In recent years, the number of freelancers in the world has greatly increased, enabling millions of people to earn and work for multiple clients simultaneously.

But as with many good things, there are often challenges. For many freelancers, especially beginners, finding the right app or platform to receive money is a challenge. In this article, we will highlight the five best apps to receive money as a freelancer.

5 Apps to Receive Money Online

Whether you work on Upwork, Fiverr, PeoplePerHour, or you scout for freelance jobs online, finding a suitable payment app is almost as important as finding a job itself. Read on to find the payment option most suitable to you and to have all your questions answered.

1. PayPal

PayPal is probably the most popular payment platform known to freelancers. It allows you to receive money internationally, send money over the internet, and buy goods. It is safe, easy to use, and well-protected. You do not need a bank account to open an account on PayPal or receive payments—although you can connect your bank account to it to make withdrawals. PayPal only requires your phone number, name, e-mail address, and proper identification. Here's how to set up a PayPal account and receive money from anyone.

PayPal allows you to withdraw as low as a dollar, and it does not impose any withdrawal limits on verified accounts. Unverified accounts, however, have a $500 monthly withdrawal limit. Transactions on PayPal attract a very tiny percentage that is remitted to PayPal. The major disadvantage of PayPal is that it does not offer its services to some countries. Before choosing PayPal as your payment app, be sure to check if PayPal supports your country.

2. Payoneer

Payoneer, founded in 2005, is the second most popular payment app for freelancers and employers alike. Payoneer is a safe and secure payment platform that allows you to receive international payments, transfer money internationally and withdraw at your convenience. To open a Payoneer account, you only need an email address, your phone number, and appropriate identification.

It has a great user interface that freelancers love because it is easy to use and navigate. Payoneer collects a $3 fee on every transaction. It sets a $50 minimum withdrawal limit and a monthly maximum limit of a hundred and ten thousand dollars. It offers its services to over 150 countries, so check if Payoneer supports your country before choosing it as your preferred payment platform.

3. Stripe

Stripe is an online payment platform that offers its financial services to businesses and organizations of every size. Its most appealing feature is its easy-to-integrate API (application programming interface) for the websites of small and large businesses. Even though Stripe is majorly tailored to proffer solutions to businesses, it also offers its services to individuals.

Stripe can be used to receive and process payments for individuals too. Many companies and freelancers use Stripe for their transactions. The only downside to Stripe is that you need a physical bank account to open an account on the platform—apart from your email, address, and necessary identification.

Stripe is only available in 46 countries at the moment, so please check if Stripe supports your country before using it.

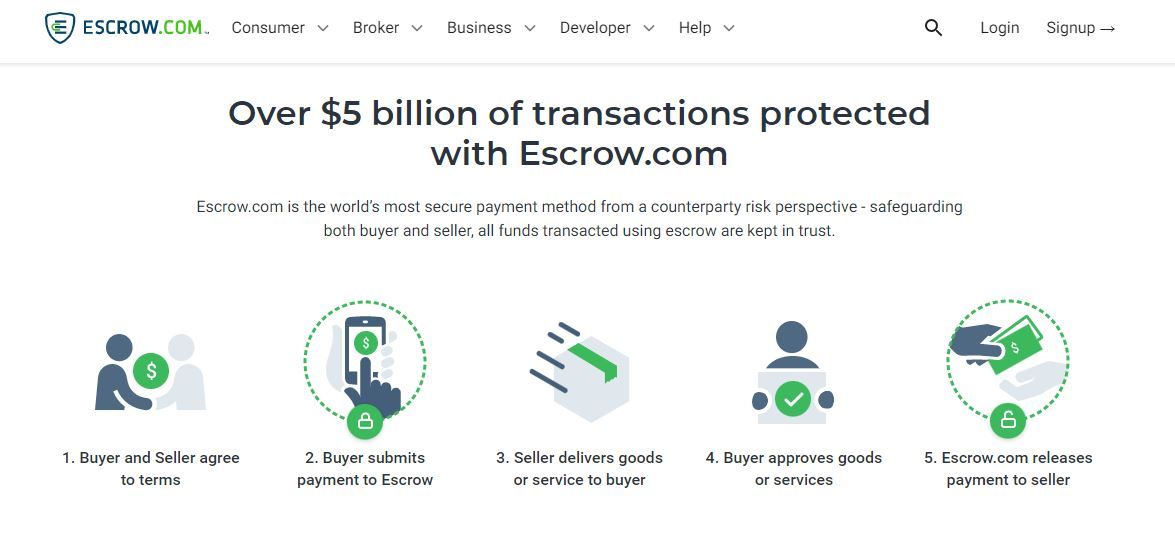

4. Escrow

Escrow is probably one of the most secure online payment platforms. It is a third-party platform used to send and receive money among buyers and sellers and manage transactions.

In Escrow, when a freelancer agrees on a contract or agreement with his or her client, the client remits the payment to Escrow. When the freelancer is done with the service and the client approves it, Escrow then releases the payment to the seller. Upwork uses Escrow as its payment platform.

5. Skrill

Skrill is an online digital wallet and financial service provider. It allows you to store, receive, and send money in 40 different currencies. Skrill is fast and preferred by many freelancers because of its low fees and fast customer support.

Unlike PayPal and other payment platforms that limit their MasterCard debit cards to only US or UK users, Skrill's debit card is available to all. To open a Skrill account, you only need your e-mail, address, phone number, and a $5 deposit.

Charging Right as a Freelancer

Choosing the right payment app for your freelancing career is extremely important. But learning how to charge right is crucial.

Should you charge by hour, milestone, or project? To find out how to choose, click out the following article.