There's no getting around it: insurance is really expensive. Health insurance, auto insurance, home insurance... all of it can cost thousands of dollars every year. Saving even a little bit each month can add up to huge amounts of money back in your pocket over time.

But how can you get better rates on insurance? It might seem impossible, but there are a number of things you can do to stop paying so much. Some depend on your circumstances. Some have specific requirements. But there's almost certainly something you can do to save some money.

Assess Your Needs

This is important, and a step that many people neglect. What level of insurance do you need? What are you likely to use it for? To give you a personal example, in my household, we're more concerned about the prescription benefits of health insurance plans than other factors. If you're injury-prone, you might have different priorities.

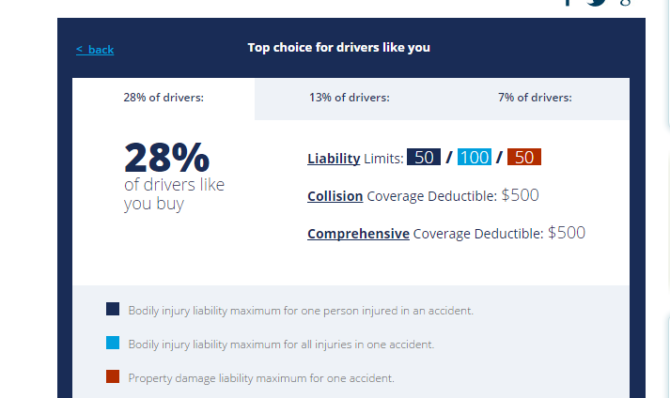

You might be able to prioritize your needs for home insurance, as well. If you're more worried about environmental damage than someone stealing your belongings, you can get a plan that meets your needs. Don't pay for a plan that covers way more than you think you're likely to need unless you can afford it. For an idea of how much car insurance you might want, check out this calculator at CarInsurance.com.

Of course, reducing coverage comes with some risk. If your high-deductible insurance plan has a low monthly payment and you get in a significant car accident, you could be faced with some pretty serious medical bills. Try to find a balance between coverage and affordability.

For a great example of how to figure out how much insurance to get, check out Dave Ramsey's break-even analysis of car insurance. You can apply these principles to any type of insurance.

Do Your Research

With some investigation, you might be able to find a plan that will save you some money. There are many insurance comparison sites that will help you find insurance for your particular circumstances. The United States currently has state-based health insurance websites that let you look around at different plans, for example. You can find your state here.

But remember that there are almost always alternatives. Some providers might not appear on these sites. And many providers don't offer their best deals on comparison websites. If you really want to save, you may have to call your provider or an insurance agent to ask them what sort of deals you can get.

Remember that there are a lot of options for finding insurance. For example, in the U.S., you can visit eHealth, an alternative to the state-based marketplaces. Ask your friends and family where they've found the best insurance deals. Check /r/insurance to see where people have found good deals or are in a similar situation (reddit can be a surprisingly good source of financial advice). Any of these might point you toward a better deal than you're getting now.

Yes, all of these things take effort, and you'll spend a number of hours doing your research. But it could easily save you a few thousand dollars over the next several years. Our own Joel Lee recently reduced his car insurance payment by $225 per month without even switching providers. Get online or pick up the phone and do some research. It really can pay off.

Find Alternative Insurance Plans

There are a number of alternatives to traditional insurance policies that can save you money. For example, a direct primary care health membership lets you pay $100 or less per month to have your primary care needs covered by a specific medical provider. You'd still need a high-deductible plan to cover emergencies, but the combination of these two plans could save you a lot of money. To find a direct care provider near you, check out MyDPC.org.

There are other options, too. Catastrophic health insurance plans also keep costs to a minimum for young, healthy people. Healthcare sharing ministries are faith-based options for sharing the costs of healthcare. High-deductible plans have lower premiums, and if you're in good health and have a health savings account, that could be a great way to save.

On the auto insurance front, if you don't drive much, consider a pay-by-the-mile plan. You pay a small monthly premium, and then a per-mile fee as well. The fee is capped at a certain number of miles per day, so a cross-country roadtrip won't cost you a fortune. This is great for people who commute to work by bike or don't do much driving.

Bundle Insurance Policies

Many insurance providers offer multiple types of insurance, and if you take out multiple policies from the same provider, they may give you a discount. For example, Progressive offers home and auto bundles, and Nationwide will let you bundle your home, auto, and life policies. It's difficult to find specifics on how much you can save, but Nerdwallet reports that average savings are in the 10--20 percent range for each policy. Again, it might not seem like a whole lot, but it makes a big difference over time.

To get information on bundling, you'll probably have to call your insurance company; these deals are harder to find online. And you may not be able to get the bundling discounts until your policy needs to be renewed. But by combining a policy that's a good fit for your circumstances with a bundling discount, you could save hundreds every month

Take Advantage of Eco-Friendly Offers

Some home and auto insurance providers offer discounts for people who choose eco-friendly alternatives. For example, Travelers offers up to 5% off your home insurance if your house is LEED certified. If your home is powered by an alternative energy source, or you replace your appliances with more energy-efficient ones, you may get a better deal on insurance, too. You might also get a discount on rebuilding if you choose to use environmentally friendly materials.

If you drive a hybrid or electric car, you may also be eligible for discounts on your auto insurance. Both Farmers and Travelers offer up to 10 percent off of your policy if you have a hybrid or electric car. Not all insurers offer this discount, but if you have an eco-friendly car, you may want to pursue this one. You may also be able to get a discount if your vehicle uses an alternative fuel, like biodiesel or ethanol.

Look for Other Discounts

Many insurance providers offer other types of discounts, as well. Young drivers can get insurance discounts for good grades. Anti-lock brakes or theft deterrent devices could cut down your premium. Using a dashcam might be worth something. Veterans can often save. Using direct debit can score you a discount. You might be able to get a discount through your employer. Federal employees can save, too.

It's probably best to call your insurance provider to ask about potential discounts. Their website may also list a number of ways to save.

Share Your Best Tips

These six tips will help you make sure you're not overpaying for insurance. But we're sure there are tons of great strategies out there, and we want to hear about them!

How have you saved on insurance? Which tips do you find the most useful? Share your thoughts in the comments below!

Image Credit: Africa Studio via Shutterstock.com