Keeping track of your personal finances can be a hassle, especially if you have a lot of accounts or you run a small business. There are some great online options, but many people prefer to have dedicated software on their home computer to keep track of everything. Quicken is the biggest name in the business, but what else is out there?

These five apps will help you budget, keep track of spending, and monitor your investments from your Mac.

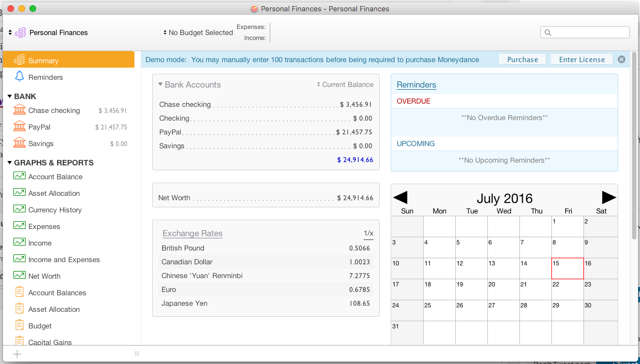

Moneyspire ($35 / $70)

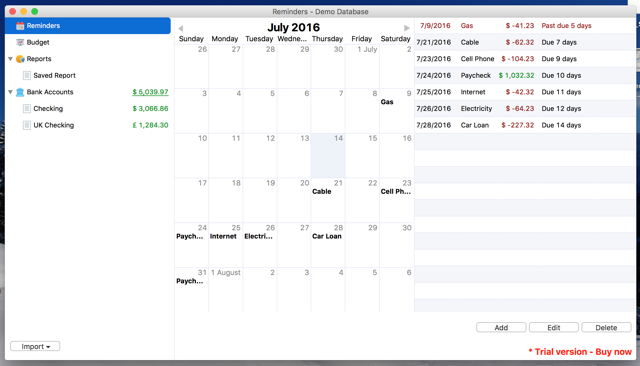

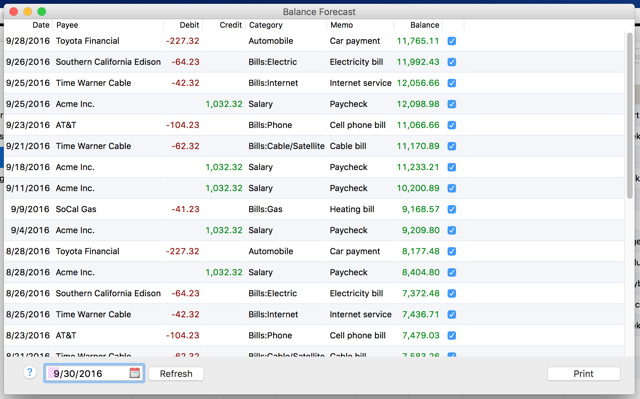

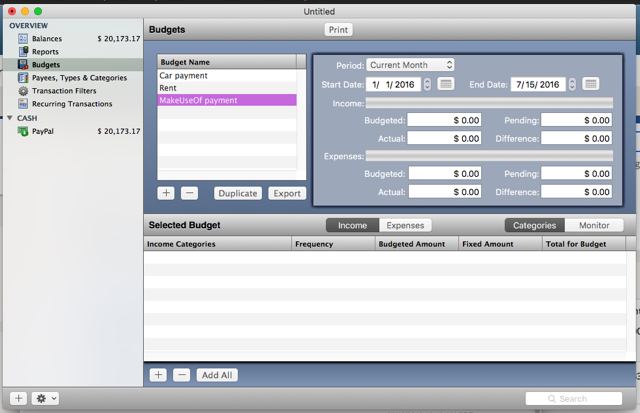

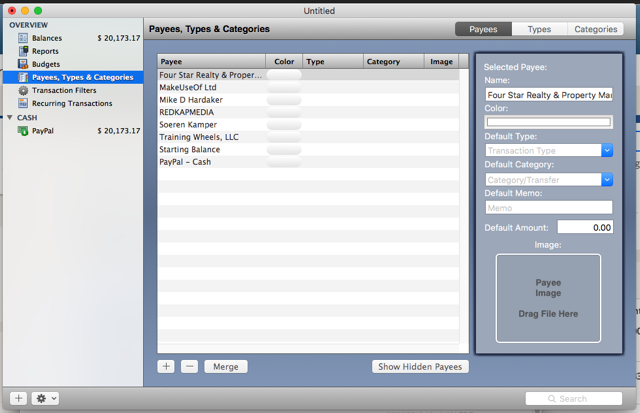

It might not win any aesthetic awards, but Moneyspire is a fast and versatile personal finance client. Its strengths include direct connection to your bank, a Reminders view that keeps you on top of upcoming bills and paychecks, multiple-budget support, and balance forecasting (though it's not clearly explained how this is done; it appears to just look at recurring transactions, so it might be a rather simplistic forecast).

Moneyspire also lets you use multiple currencies on your accounts, which will be really useful for anyone who's moved to a different country or does business internationally. The interface isn't especially striking, but it's very easy to navigate quickly.

There aren't many downsides to Moneyspire, but some of them might be deal breakers. The Reports tabs aren't especially insightful; they show you your cash flow, tax-related cash flow, expenditure by category, and net worth over time. Not every bank is available for Direct Connect, and you'll need to make sure your accounts allow Quicken-style access, which could cost money. And PayPal isn't supported.

Also, you only get Direct Connect with the premium version of the app, which costs twice as much. The basic version requires that you download your transactions manually.

Moneyspire seems like a good option for people who run small businesses and want to use the same software for both home and business accounts. Being able to create multiple data files and multiple budgets within each file means you can manage a lot of different financial information at once.

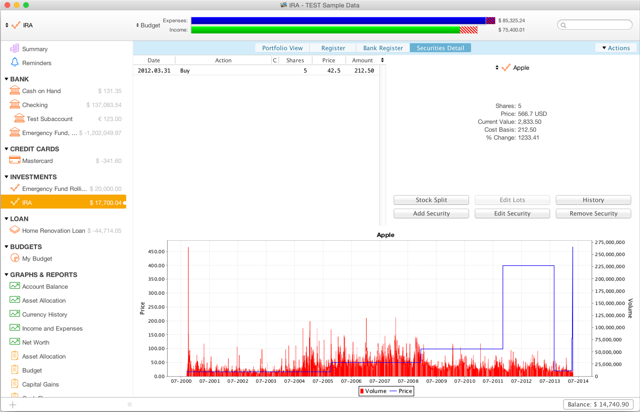

Banktivity 5 ($60)

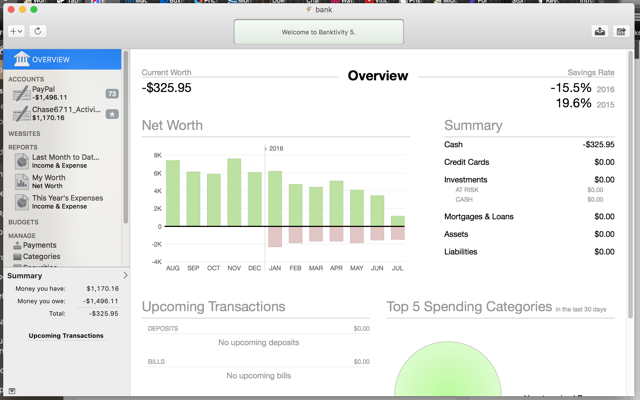

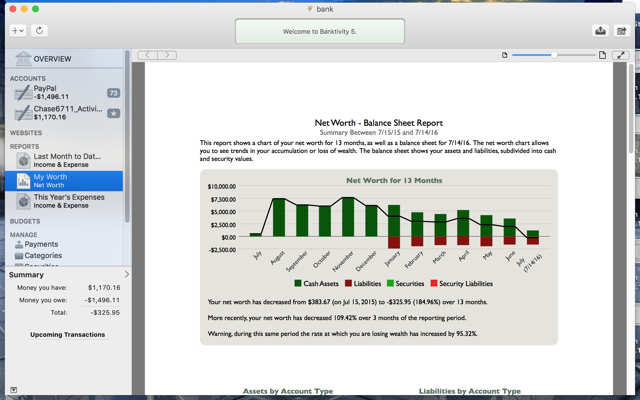

Formerly called "iBank," Banktivity 5 is a powerhouse of a personal finance app. Some of its most notable features include very nice-looking, print-friendly reports, support for multiple currencies, easy attachment of images to any transaction for storing receipts, financial quotes, many investment-related capabilities, and key facts in the Overview.

Although you'll need to have a subscription plan (for $40 per year) to get direct, automatic access to your bank accounts, Banktivity makes it easy to download and import your transactions directly within the app. To make sure all of your accounts are displaying the right amount, though, you might need to do some extra work compared with automatic downloads.

Banktivity also has a great budget-creation wizard that walks you through setting up budget for income, regular expenses, unplanned expenses, bonuses, unscheduled income, and more. Creating multiple budgets could be useful for multi-person families or small business owners, and the option to budget in the "envelopes" method, much like You Need a Budget (a service we like around here), provides another good way to keep track of your money.

Like Moneyspire, Banktivity is probably best for people who have complicated budgeting and tracking needs; if you do a lot of investing in different places or run a small business, for example. The price tag combined with the subscription fee for automatic updates on your accounts can add up quickly, and likely won't be worth it for the average user.

Moneydance ($50)

If you like the overview that your checkbook register gives you of your transactions, you'll like Moneydance's transaction screen, as it's styled after the log you might be familiar with. Other features include automatic transaction downloading and categorization, online bill pay, a nice overview screen, good support for investments, and useful reports and graphs. The inclusion of exchange rates on the overview screen is a nice touch for users with international accounts, too.

The investments screen is especially nice, as it gives you a lot of useful information in a small space. By automatically downloading investment information, you'll always have the most up-to-date information on your stocks, bonds, and other investments, as well. The wide variety of views, including charts and graphs, is really nice, and can easily be accessed with a couple clicks in the sidebar.

Overall, Moneydance doesn't have many downsides. Because I was working with a free trial, I couldn't use its ability to connect to a bank, so I had to download and import my transactions, which was kind of a pain, but I was able to get a good overall idea of how to use the app. The price will still be prohibitive for many users, making this, like the other choices, best for people who want an all-in-one solution for multiple accounts and different subsets of accounts.

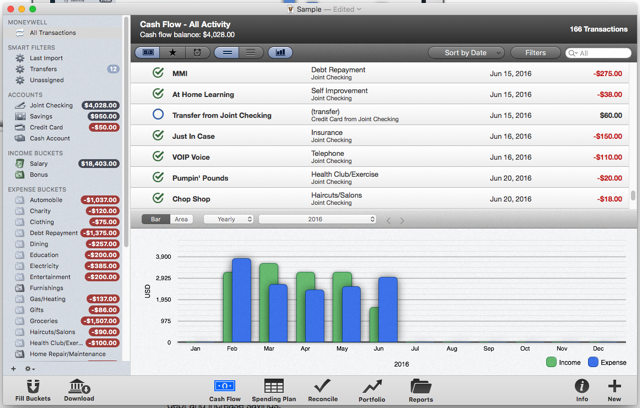

MoneyWell ($60 / $30 during Preview Sale) [No Longer Available]

Fans of You Need a Budget will like MoneyWell; the layout is very similar to YNAB's online client, and budgeting works in the same way. The envelope-budgeting system is one that's been around for a long time, and has worked for a lot of people, so there's a good chance that MoneyWell's system will work for you. The income/expense graph that can be displayed at the bottom of the transaction screen is a very convenient way to see how your monthly cash flow has been going, which is always a good thing to have front and center.

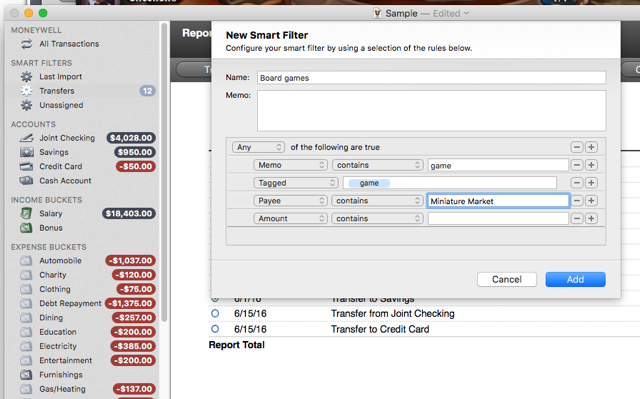

MoneyWell's interface is really nice -- possibly the nicest of all the apps reviewed here. While it doesn't display quite as much information as some of the other options, it's very clean and easy to read, and it doesn't look like it was designed in the 90s. The inclusion of smart filters is nice for finding specific groups of transactions without having to search for them, and the app is very flexible when it comes to dealing with multiple currencies. MoneyWell's website states that it's the only app that "allows you to record a transaction in one currency, store it in an account register in a second currency, and assign it to a budget bucket in a third."

Unfortunately, MoneyWell doesn't connect to PayPal (though you could presumably manually download and import your transactions), and its reporting capabilities aren't quite up to the standard of other apps. You can create custom reports that will get you the information you want, but it doesn't have nearly as many built-in reports as Moneydance. However, if you're not looking for extremely detailed reports or you want a client that's built to work well with envelopes-based budgeting, MoneyWell is a great option, especially during the Preview Sale, while it's still only $30.

SEE Finance ($40)

With a highly customizable interface, SEE Finance is likely to appeal to people who like to tinker with their apps until they get the exact layout and functionality they want. Transaction displays, colors, fonts, even transition effects can be tweaked. Budgets and transaction filters are also customizable so you can keep track of your finances in exactly the way you want.

The rest of SEE's features are the ones you'd expect: automatic account syncing, multiple currency support, graph-based reporting, investment monitoring, and the ability to work with a wide range of account types. You're also given the option of password-protecting your financial files, and the login information for your account is stored in Apple's Keychain for additional security.

Unfortunately, SEE's interface isn't always easy to use; I couldn't figure out how to get an amount set in my budget without referencing the help files, and the interface -- like many of the interfaces belonging to apps in this list -- felt quite dated. And SEE doesn't natively support PayPal, which is likely to be a problem for many of our readers. Although the price is reasonable compared to other options, I'd be hard-pressed to recommend this unless there are very specific features you're looking for that you can't find in other apps (though I'm not aware of any notable ones).

Your Mac Personal Finance Software Recommendations

While these five are some of the most popular options for personal finance software on the Mac, there are certainly other options (including, of course, Quicken). We'd love to hear what you like or dislike about these apps, and whether you use one of these options or one that wasn't listed.

Or do you just use an online solution? Both Mint and YNAB are great web apps for keeping track of your finances, and there are plenty of mobile-only apps that help you stay on top of your spending and budgeting as well. Maybe you just don't need all the features of a paid Mac app. Maybe you just stick to using your own budget spreadsheet. Either way, we want to hear from you.

What do you use to keep track of your personal finances on your Mac? Share your best recommendations in the comments below!