One of the top new year resolutions on many people's lists is to spend less and save more. It's easier said than done, but you can still rely on several apps and tools to help you out.

Saving money is not just a goal, it's a change in lifestyle. In fact, it's like forming a good habit and breaking a bad one. It won't happen overnight, you have to keep working at it over a long period, and there will be slip-ups. The best approach is all about making your transition from spendthrift to money-saver as smooth as possible.

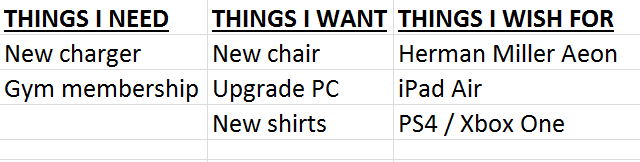

Make Need/Want/Wish Lists to Prioritize Your Spending

If you're spending more, you are probably buying more than what you need. It happens to everyone. You had no intention of buying that new gadget, you don't really need it or want it, but in an impulsive moment, you grabbed it — probably because it was on sale. We don't think that well, especially when we see a too-good-to-be-true deal.

You need to stop your brain in its tracks. Just like it's common money advice to make a shopping list before you go to the market and stick to it, you have to do that for all potential purchases. Don't open up Amazon.com and then think about what you can or can't buy.

Make three separate lists: need list, want list, and wish list. In the need list, write only the things you need to buy i.e. items you will buy before it comes to a point that you have to borrow for it. In the want list, write the things you want i.e. items that you will buy if you have saved money for them. In the wish list, note any items that you would like to have, but you can't afford.

Here's how to use it: You don't buy anything on the wish list till the want list is crossed off. You don't buy anything on the want list till the need list is crossed off. You have to add items to this list as you think of them, so use a cross-platform, versatile app like Wunderlist. The key is the discipline not to buy from one list till you've completely crossed off the other.

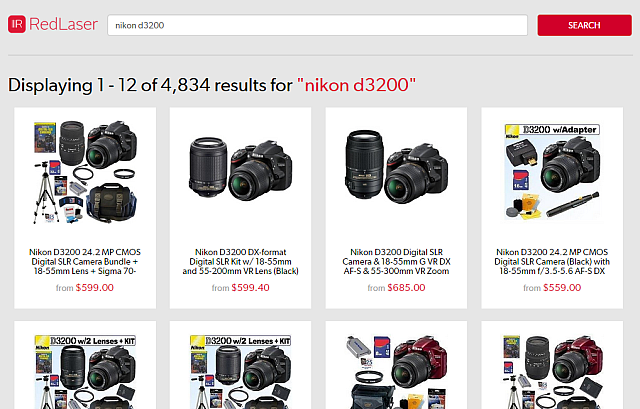

Haggle To Get Discounts By Comparing Prices

Consumer Reports recently reported that 89 per cent of people who bargained got a better deal. Unfortunately, too few people like to haggle and instead pay the price they see. The top tactic that worked? Comparing prices with competitors. If you're uncomfortable doing this, you need to treat it like any desirable habit — a lifestyle change that you have to achieve.

Thankfully, your smartphone makes this threat a whole lot easier to carry out. Of course, you can just head on over to Amazon.com and search for the same item, but there's no guarantee that Amazon will have the best price. You might want to try RedLaster to quickly compare prices from your mobile. All you need to do is scan the barcode and the app will tell you prices from other stores.

PriceZombie is a more comprehensive website to find the best shopping deals. But this money-saver isn't that great to use on your mobile. Still, it's worth visiting for its price tracker feature, which will show you the rate of an item over recent history, so you know how low it can go.

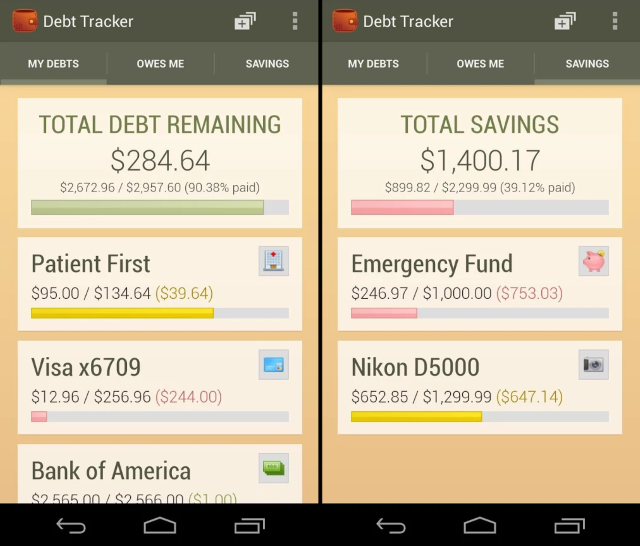

Keep A Visual Reminder Of Your Debt

Just like motivational quotes can spur your productivity, The Simple Dollar recommends creating a visual debt reminder to keep your spending in check. It takes hardly any time: all you need is a way to track your debt and a photo of what you will buy once you achieve your goal.

You can do the whole thing in a spreadsheet app quite easily. Ryan has detailed how to make a personal budget in Excel in just four steps. And Google Sheets has a bunch of useful, free templates for financial needs.

Bakari has covered the best iPhone apps to track your spending, but on Android, I find Debt Tracker to be best suited for our purpose. It's well-designed and does its only job brilliantly: tracking how you are paying off your debt. There are also trackers for what others owe you, as well as your total savings. Debt Tracker Pro ($0.99) lets you back up to Dropbox and choose different icons for different credit cards or other debts, for a visual cue.

As for the visual reminder of your goal, there's nothing like changing your PC or smartphone's wallpaper to your object of desire.

"Spend A Little, Save A Little"

My personal trick, which has been quite successful, is called "spend a little, save a little". I rely on Internet and mobile banking as a trigger to start saving more and cut down on spending. First, choose a target: what percentage of your earnings do you want to save? Ideally, use a round number, like 10% or 20%, to make calculations easy. For the sake of example, let's say it's 10%.

You will also need a second bank account, linked to your main account. Make this a Savings account, you won't be withdrawing from here often.

Now, every time you purchase something, you start your mobile or Internet banking app and transfer 10% of your purchase to your second bank account. This second account is only for investments or expenditure that is not for you or your needs (like charity). And make sure you're following the five vital security tips for smartphone banking.

The more you do this, the more you think twice before buying anything. Suddenly, it's not the cost of the item alone; there's a 10% added surcharge on that cost, which makes you think twice about whether you really need to buy it or you're just indulging.

Give Us Your Best Money Advice In 10 Words

The Simple Dollar invited its Twitter followers to give money advice in 10 words and compiled the best choices. We can do better, right folks? So tell us your best money insights in 10 words!

Image Credit: Money-Savings/Wikimedia, Gaertringen/Pixabay