Scrolling through the Forbes list of billionares, you'll be forgiven for thinking of yourself as poor. I mean seriously: Bill Gates has done nothing but give his money away for over a decade, and he's still worth $79 billion.

Yet, if you're reading this, there's a decent chance you're among the global 1% of earners. Don't believe me? That makes sense: every human compares their wealth to people richer than them, ignoring completely how much they really have in a global context.

Today Cool Websites and Apps hopes to provide some context, pointing out sites that can show you how rich you actually are. If you've got an Internet connection, you're doing pretty well. Stop feeling sorry for yourself and start planning your financial future.

Global Rich List: See How You Rank Globally (broken link removed)

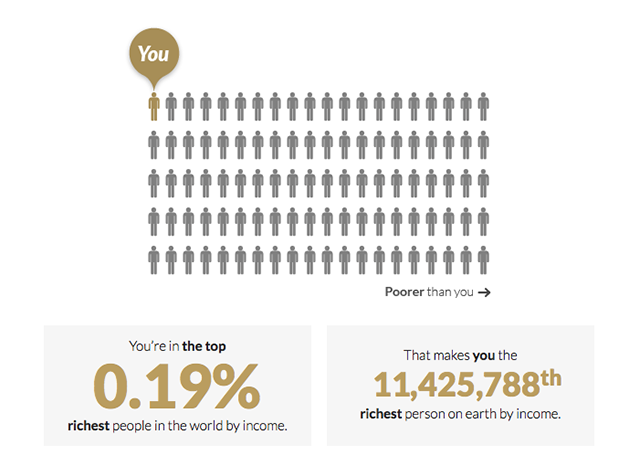

Forbes ranks the richest people on earth, but you probably didn't make that list. Have you ever wondered, if the list kept going forever, where you would rank?

Global Rich List gives attempts to "calculate" this. It's not precisely accurate, of course, but it's still interesting to play with. You can enter your income for a quick assessment, or dig into your net worth for something a little more accurate.

You'll probably be surprised at how highly you rank, which is part of the point. Scroll down and you'll learn how much people make in different places all over the world, which will hopefully give you a bit more context.

The idea isn't to feel guilty: it's to feel empowered. If you're part of the global elite, you should realize that.

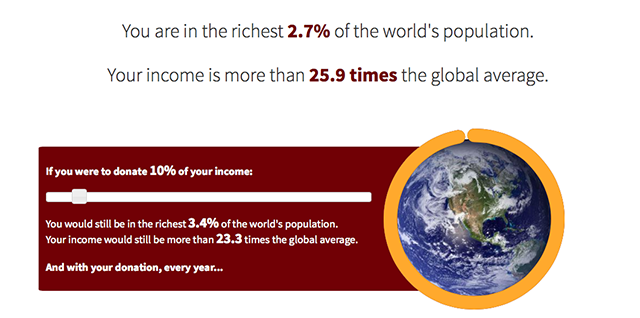

How Rich Am I?: See How Much Donating Would Affect Your Rank

Global Rich List is only one tool for this: How Rich Am I is similar, but some might prefer it because it takes the size of your family into account.

Additionally, this site doesn't show you you how your income compares to people in other countries (something you can't do anything about), instead focusing on how big of a difference your contributions to various charities can make. It's worth thinking about, so please take a look.

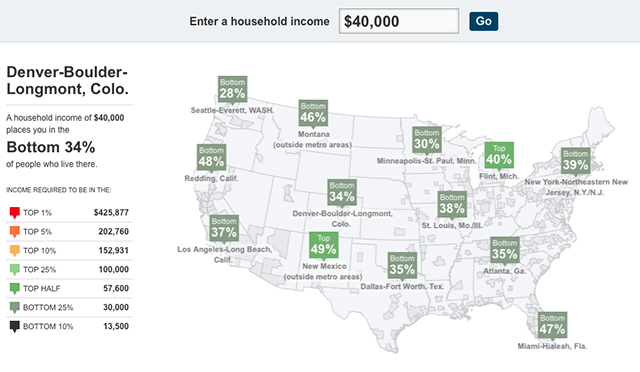

One Percent Map: Your Income Compared to Various US Metro Areas

"Of course," you might be saying, "This doesn't take cost of living into account."

I'm not going to get into that – the economics are complicated, and the above tools of necessity simplify things a little. But if you're interested in cost of living, and how your income compares to the people near you, you should really check out the One Percent Map. This tool, from the New York Times, compares your income to cities all over the USA.

See how your wages compare to other people in your city or area, or explore other areas just for comparison's sake. There's no information outside the USA, sadly, but non-Americans can still learn a little here. Explore just how much regional variation exists in the country, because it's staggering at times.

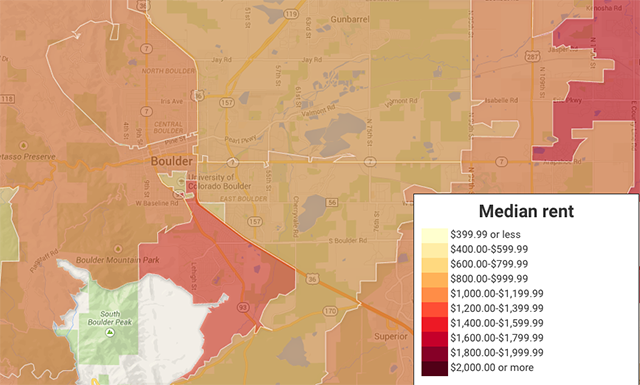

Rich Blocks Poor Blocks: Even More Data in Map Form

Income is only one stat worth looking at: housing costs, owner-occupancy and poverty levels can all tell you so much about the economy near you. Rich Blocks Poor Blocks breaks all of the USA down into maps, so you can see regional variations in your city.

You only get a few "free" maps, so use them on something you're really interested in.

Mustache Calc: Calculators That Help You Plan for Freedom

Developing a savings plan is hard, but it doesn't have to be. If you're not sure where to start, I recommend checking out Mr. Money Mustache, an excellent blog all about financial freedom – the author describes himself as a 30-something retiree. It might sound crazy, but the advice offered is surprisingly straight-forward: it basically boils down to spending less than you earn, and learning to embrace (and enjoy) challenges.

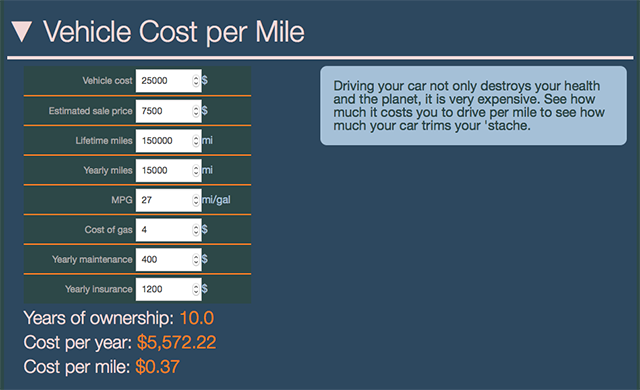

The blog's earned a loyal following over the years, and a few fans put together a handy page of calculators to help you learn more about your money. You can use them to realize all kinds of things – like how much your car is costing you.

The "real hourly wage" calculator, for example, works out how much you make when you subtract things like commuting costs, unpaid overtime and taxes. Another calculator lets you figure out how much cutting regular expenses your budget can earn you, with interest, over ten years.

Take some time to play with this and see what you can learn about your financial situation.

Let's Talk About Money

Money is complicated, and personal – no one is denying that. But in rich countries today, we have blessings and wealth previous generations couldn't imagine – and that countless people around the world do without. You shouldn't feel guilty about that, but you also shouldn't ignore it.

I want to know how you plan to save more money, so let's hear your best cost-saving tips in the comments below. I personally like to use tech knowledge to save money, but would love to hear your approaches. Also feel free to let me know what sorts of apps I should look for in future editions of Cool Websites and Apps!