High transaction fees can be a serious problem for online workers and stores. Shelling out cash just to accept a payment can eat into profit margins. PayPal, the online shopper's favorite payment method, earns over 4% per transaction. Surely there's another way.

Skrill, known in another life as Moneybookers, advertises fees and commissions that are often much lower than PayPal's. The company is aggressively pursuing the EU market and has gained over 30 million customers so far.

Beyond the fancy banner ads and sales copy, Skrill likes to keep extra clauses and fees out of the spotlight. Their services very often trump PayPal's but at what cost? Switching to Skrill is worth it for some, but not for others. Find out which side of the fence you should sit on.

Debit Cards To Access Cash

PayPal and Skrill offer Debit cards to their customers, which enable instant access to funds. Using a debit card is safer than carrying cash or your own credit cards when abroad. It also means you don’t have to wait the few days for the company to transfer funds to your real bank account. I also find debit cards help manage spending. Unfortunately, PayPal only offers this service to US users, while Skrill offers debit cards worldwide. This is what initially attracted me to Skrill.

PayPal’s debit card for private users isn't attached to your PayPal account directly, meaning you have to transfer funds from your PayPal account to the card. However, for business accounts the debit card is attached directly to the account. ATM withdrawal fees (promoted as an alternative to transferring funds to your bank which can take days) cost $1 and purchasing from a foreign merchant online yields a 2.5% fee on top of the currency conversion fees PayPal already charges. Ouch.

Skrill’s card on the other hand presents a much more straightforward approach. An annual fee of €10 is paid along with a €1.80 (~ $2.40) ATM withdrawal fee. All other day-to-day activities on the card are free.

Although the more expensive option (particularly if using ATMs), Skrill’s card has a trick up its sleeve. To avoid currency conversion fees, you can get your card in Euro, USD, British Pounds, or Polish Zlotys regardless of where you live. Skrill is the cheaper option by a mile when you make an online purchase in a different currency or spend while traveling. This is particularly true if you'll only be using the card to pay in-store, rather than withdrawing cash from ATMs.

So, if you’re a business user in the US it’s PayPal. Otherwise the world-wide availability of Skrill and the functionality of their card makes Skrill the better option.

Payment Gateways for Stores and Online Workers

For European users, Skrill can seem like the best option. Their 2.9% commission and €0.25 transaction fee trumps PayPal’s 3.4% and €0.35 fee. To receive €100, Skrill is €0.60 cheaper. If you plan on spending your funds via your debit card, then Skrill is the cheaper option. But if you withdraw it in cash or send it to your bank account, the extra €1.80 Skrill charges (as opposed to PayPal’s free withdrawals) obliterates any savings.

Most merchants will net over €100. Skrill becomes the cheaper option when you break the €350 mark. The €1.80 withdrawal fee is eclipsed by €1.85 savings on commission and transaction fees.

Both PayPal and Skrill offer online payment gateway services, which are easy to integrate into e-commerce sites. Unfortunately, Skrill again jacks up their fees by charging a €20 merchant fee (along with the normal receiving fees) per month in stark contrast to PayPal's free gateway software.

What About Skrill’s Bad Reputation?

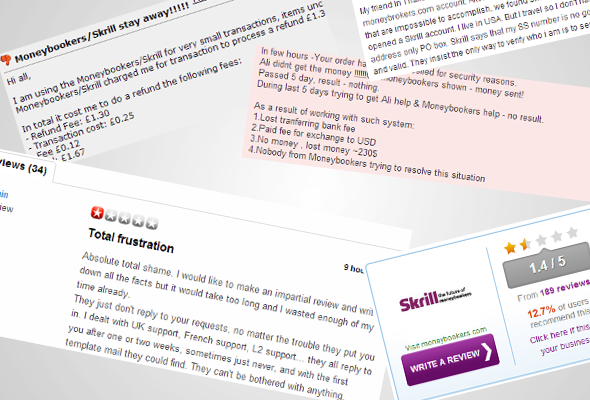

In its past life as Moneybookers, Skrill earned a bad name for itself around the Internet. Googling the company’s name quickly unearths forum posts and blog articles criticising the company’s charges. Regulated by the FCA in the UK and bound by EU monetary directives, Skrill is no "scam" as is often claimed online.

Every charge they can apply to your account is listed on their website, albeit in hard to find or easily overlooked places. Common grievances I found were:

- If you stop using your account for a period of 12 months, €1 will be deducted monthly thereafter. Why? I have no idea. It seems like a sly way of slowly draining forgotten accounts for no good reason.

- A refund fee. With PayPal, a seller can refund a customer. They receive their commission back too, but not the 35c transaction fee. This seems reasonable enough to me. With Skrill, transaction commissions are not reversed and the seller is charged an additional €0.49!

PayPal has its flaws, but it also has world-class security and insurance features as well as transparent fees. Their brand is certainly the most recognized and trusted for sending or receiving money online. This brings with it a certain degree of inherent trust among potential customers.

So, Should You Switch to Skrill?

For business owners, it is only worthwhile to switch to Skrill if your business has a high enough turnover to save money on Skrill's cheaper transaction fees in order to compensate for their higher withdrawal and payment gateway charges. Fortunately, Skrill's background fees are not so high for small to medium sized eStores also.

For private users, Skrill can be advantageous in one aspect. It’s free to receive money and spend it via their debit card. PayPal is lagging behind with offering EU users a debit card, but perhaps that’s because they're focusing on PayPal Here, their real world mobile payment system, launched last year.

As an EU citizen who gets paid in USD, I am often annoyed by PayPal's fees. Nevertheless, their system is straightforward, has a good reputation and is almost universally accepted online. Notwithstanding exceptional circumstances (such as in India where their central bank severely limits PayPal's functionality), moving to an alternative to PayPal will likely be a costly endeavour, despite cheaper rates advertised in big print. I advise independent online workers and small stores to continue using PayPal if they are comfortable with it.

So, tell us which side of the fence you are on? Have you used Skrill for any transaction or does PayPal remain your trusty go-between?

Image Credit: Eurogears via Pixabay