Now that we've entered the new year, U.S. residents are starting to think about their taxes. Scammers know this, and they're out to cheat you out of money. IRS scams are commonplace, because scammers know how nervous people are to deal with the IRS.

But if you know how to recognize tax scams, you can stay safe throughout tax season. There are a few things you need to watch out for. Here's how to avoid being fooled by a scammer impersonating the IRS.

1. The IRS Won't Call First

How the IRS contacts you depends on a few different factors, but there's one thing that they won't do: call you without mailing something first. If you haven't received a bill from the IRS, and they're calling -- even from a phone number that looks like the IRS -- it's almost certainly a scam.

Of course, it's possible that the bill got lost in the mail, or that you haven't received it yet. But chances are you're being conned. Keep an eye out for the rest of the warning signs below if you're getting a call from the IRS.

2. The IRS Won't Demand Immediate Payment

One of the most obvious warning signs that you're being targeted by an IRS scam is that the scammer will demand immediate payment. They'll tell you that you need to pay right away, and might even offer to take payment information over the phone.

Don't fall for it. The IRS might call you, but they'll never ask for payment over the phone. And they won't demand that you pay right away. Instead, they'll send you a bill, and you'll have some options for paying it.

You're also always allowed to appeal the amount that you owe, or at least get the details of your bill. If they ask for payment, hang up right away.

3. You Can't Pay Your Taxes With a Gift Card

When demanding payment over the phone, tax scammers may demand payment in the form of a gift card or prepaid debit card. This is not an acceptable way to pay your taxes. If you're asked to pay in one of those forms, you're getting hit by an IRS scam.

Again, the IRS will send you a bill. They won't ask you for immediate payment. When you get your bill, you'll have a couple of payment options, including a direct debit from your bank account. A gift card or prepaid debit card is never going to be offered as a payment method.

4. The IRS Doesn't Use Automated Calls

If you get a prerecorded message saying that the IRS urgently needs to contact you, you're being scammed. The IRS does not place robocalls, nor do they leave prerecorded messages. As stated previously, they'll get in touch with you via post before they call. And if they do call, they won't ask you for immediate payment.

Some IRS scammers will also leave messages saying that you're being sued by the IRS. This is, again, a sign that you're being targeted by a tax scam. Unless you owe a huge amount of money, the IRS won't even consider a lawsuit. And if they do, they won't leave you a prerecorded voicemail message to tell you about it.

5. You Won't Be Threatened With Arrest

Just like a voicemail saying you're being sued by the IRS, a threat that a warrant has been put out for your arrest -- while technically possible -- is extremely unlikely. Whether you're told that law enforcement is being brought in over the phone or via a voicemail message, know that it's an IRS scam.

The IRS will never threaten to bring in local or other law enforcement to arrest you for non-payment of your taxes. It's possible for the IRS to show up at your door. But if they threaten to call the police, it's a scam.

6. The IRS Won't Ask for Personal Information

If you're asked for identifying personal information, like your social security number, address, or banking information, you're being scammed. The IRS won't ask you for this information, and if you give it up, you're likely to have your identity stolen.

This goes for calls and emails. While it's possible for the IRS to email you, they'll never ask for any personal information via that email. They won't ask for tax-related information, either. If an email asks for your IRS website PIN, it's not from the IRS.

IRS scams are getting more deceptive, so you'll need to be wary. Don't give away any information that's potentially of value to identity thieves unless you're 100 percent certain you're speaking with the IRS.

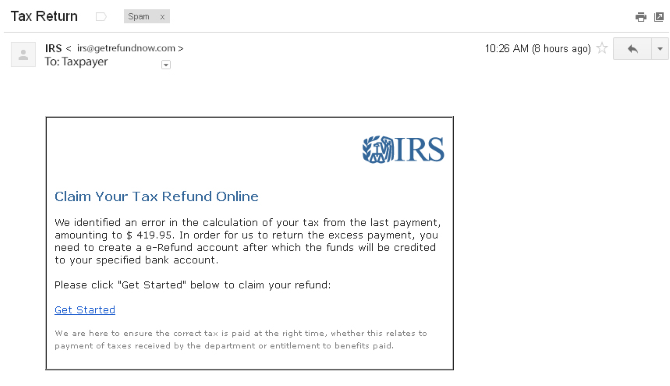

7. Tax Scammers May Offer You Information on a Refund

While many IRS scams involve threatening taxpayers with lawsuits or arrest, some scammers are getting more clever and approaching their targets with more finesse. For example, some tax scams now claim to be offering information about a tax refund.

They may also say that they're only seeking information to confirm your tax information or complete your return. The same goes for emails: they might simply ask you for your PIN or for a simple piece of information to confirm your identity. Don't fall for it.

What to Do If You Think You've Been Scammed

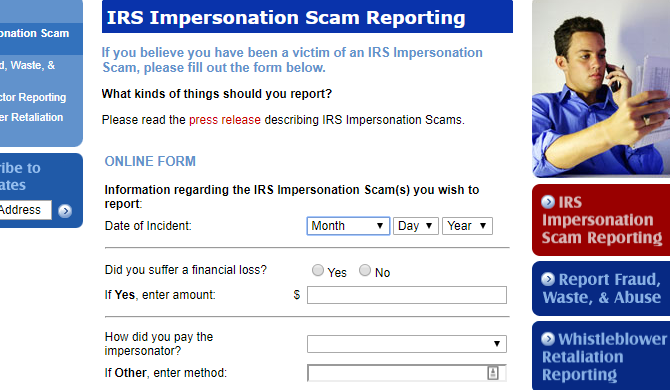

If you think you've been contacted by a tax scammer, you should report it to the IRS. Your best bet is to send an email with all of the details you can remember to phishing@irs.gov. That's where they take all reports of IRS scams.

Tell them how you were contacted, anything you can remember about the interaction, whether you paid, and any other details that you think might be relevant.

You can also use the Treasury Inspector General's online form to report tax scams. It looks like a scam page itself, but it's legitimate. Like the rest of the site, it just probably hasn't been updated since the 90s.

Avoid IRS Scams This Year and Every Year

Tax scammers change tactics all the time, and we'll see new methods before long (evidently one of the 2017 IRS scams involves asking people to pay taxes using iTunes gift cards). But if you know about the basic warning signs and you're wary of any contact by the IRS, you should be safe.

Have you ever been targeted by a tax scam? Or know other warning signs our readers should be aware of? Share in the comments below!

Image Credit: WVDZ/Depositphotos