When it comes to retirement, there's a lot of terminology to know. But one term that you might not be familiar with is safe withdrawal rate (SWR).

You'll most often see it discussed in financial independence/early retirement (FIRE) forums, but it's applicable to anyone who wants to retire. If you want to retire early, it's even more important. Let's look at what it is, how to calculate it, and how it can help you retire.

What Is the Safe Withdrawal Rate?

Bogleheads.org defines the SWR as "the quantity of money, expressed as a percentage of the initial investment, which can be withdrawn per year for a given quantity of time, including adjustments for inflation, and not lead to portfolio failure; failure is defined as a 95 percent probability of depletion to zero at any time within the specified period."

In layman's terms, it's how much money you can take out of your retirement account every year without going broke. This is a very important number for a retiree. Basically, as long as you stay under the SWR, you'll have enough money. If you start withdrawing too much, you're going to be in trouble.

While many financial experts have given 4 percent as the safe withdrawal rate, that's just a generalization. The SWR depends very much on your specific circumstances, as well as the actions of the economy. In general, it's very safe to use the 4 percent figure. Let's see what that would look like.

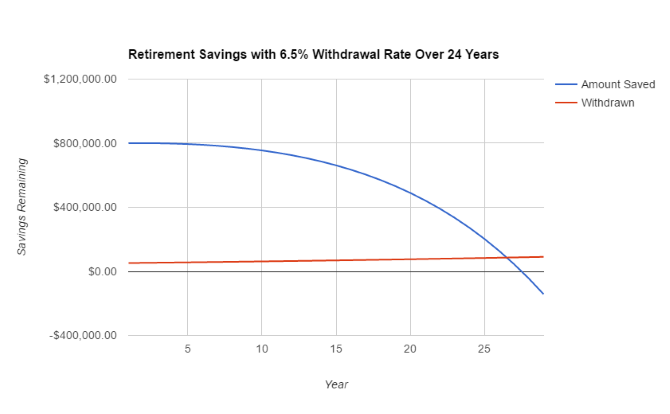

Let's say you start with $800,000 in your account and you'd like to spend $52,000 each year. We'll use 2 percent inflation. The very first row of the table is easy to calculate: you've taken $52,000 out of your account, which is equal to 6.5 percent. That leaves $748,000 in your account, which will increase in value according to the market. Most estimations of the market value use a 7 percent annual increase. So, in year two, you'll have $748,000 x 1.07 = $800,360.

Because of inflation, you'll take out more than $52,000 in the second year. With 2 percent inflation, you'll need to take out $53,040. At the end of year two, you'll have $747,320. At the beginning of year three, you'll start with $799,632. Keep this going and you'll find that your account will be depleted in 27 years. So it's probably a good idea for you to either save more before retirement or spend less each year.

It Gets More Complicated

This method of calculating your SWR is pretty simple. But it doesn't account for several things.

For example, medical expenses can start to really add up later in your life, and that can take a big toll on your retirement accounts. Inflation may go crazy for a couple of years. You might not get the returns you expected on your investments. These variables can make the basic SWR calculation inaccurate.

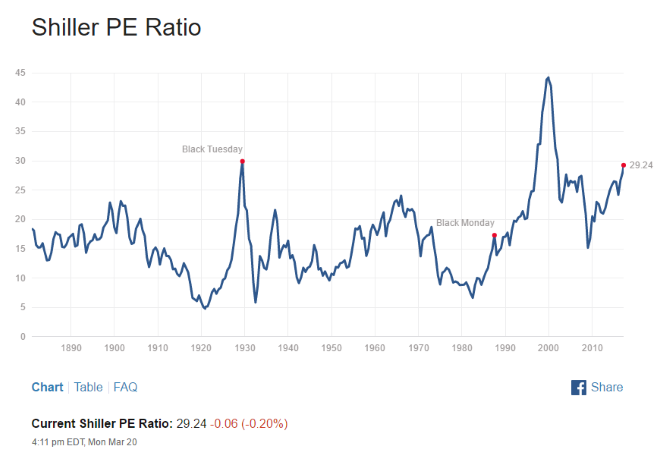

A number of other more complex systems have been recommended. One of the most popular (at least at the time of this writing) is the Shiller cyclically adjusted PE ratio (CAPE).

The inverse of this number, known as the CAEP, often correlates with the safe withdrawal rate. At the time of this writing, the current CAPE, as reported by Multpl.com, is 29.25. The inverse of that is 3.4 percent. That's the estimated safe withdrawal rate now.

Some online calculators take this number into account when reporting your SWR. The Mad FIentist, for example, has an indicator in the FI Laboratory that shows you what the current SWR is based on the CAEP. Robert Shiller himself helped design a calculator at Passion Saving, which gives you probabilities for success based on a variety of input and goals.

What to Do With the Safe Withdrawal Rate

Once you've determined your SWR, what do you do with it?

You use it to make sure that you're going to be able to live off of your retirement accounts. Run a few different numbers through it as an experiment. Start with a number you think you can reasonably save by the time you retire, and the standard 4 percent, 7 percent, and 2 percent numbers. See how much you'd be living on per year. Then see if your account would see you through a market downturn. Or a period of high inflation. Or a spate of medical expenses.

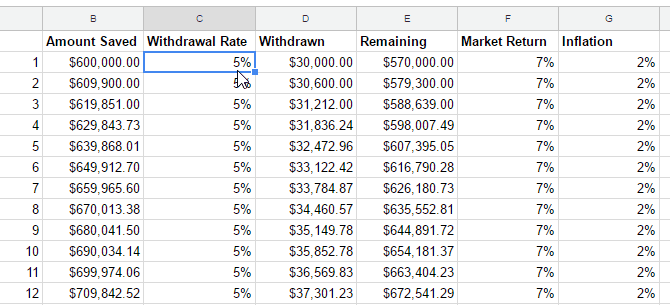

I've included a downloadable spreadsheet template for playing with your withdrawal rate. Just change the amount saved, withdrawal rate, market return, and inflation values, and you'll see how your retirement accounts will be affected. Click on the above link to download the spreadsheet.

You can also check the current Shiller CAEP to determine a reasonable withdrawal rate to put into the calculator. If you want to use a more full-featured retirement calculator, there are plenty available.

Remember when you're using these tools that you may have other sources of income. Retirees often collect social security payments or pensions, and a large portion have small jobs from which they earn supplemental income.

Also remember that the amount you'll need to withdraw each year depends largely on where you live. Retiring in Wisconsin is going to be cheaper than retiring in California. Another country could be significantly cheaper or more expensive.

The More You Know

The SWR, like any other savings or retirement metric, can be useful in planning your financial future. But should be taken with a grain of salt. Everyone's financial circumstances are different, and many people have very different expectations for their retirement. Nevertheless, having a better idea of how much money you have will always be beneficial.

What sorts of calculations do you use for your retirement savings? How do you calculate your own SWR? Share your tips in the comments below!