Being the type of guy that burns through money I jumped at the opportunity to review Mint. Mint is a finance tracking and budgeting platform much like Microsoft Money or Quicken. But the main difference is it is Online - if you don't have a problem adding your banking information to Mint.com you can have access to a complete financial overview from any web browser.

Mint has been in Beta for about 3 months now and is showing somewhere in the neighborhood of 60,000 early adopters throwing in over 2 billion dollars of their hard earned accounts into Mint's databases. 2 fricking billion dollars? That's a lot of moolah"¦

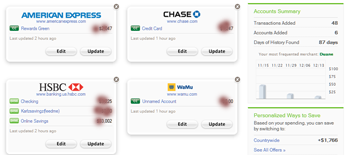

I jumped right in, after thoroughly checking out the website and its history. I couldn't just give my info to anyone - right? They have their security and safety information posted here (this should calm you down a bit). But, I was immediately impressed. It allowed me to add 2 Credit Cards and all my accounts from HSBC in 4 or 5 clicks. It has some 1500 institutions in its system so it can grab your transactions with ease.

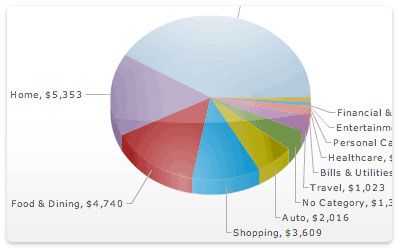

Now that my information was in the system Mint can give me a detailed analysis of where my duckets are going. Obviously there are some things that the program can not discern like all those cash withdrawals for your trees and late night escapades "¦ They will still show up as No Category. I think that is better for all of us - don't you J. But your overview of all your accounts is DOPE. You can set low balance warnings per account and other alerts as well.

I noticed that Mint says it can save me money. I was extremely interested in how they were going to save me almost 2 grand a year"¦ Sadly enough the info behind this was WRONG. Mint thought my HSBC savings account was 0% interest when it is actually almost 5.3%. So that part was way off. But to be fair they are still in Beta. And if my accounts were not interest baring this could have been VERY helpful.

All right and now for some of its short comings. I have YEARS of back financial data and I could not import it into Mint. It would only take data from financial institutions directly. So for the security freaks and data mongers this isn't for you. I also had issues with some of the description editing for transactions coming in. They cut off intuitive descriptions for crap that didn't make much sense"¦To really use it as is I would need to create a gajillion renaming rules.

As I was finalizing my review I got an email from Mint letting me know that my AmEx bill was due in 14 days, the balances and due dates on all my accounts. That was DOPE. I like it even more now. I'm glad I got that in! AskTheAdmin gives Mint two thumbs up!

The big financial apps should take a few notes on what Mint is doing because if they don't they are going to be out of business!

For some simpler expense trackers check out previously posted 15 Tools for Easy Expense Tracking and Budgeting.