should be able to figure these out, as the platforms are designed to be very simple without any requirements for your personal details.

.jpg)