Properly managing your money is an essential part of financial security, and smartphones make it easier than ever. While budgeting and personal finance apps have been around for some time, money management apps have evolved significantly over the past few years.

Creating and tracking a budget isn’t all your phone can do. It can also cancel subscriptions, give you insights into your credit health, and help you plan your financial future.

Here are some great money management apps that go beyond tracking a budget.

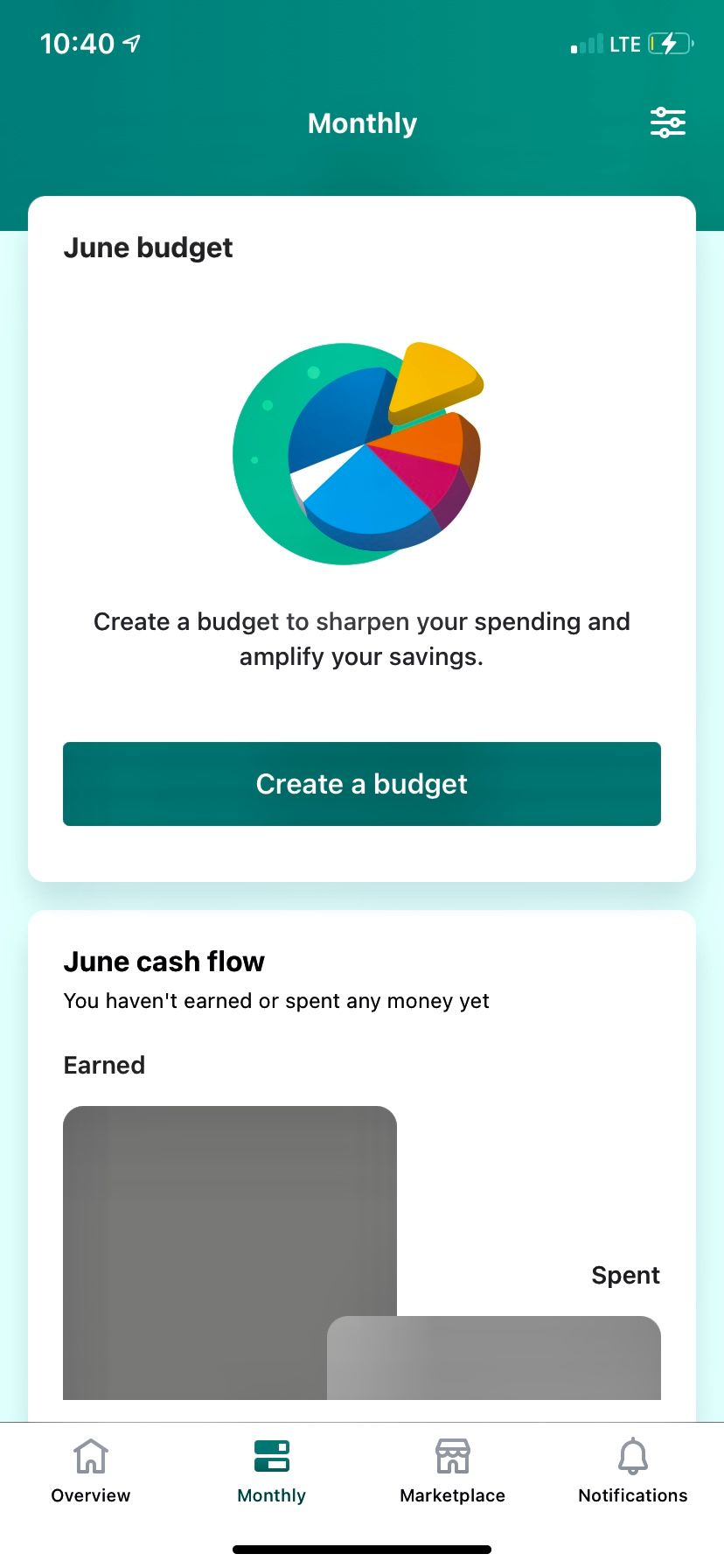

1. Mint

There aren’t any money management apps as popular or well-rounded as Mint. It's a great all-around finance solution because it allows you to track your cash flow across all your bank accounts, create a budget, set reminders for your bills, and develop goals for your financial future.

Mint also has a lot of great partners that will help you find new credit card or loan offers, cheaper deals on car insurance, and more. If you’re just starting to take money management seriously, Mint is a great place to start because the app has blog posts that teach you more about responsible spending habits and personal finance.

Download: Mint for Android | iOS (Free)

2. Quicken

Quicken is another money management platform, similar to Mint. It offers many of the same services, such as tracking your bank accounts from one location, creating budgets, and meeting financial goals.

What makes Quicken different is that you can track your investment portfolios with it. Quicken also has a bill manager that lets you pay bills from the platform. The service even has its own credit card for members.

However, not all the differences are positive. While Mint is free, Quicken has an annual fee. It starts at $36 and goes up based on what features you want. That might sound pricey, but the benefits could be worth it for the convenience and perks Quicken offers.

Quicken is primarily for Windows and Mac, but it offers a companion app as well. This allows you to conveniently track your finances from anywhere.

Download: Quicken for Android | iOS (Free, subscription required)

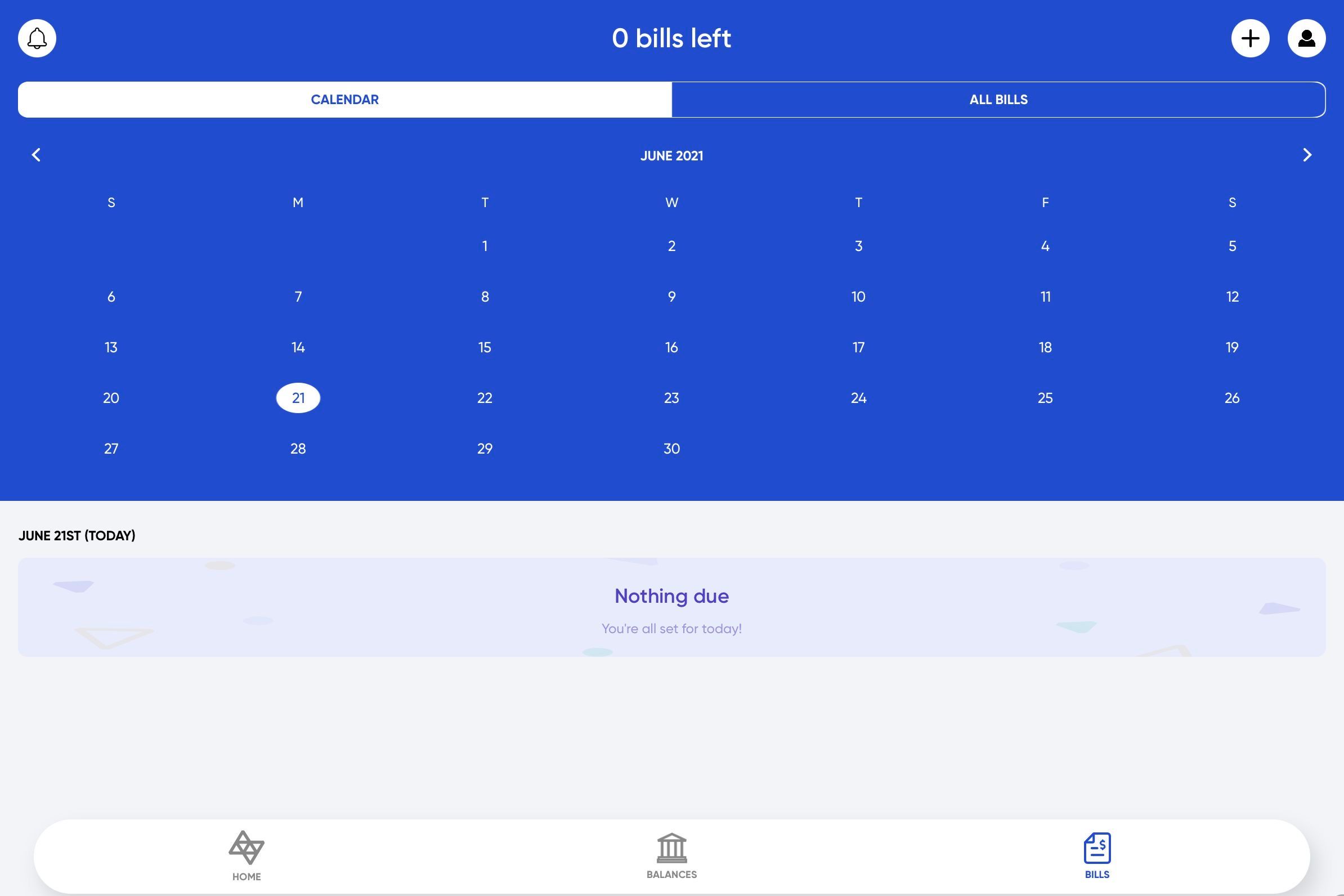

3. Prism

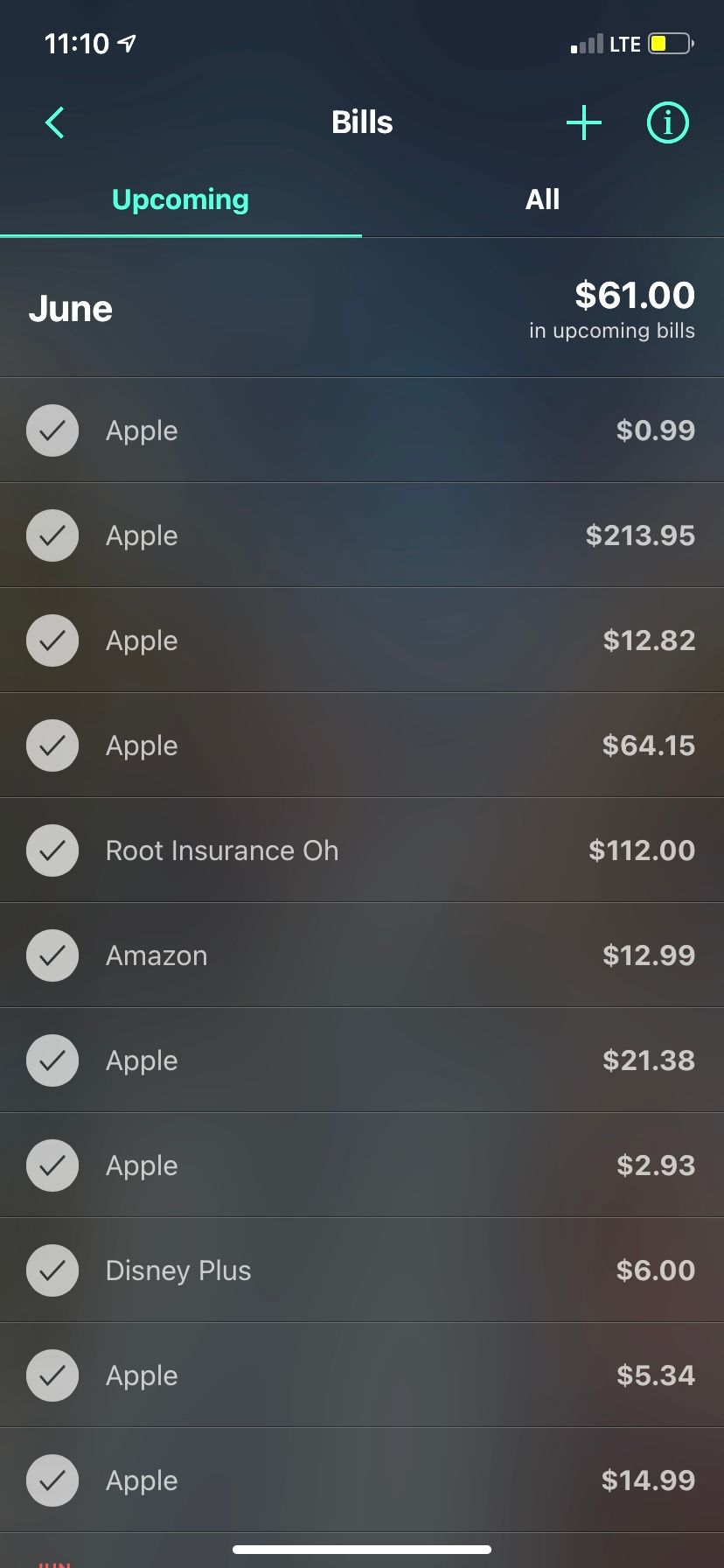

Paying your bills on time is one of the most stressful parts of money management. After all, a missed payment or two can harm your credit score. Payment history is one of the most significant factors when banks look at your credit.

That’s what makes Prism such a convenient and essential app. Prism’s whole focus is making sure you pay your bills on time. It lets you set reminders for bills so you will never forget when one is coming up.

Best of all, Prism will even let you pay bills directly through the app. With 11,000 partners currently and more added every month, Prism is an excellent way to pay your student loans, credit card bills, and phone payments all in one place.

Prism is free to use, so you don’t have to worry about any extra charges when you pay your bills.

Download: Prism for Android | iOS (Free)

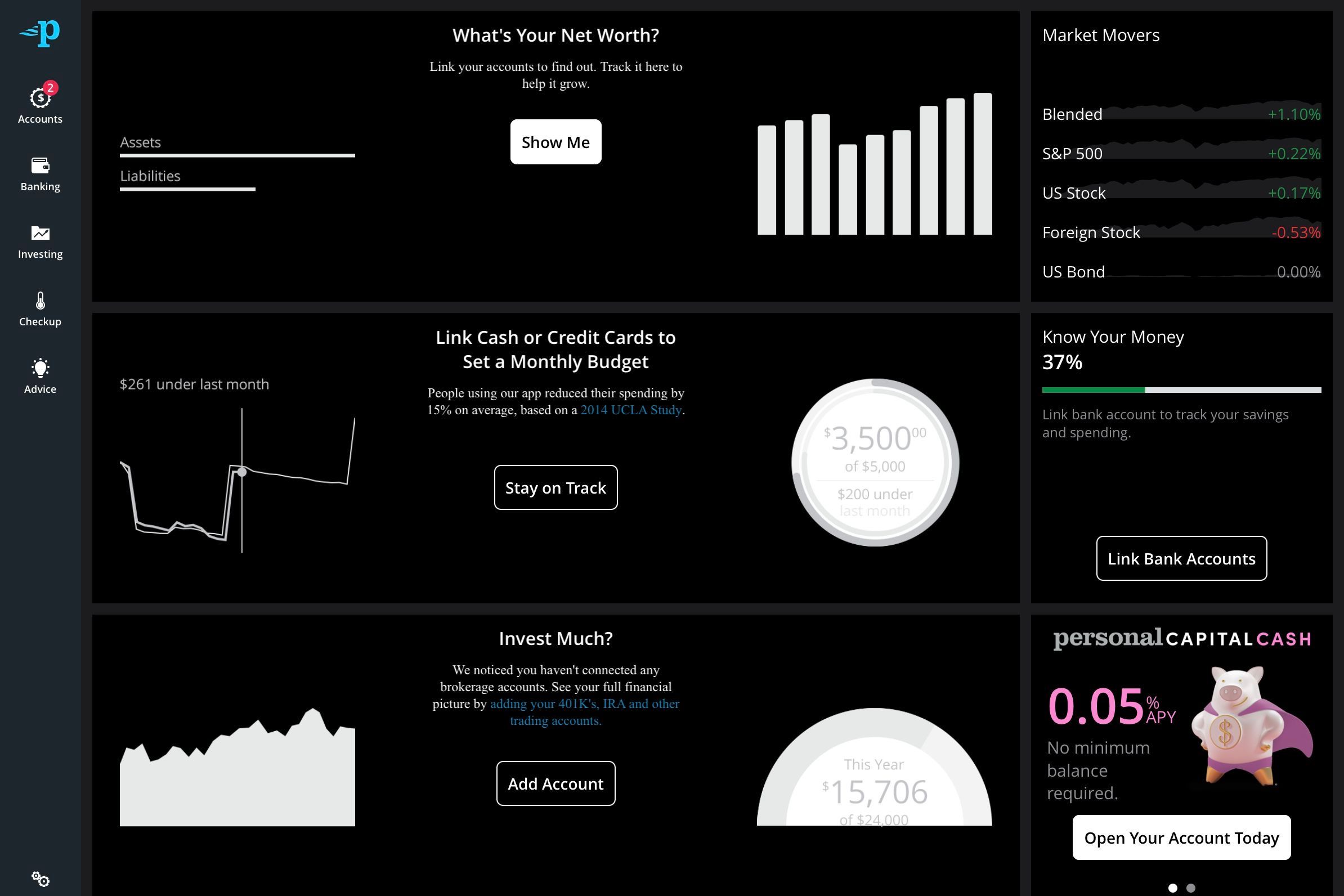

4. Personal Capital

Planning for the future can be tricky, especially if you didn’t take any classes on personal finance. It can be hard to tell if you are saving enough for retirement or which account fees are too high. Personal Capital demystifies a lot of the money management process, and it gives you a clearer picture of what to do in the long-term with your money.

Like the apps above, you can sync all your accounts, including your bank, IRAs, and similar. You can also track your debt from the app, giving you a clear-cut view of your net worth and where you are at financially.

Personal Capital also has a retirement planner, allowing you to find precisely how much you must make in order to be comfortable. Personal Capital will also analyze your accounts and make sure what you're using is a fit for you.

Personal Capital is also free, so it's great for budget-conscious folks.

Download: Prism for Android | iOS (Free)

5. Pocket Guard

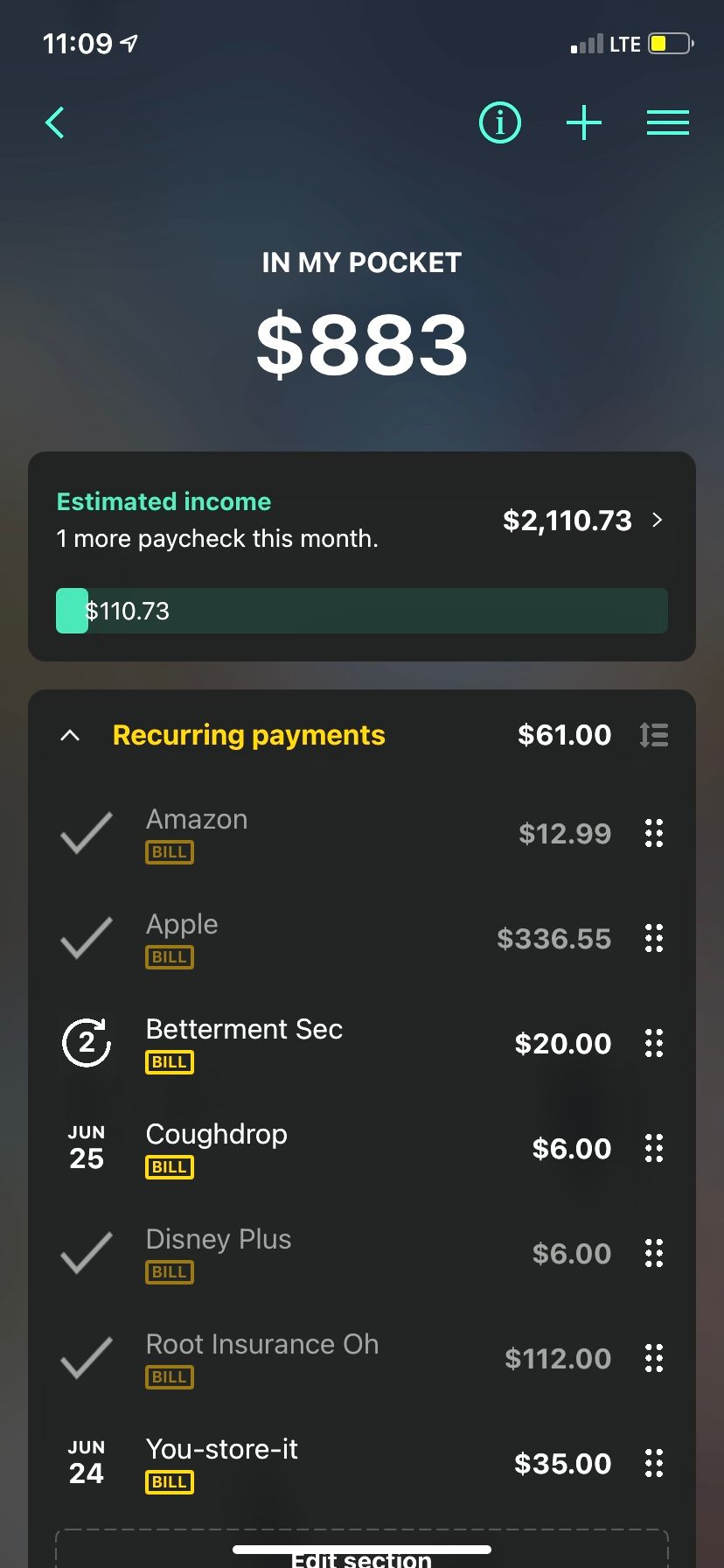

Not everyone has the willpower to sit down and meticulously plan and execute a budget. Some of us just want to know what money we have and what we can spend. Pocket Guard is designed for these people, as it essentially automates the money management process.

Pocket Guard’s main appeal is its In My Pocket feature. Pocket Guard tracks all your bank accounts and any bills you have coming up. It will then calculate a "safe to spend" number, so you can quickly see how much disposable cash you have. It’s relieving and simple all at once.

Pocket Guard will also track subscriptions and recurring payments and help you cancel the ones you don’t want. You can also set up a plan to help pay off debt faster.

If you’re looking for a more hands-off experience once you get a finance app set up, Pocket Guard is a great option. The base experience is free, but you can also sign up for Pocket Guard Plus for even more features.

Download: Pocket Guard for Android | iOS (Free, subscription available)

6. QuickBooks Self-Employed

QuickBooks Self-Employed is an essential service to use if you’re a freelancer or run your own business. It helps you organize personal and business expenses, get a quick view of your cash flow, and get an overview of how your company is growing and performing. It’s a subscription service, but worth the cost if you're invested full-time.

On its higher tiers, QuickBooks will even track and help you file your quarterly taxes. That’s essential for anyone who doesn’t want to deal with that headache every few months (everyone, we imagine).

QuickBooks has a mobile app that lets you access your dashboard from anywhere.

Download: QuickBooks Self-Employed for Android | iOS (Free, subscription required)

Money Management Doesn’t Have to Be Difficult

Taking care of your finances is more than just creating a monthly budget. It’s about creating a plan to lower expenses and improve cash flow. It’s thinking about both the long-term and the short-term.

Luckily, there are apps like Mint that help you set up a solid foundation for money management. After that, you can move on to solutions like Quicken or Personal Capital to maintain your expenses for a lifetime. Even if you don’t want to think about it at all, apps like Pocket Guard exist to make money management simple.

So you have no excuse to put off taking care of your money now. The many apps on the market can help you improve your financial situation, even if you're new to it all.