Finances are a tricky thing to master. For most people, more earning causes more spending, but less earning doesn't always result in less spending. This creates a situation where people are financially upside down, and it isn't always an easy situation to recognize.

It's actually very surprising how long a family can go while running in the red, earning less each month than they spend. The warning signs of this are climbing credit card debts and sinking savings accounts.

So how do you recognize when you're in this situation before it's too late? Read on and we'll look at a few tools you can use to figure this out and turn things around.

Give Mint a Try

If you've never tried Mint, or like me, you've tried it before but didn't entirely get it when you did, I highly recommend giving it a chance so you can take advantage of its automated budgeting capabilities.

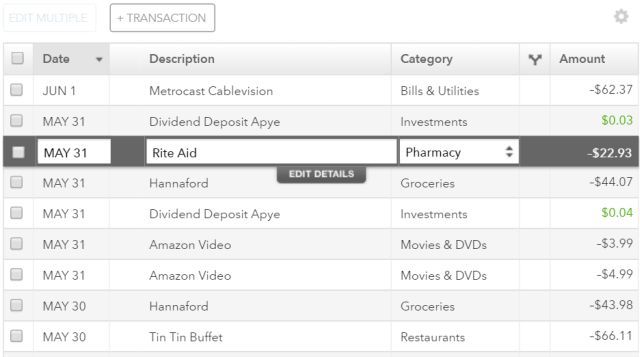

How does this work? When you provide your online banking credentials to Mint, it'll go out and pull a transaction history from your account. Mint will then attempt to auto-select appropriate categories for each item based on what the service knows about those businesses.

Most of the time the transactions are classified correctly. If Mint doesn't know what a certain company is, it'll leave the transaction uncategorized, and you'll need to manually select it -- but that doesn't happen often.

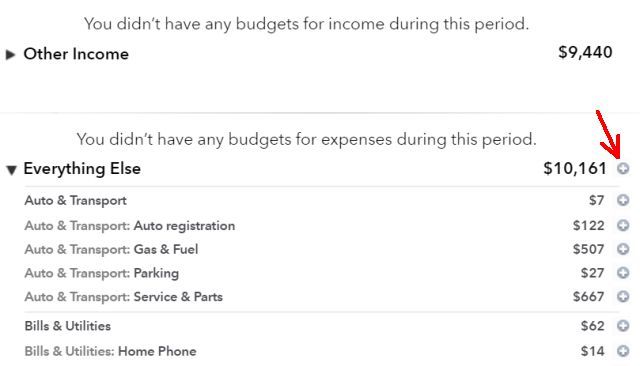

The beauty of this is that with very little effort, you can go into Mint's budgeting area and see an aggregate of those categories. Basically, Mint can show you, on average, how much you spend in each area. This has always been one of the most time-consuming parts of putting together a budget, and it's also the moment when you may realize that you either are, or aren't, in over your head with bills.

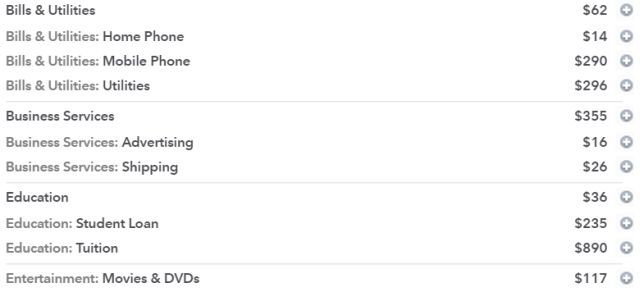

As you go down the Mint categorization list, you can click the + icon to add any bill as a monthly budget item. Mint will try to take an average of three months and suggest a monthly budget amount, but you can correct it and set it to whatever you like.

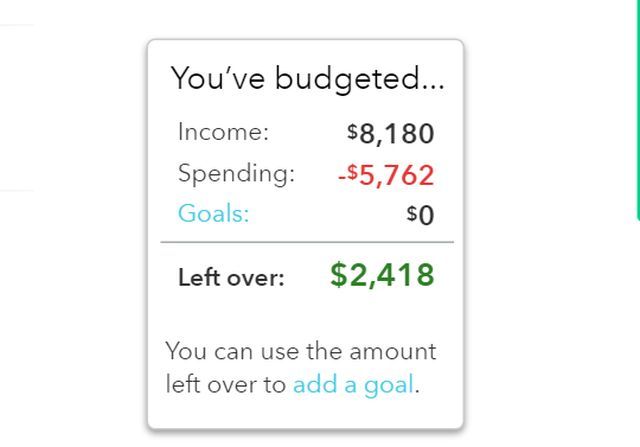

Once your Mint budget is finished, you'll see whether you're doing okay, or whether you're drowning in more bills and debt than your income is capable of supporting.

Do not let a red bottom line scare you into giving up on your budget. The point of seeing where you stand is so you can finally get around to doing something about it. If you're in the red, we've got some great tips and resources at the bottom of this article that can help you streamline and trim down your budget.

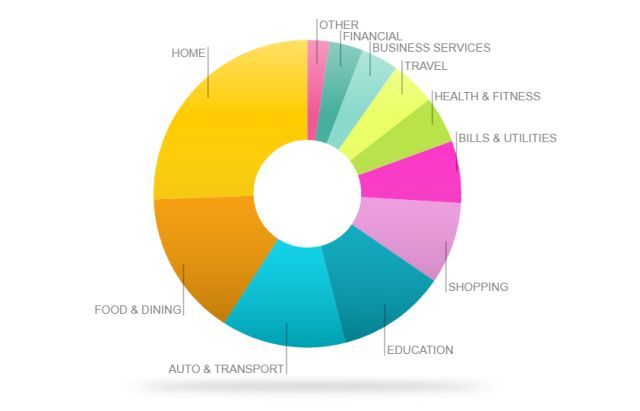

A nice place to start if you need to see where in the world all of your money seems to be going is the Trends section of Mint. This will show you a bar graph or a pie chart that breaks down the categories of your spending. This lets you see at a very quick glance where most of your money is going.

It's typical for Home to be a big piece of the budget, considering most people have a mortgage and home ownership expenses, and of course Bills & Utilities, Auto & Transport, and Education are often big areas -- but if you have giant chunks of expenses taken up by things like Shopping, Food & Dining, Travel or Other, then you've really got an opportunity to tighten the belt and take back control of your finances.

Use Google Templates for Budgeting

Some people don't like Mint or other services like it, like YNAB, for a number of reasons, not the least of which is security and privacy (linking your online financial accounts to a third-party service is a little bit unnerving). The fact that automated budgeting isn't perfect is also a deterrent to some -- Mint can't accurately catalog your every purchasing decision, so things are bound to be a little bit inaccurate.

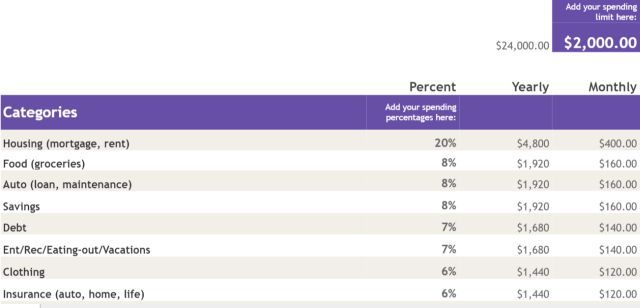

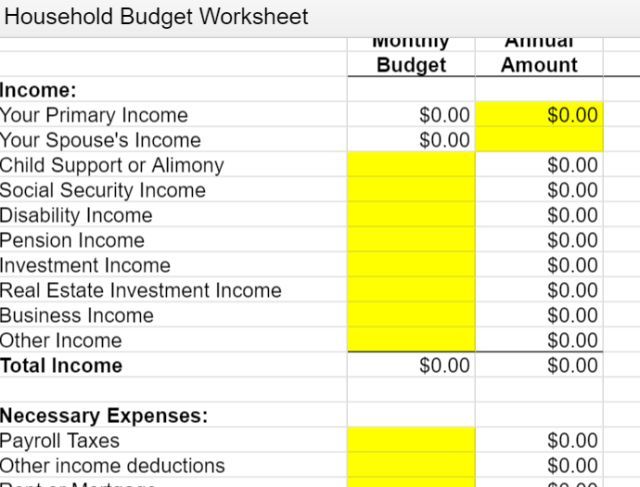

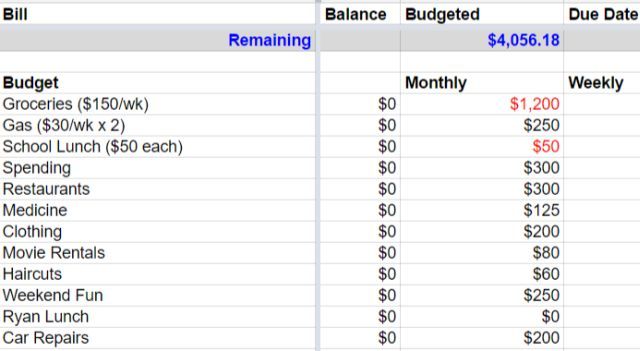

People who prefer perfection over automation often like to develop their own budget using Excel, but you can save a lot of time if you start with one of the many budget templates found in your Google drive account (just search the templates directory for "budget" to see them).

Some budget templates are fairly simple, where you just categorize and total your own budget categories (you may consider downloading three months of bank and credit card statements and categorizing all of your purchases just to make this as accurate as possible).

The budget will subtract your income from your categorized expenses and give you the remaining balance -- which will show you whether or not you're in over your head.

There are also some slightly more complex budget templates in the directory, with the ability to really break down both your income and expenses into more accurate sub-categories, giving you a much clearer picture about what where your money is coming from and going to.

Of course, there's always the option to just create your own budget using Excel. If you opt for this, do make sure to check out all of our Excel budgeting articles, including Excel life management tips, Excel templates, and even how to use it to get out of debt.

Excel can be a powerful tool in your budgeting toolbox, but understand that if you're going to use Excel to budget from scratch, it's going to take a lot more time -- so only use this option if you are willing to dedicate the time and effort to carry through.

How to Swim When You're Sinking

So, let's say that you've done the budget analysis above and you've realized that you're in the red. Lots of websites out there that offer budgeting tips don't really mention the fact that for a lot of people organizing your income and expenses doesn't always work out -- sometimes there's just not enough income to cover everything. What now?

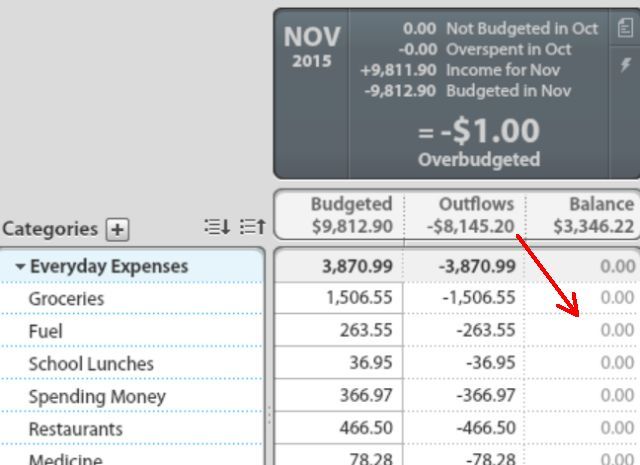

This is one area where the YNAB (You Need A Budget) approach to budgeting is useful. Instead of creating a budget ahead of time and then trying to make sure your spending aligns with your planned budget, the YNAB approach suggests that you only budget money that you actually have. So basically you end up waiting until your paycheck comes in, and then allocating that paycheck to pay specific bills and cover specific expenses, and then that's it until your next paycheck.

It's called "budgeting to zero," meaning you've allocated your income to pay down that expense to zero by the end of the month. Anything you have left over carries over to the next month, but you aren't living paycheck to paycheck, you're living expense to expense.

In theory, if you take this approach, you'll eventually accumulate a huge surplus in your checking account, because you aren't planning your spending based on how much is left in your checking account, you're planning it based on how much is planned for in your YNAB budget.

Sounds great in theory, but it only works if you have more income than expenses. If you're actually in the red, it's not going to work -- bills are going to have to go unpaid.

The better approach if you suspect you're in the red is to take the time to extract three months of your bank statements and categorize all transactions. If you're lucky, your bank is smart enough to try and categorize the transactions for you (most bank statements will do this).

Or if you use Mint, you've got everything automatically totalized for you. Just click the plus icon to move everything into your budget until all expenses are accounted for.

As you're clicking the plus icon in Mint, be very strict about "must" expenses that have to stay in the budget. If a cellphone for everyone in the family is a must, look at ways to cut the bill by switching cellular services or trying a pay-as-you-go cellphone plan.

However, don't try to totally deprive yourself of variable expenses like restaurants, fast food, coffee, gambling, and so on. Start off lowering each of them only enough so you just barely break even with your budget. Just barely get yourself out of the red by cutting each of those variable expenses just enough. Too drastic of a cut and you'll never be able to stick to it.

One trick people use to stick to their planned monthly spending is to take out only enough cash to cover those variable things like dining out or movies, put the cash in envelopes, and only allow yourself to spend from the envelopes.

Each month, you can reduce the cash you put in these envelopes by 10%, and try to find creative ways to still enjoy the things you like without running out of cash by the end of the month. You'd be surprised how creative you can be when you see the physical pile of bills dwindling in that envelope.

One example of creative saving opportunities was one that I discovered to cut my work lunch expenses. Many workplaces like mine offer cafeterias where you can purchase lunch for anywhere from around $3 to $7, depending what you order. If you imagine buying breakfast and lunch there every day, that can add up to a lot of money by the end of the month.

One trick might be to purchase ready made pouches and instant oatmeal from your local thrift food store.

You can store these easily in your desk at work, ready for breakfast and lunch whenever you need it.

Amazon usually offers some great deals on packs of these types of foods, or you can opt for freeze-dried meals like the kind you take camping. Just add hot water!

Continue coming up with creative ideas like these to cut those variable expenses until you've cut the expenses as steeply as you can without completely destroying your quality of life.

I also highly recommend reading The Tightwad Gazette for some of the most amazing and innovative ideas to cut expenses from your household budget. You'll be very shocked that you never thought of some of the ideas found in that book.

It's an older book, but still a fantastic resource.

Over time you'll find that your budget is not only out of the red, but that you are starting to build a tidy little security nest in your bank account. Once you've accumulated at least six months of living expenses in your account, the next step is to decide what you're going to start doing with your extra cash!

There are plenty of ideas to choose from.

- Apply the surplus to your long term savings plan or retirement.

- Plan your next (frugal) family vacation!

- Start saving for your kids education, or your own.

- Save for your next car so you can pay for it outright in cash.

As you can see, getting your budget out of the danger zone opens up a whole world of financial possibilities. It all comes down to taking that first step -- choose the budgeting approach and the tool or tools that you prefer, and just make the time to take that first step. You'll be glad you did.

Have you ever tried to balance your budget? What areas give you a hard time? Have you tried any of the tips above? Share your own tips to help out our other readers with their own budgets, in the comments section below!

Image credit: financial troubles by Photographee.eu via Shutterstock, Mattia Menestrina via Shutterstock.