As the world increasingly moves towards digital assets and away from traditional fiat currency, a new breed of financial platforms has emerged to meet the demand for crypto-friendly services. These so-called CeFi (centralized finance) platforms offer a wide range of features and services, from lending and borrowing to staking and earning interest on your digital assets.

As the CeFi ecosystem continues to evolve and grow, a number of new platforms are emerging that offer unique advantages for users. So, let's explore some of the best new CeFi platforms worth keeping an eye on.

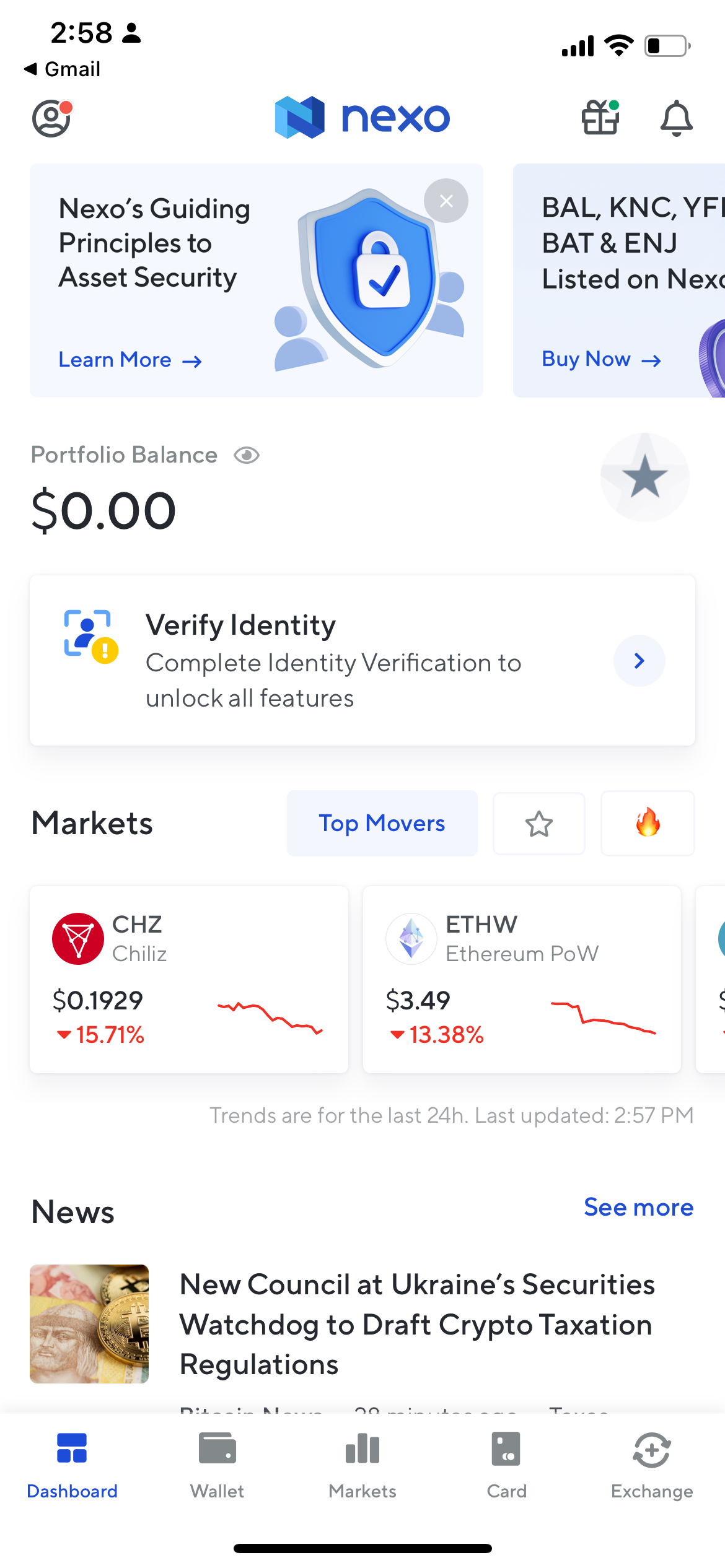

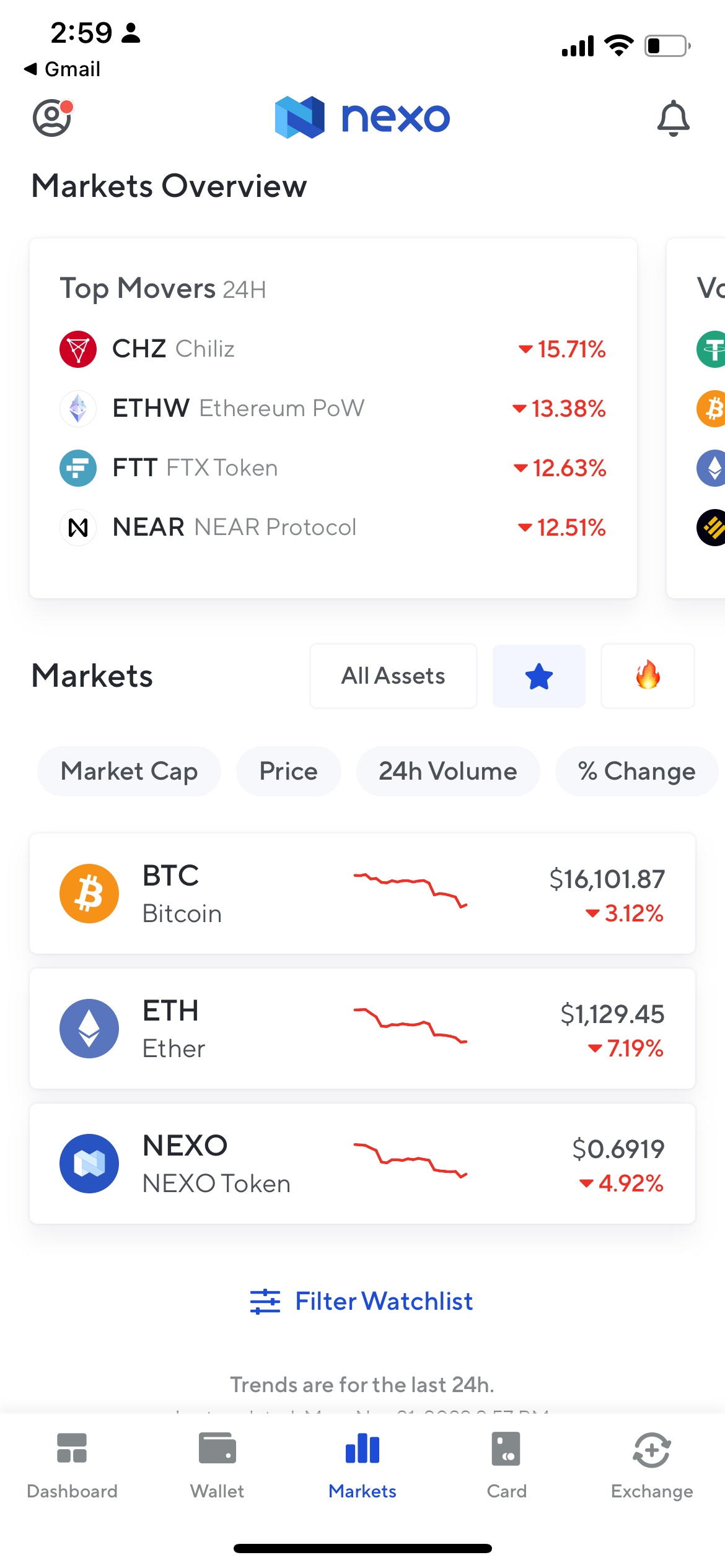

Nexo

Nexo is a leading crypto lending platform that allows users to collateralize their digital assets and receive instant loans in fiat or stablecoins. With over $5 billion worth of loans originated and zero losses incurred from loan defaults, Nexo is one of the most trusted names in the industry.

Nexo is an excellent option for those looking for crypto-backed loans. With Nexo, users can borrow up to $2 million without going through credit checks and with instant approval.

In addition to its lending services, Nexo also offers interest-bearing accounts, with rates as high as 16% APY on cryptocurrencies and 12% on stablecoins. However, the best rates are reserved for users who have purchased the native NEXO tokens.

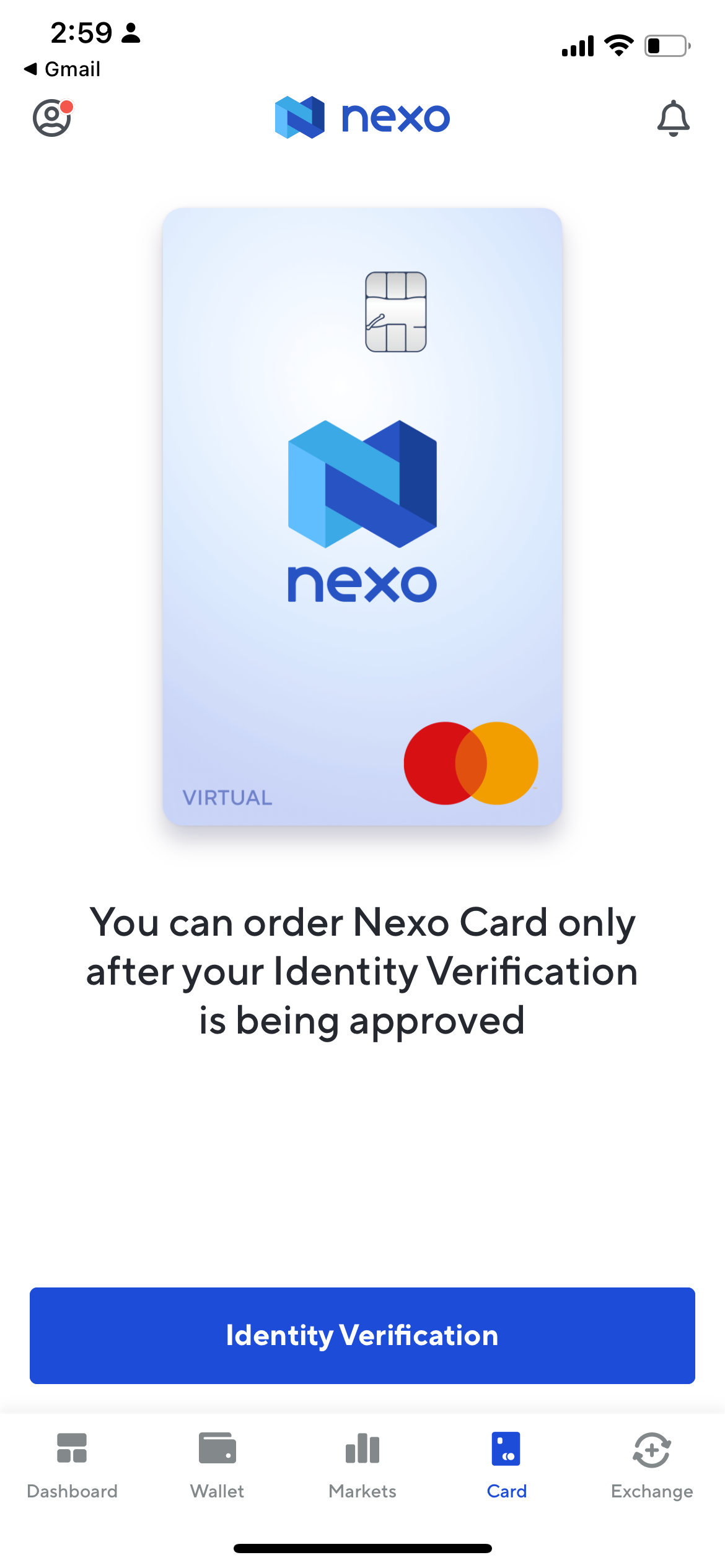

With a NEXO token in your account, you will have access to the Nexo Loyalty Program, which offers up to 0.5% cashback, 50% higher yields, up to 5 free withdrawals per month, and 0% APR rates when borrowing. If you also own a Nexo Card, you can increase your cashback potential by up to 2%.

Nexo is based in Switzerland, which means they follow Swiss financial laws. To protect users' crypto, it stores them in cold wallets held in military-grade Class III vaults. In addition, it has a $1 billion insurance that covers custodial assets.

If you need cash but don't want to sell your crypto, Nexo is the perfect solution.

Download Nexo: Android | iOS | Web

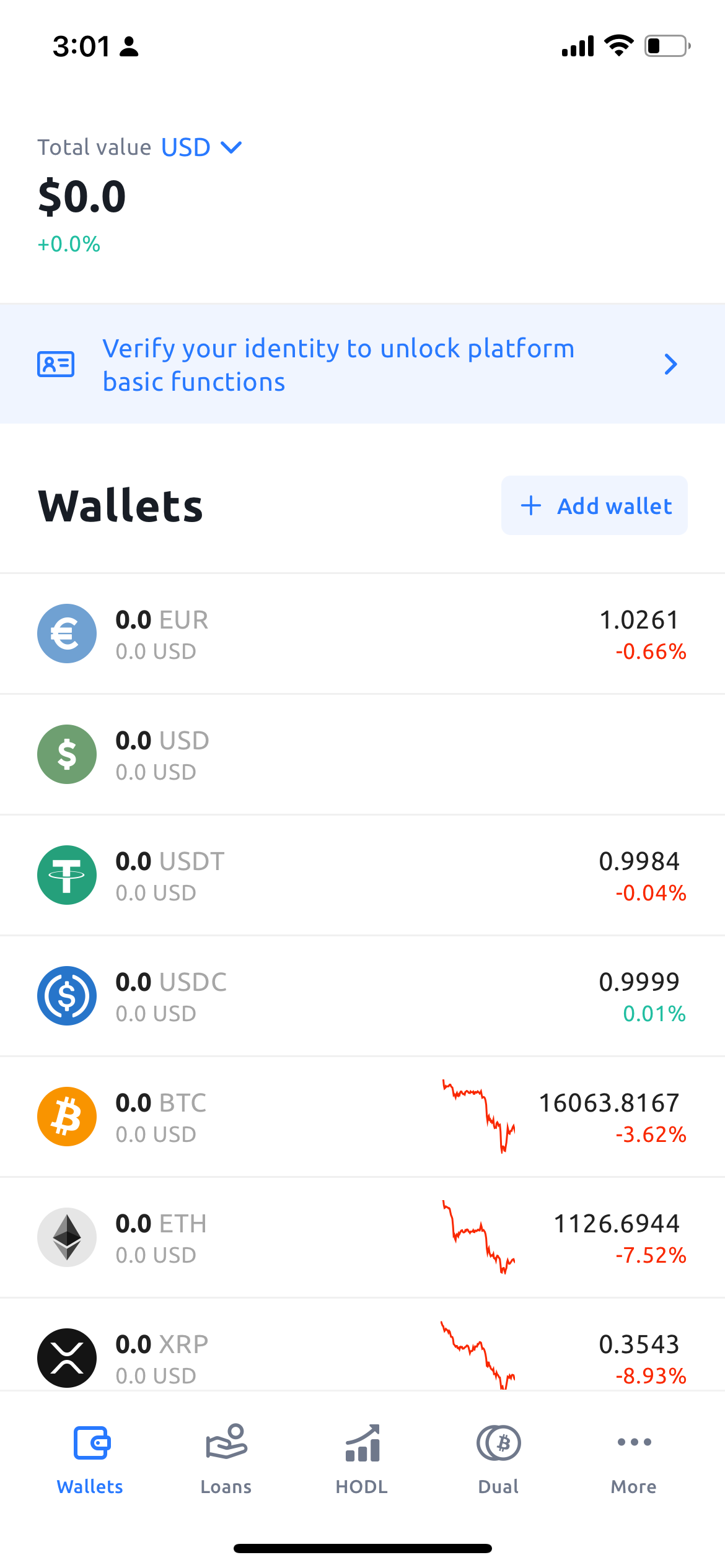

YouHodler

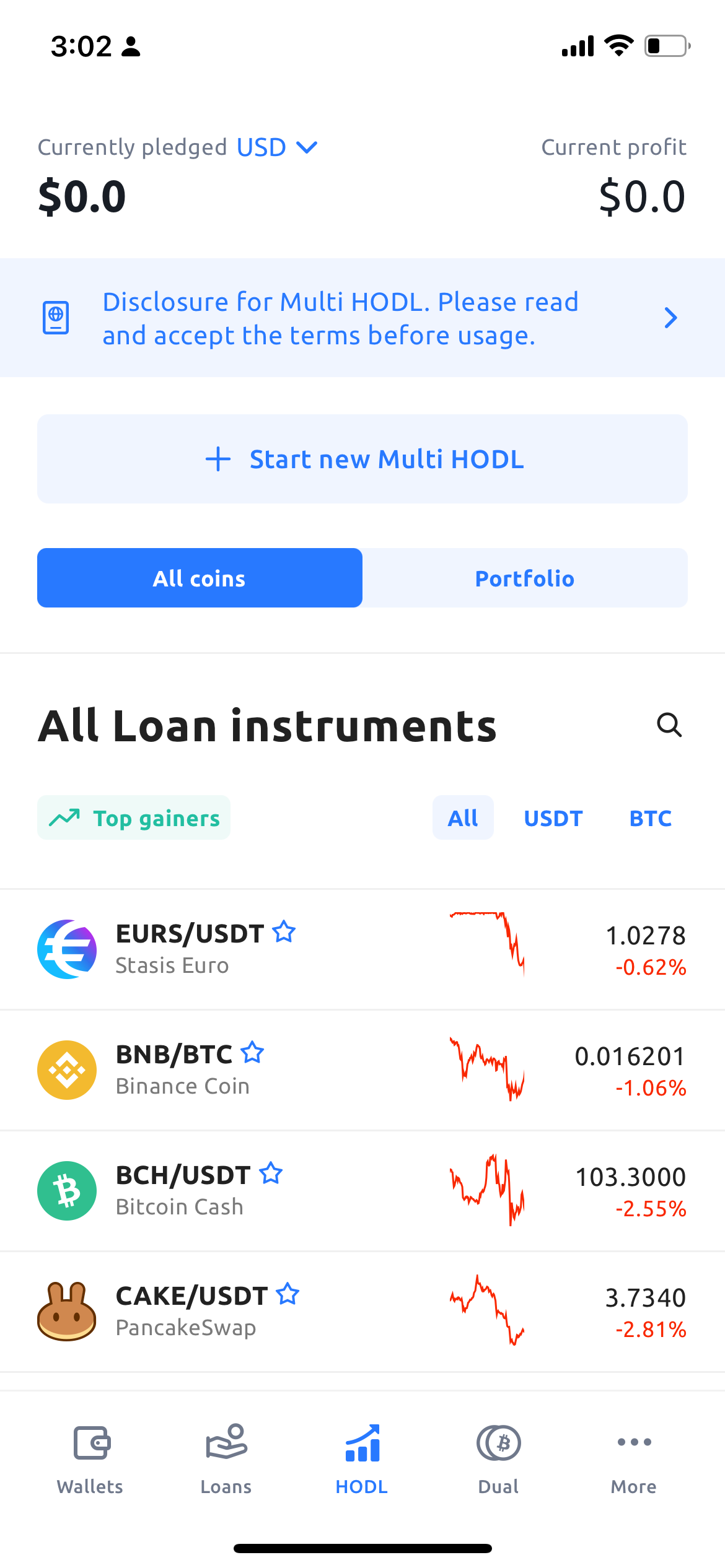

YouHodler offers many of the same features as Nexo, with the bonus of some really cool features. Namely, you can get a crypto-backed loan on this platform. This allows you to get up to 90% of the loan value in cash, which you can then withdraw instantly. You can also receive your funds via bank wire.

What makes YouHodler special is the Multi HODL feature, which allows users to capitalize fully on their investment. This tool will enable you to set a maximum loss and multiply your crypto up to 50 times.

If you're looking to boost your earnings potential, the platform offers Turbocharge loans. This allows you to borrow more crypto to supercharge your earnings by utilizing your current assets.

Download Youhodler: Android | iOS | Web

Risks Associated With CeFi

Crypto-lending platforms like Nexo, Youhodler, and Hodlnaut have been growing in popularity in recent years. However, there are some risks associated with using these types of platforms.

First, it is important to note that these platforms are not regulated by any financial authority. This means there is no guarantee that your money will be safe if the platform goes out of business or is hacked.

Second, these platforms often lend money at high interest rates. This can be a problem if you need to borrow money but cannot repay the loan on time.

Third, these platforms may not be available in all countries. This could make it challenging to get your money back if you need to transfer it to another country.

Fourth, the value of cryptocurrencies can fluctuate greatly. This means that if you take out a loan in cryptocurrency and the currency's value falls, you may end up owing more than what you originally borrowed.

Finally, it is important to remember that lending money always carries some risk. There is no guarantee that you will get your money back if the borrower does not repay the loan.

Despite these risks, crypto-lending platforms can still be a helpful way to borrow money or earn interest on your cryptocurrency holdings. Just be sure to do your research before using any platform and only lend what you can afford to lose.

How To Be Safe in CeFi

Here are some tips to help you stay safe when using a CeFi platform:

- Do your research. Not all CeFi platforms are created equal. Some may be more reputable than others, so it's important to do your research before choosing one to use.

- Read the terms and conditions carefully. Before you agree to anything, ensure you understand the terms and conditions of the loan or yield agreement. This includes things like the interest rates, repayment schedule, and any fees that may be charged.

- Be aware of the risks involved. Since you're putting up your crypto assets as collateral, you risk losing them if you default on the loan. Make sure you're comfortable with this risk before proceeding.

- Keep track of your repayments. Once you've taken out a loan, it's important to keep track of your repayments so that you don't miss any payments and put your collateral at risk. Setting up reminders can help make this process easier.

- If you're unsure of what you're doing, it's best to seek licensed experts who can advise you on managing your crypto holdings.

Earn Interest on Your Crypto

Overall, CeFi platforms have been growing in popularity due to their many benefits. Crypto-lending platforms offer a great way to earn interest on your digital assets without worrying about the market's volatility. In addition, these platforms tend to have low fees and offer a high degree of security. As the industry continues to grow and evolve, we can expect to see even more CeFi platforms emerge and become available to investors.

This article is not financial advice. It is for informational purposes only and does not constitute an offer or solicitation to buy or sell any cryptocurrencies, digital assets, or other financial instruments or services. Crypto investments may be volatile and involve a high degree of risk. Readers are strongly advised to conduct their own due diligence before making any investment decisions.