Here's a proposal. I'd like to give you a 20 dollar bill, and in return you will agree to give me back a 100 dollar bill. Seem fair? Well, if you have a credit card you've been doing this all along, and I'm going to show you how to stop.

Credit cards can be a powerful money management tool. It can allow you to leverage your finances to accomplish things that you otherwise wouldn't be able to do without waiting for the funds in your savings account. On the flip side, credit cards can also become a major evil that destroys lives. It's a convenient access to money that you don't have, and it allows purchasing decisions that you may have to live with for many years after the item you purchased has been thrown away.

So what do you do if you find yourself chest deep in debt and no obvious way to pay it all of? What if you find that you're even sinking backwards in debt -- attempting to pay off several high-interest credit cards and getting nowhere?

A few years ago I described how you can use Excel to focus your credit card payment efforts in order to pay off your overall debt faster. This is an effective approach to debt management, but it can also be complicated to sort out payments based on interest rate calculations like I described. Wouldn't it be nice to have a tool that does all of the work for you, and tells you what you should be paying first, and how much you should pay?

Well, in fact there is such a tool called ReadyForZero, which Tehseen described earlier at MUO. It's a tool that I recently discovered and realized that it completely automates the Excel system I developed for myself a few years ago. I believe it has the potential to save countless people from the overwhelming burden of carrying rolling credit card debts.

Note: ReadyForZero is U.S. only, but the developers say they have international aspirations.

Are you Ready For Zero Debt?

Really, there are two major reasons for extremely high credit card debt. The first is the inability to control your spending within your means. That isn't something that an app or website is going cure for you, but they can help you manage your spending issues. You know MakeUseOf always has you covered -- and we've offered plenty of resources that can help get your spending under control. Erez covered One Touch Expenser, an Android app that can help you log and control your spending behaviors. I also reviewed five other Android finance apps that could help you out as well.

Setting Up Your Accounts

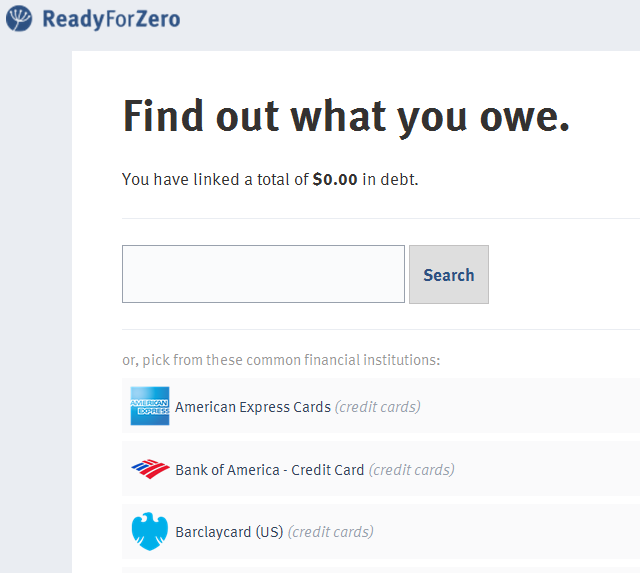

Once you get your spending under control, your next step is to pay off all of that insane debt. Don't let it overwhelm you. First, visit ReadyForZero.com and get the process started by finally collecting all of your debts in one place.

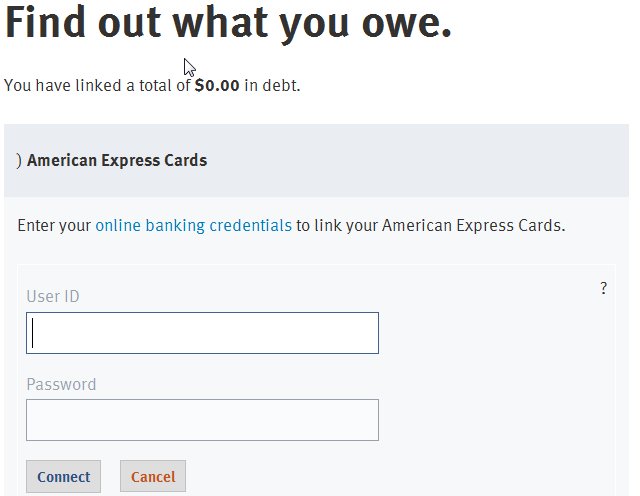

It is extremely easy to get started with Ready For Zero. All you have to do is search for the credit card company where you have an account. It will then present you with fields where you can type in the log in credentials for that account. Ready For Zero is is a secure application. They've got commendable press exposure in Times, Market Watch, Inc., Kiplinger and more. It's safe -- so go ahead and add your accounts. It's about time to take back your financial life, isn't it? Today's the day.

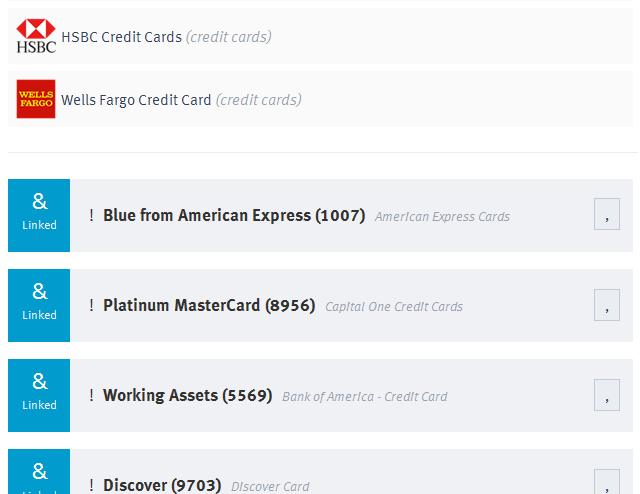

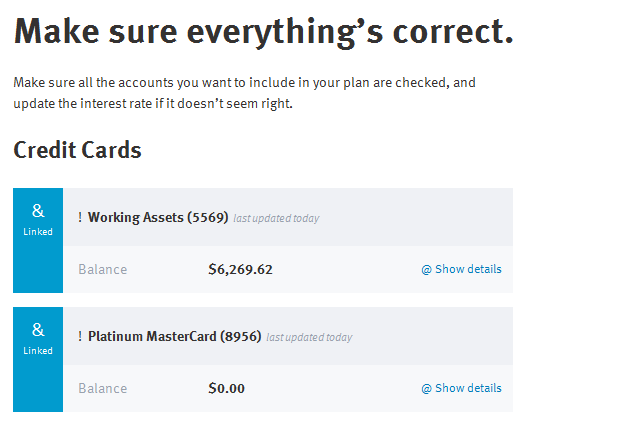

The site provides access to just about every major financial institution you can think of. American Express, Capital One, Discover, HSBC, Wells Fargo - the list goes on. You'll be hard pressed to find a credit card company that isn't covered here. As you add your accounts successfully, you'll see the list with a blue "Linked" status on the left of each account.

After a few minutes, the accounts will start updating with your details, including your current balances, current interest rates, and minimum payments. In some cases, if the system can't retrieve your current interest rate for that account, you may need to fill it out manually.

Once you have all of your accounts loaded up (which really only takes 10-20 minutes depending on how many accounts you have), you're ready to move forward to the next, most important step. That is...creating a plan to take back control of your financial life.

Planning For A Life With Zero Debt

Dream about it. Meditate on it. Imagine it. A life where you don't have to make a single debt payment again. A life when you can save up for a new car in just a few months. A life where your only real debt is a mortgage and a car payment (if that). This can be your life -- don't doubt it. The first step to that life is creating a plan, and Ready For Zero will help you put together the most effective plan.

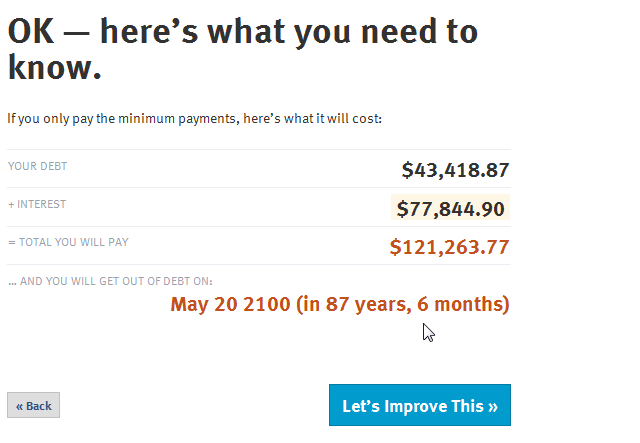

The first stage of this is showing you where you stand today. Trust me, the numbers are going to be scary. They look huge. Not only will you see what you owe today, but you'll see how much interest you're going to pay on that debt if you continue only making minimum payments, and the total you'll end up paying in the end. It's terrible to see -- but the first step of destroying that monster is staring it down directly in the eyes.

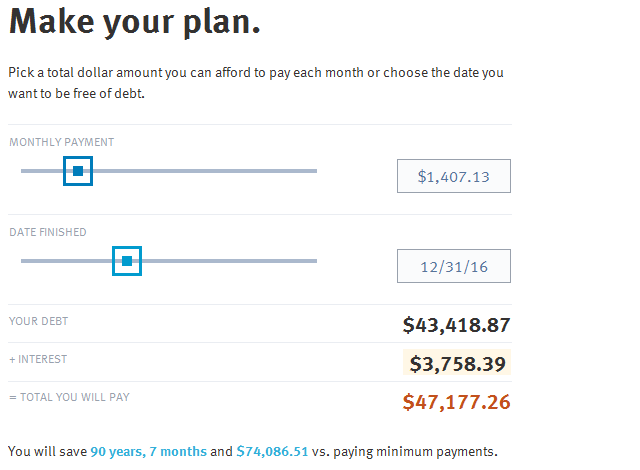

Now you've stared down the beast, it's time to take out your sword and create a plan. Click on the "Let's Improve This" button and Ready For Zero will bring you over to another page that basically asks you how far you're willing to stretch your budget to conquer your debt. You can either slide the "Monthly Payment" slider to the highest number you can handle each month, or you can set the "Date Finished" slider to a date where you really want to be debt free no matter what. Which goal you set is really up to you -- it comes down to what's more important for you -- what will drive you to stick to your plan.

So, the above shows that if I double my monthly payment, I'll pretty much pay a third less than I would have previously for the overall debt, and I'll cut 90 years from the time it would take to pay off the debt. Obviously, paying the minimum is a very bad idea.

Focusing Payments Where It Helps the Most

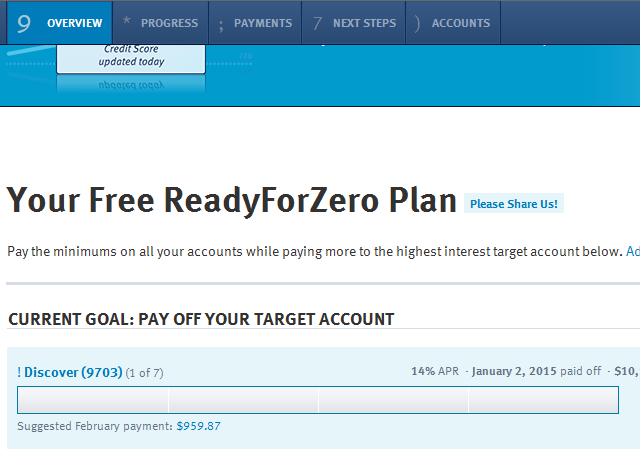

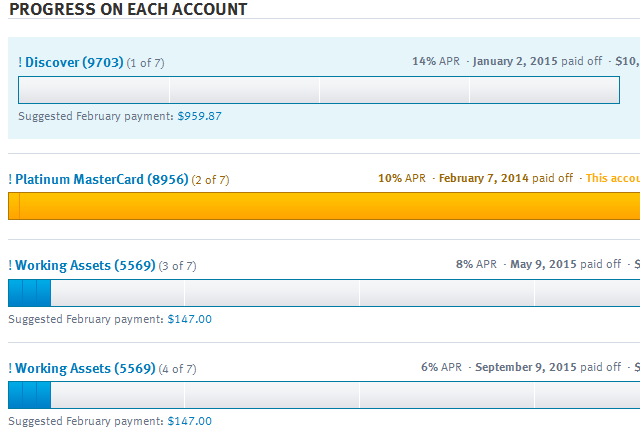

Paying multiple credit cards gets tricky. When you're dealing with so many different interest rates, it's not always clear how much more impact a payment will have. ReadyForZero looks at all of your accounts and it spoon-feeds you with the size of payments you should make to each account. It creates a "Target Account" where most of your monthly payments will go. This wipes out the highest interest card and then frees it up to apply your monthly payments toward a new target account.

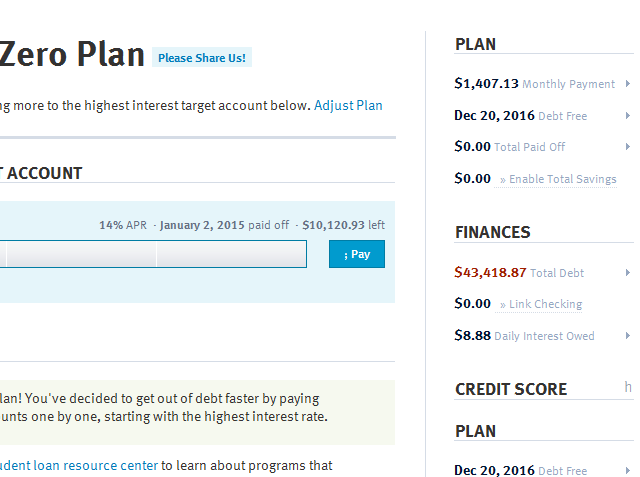

This is basically called your "Zero Plan". It's a path to a new life with zero debt. On the right side of the Plan page you'll see your stats -- overall monthly payment you've committed to, the date when you are guaranteed to be debt free, and the total you've paid off.

Tracking Your Progress

The account also gives you a "Progress" area where you'll see a breakdown for each account. There's a degree of satisfaction to gain from seeing the progress bar sliding across each account, and then the wonderful golden highlight when you've reached your goal with each account payoff.

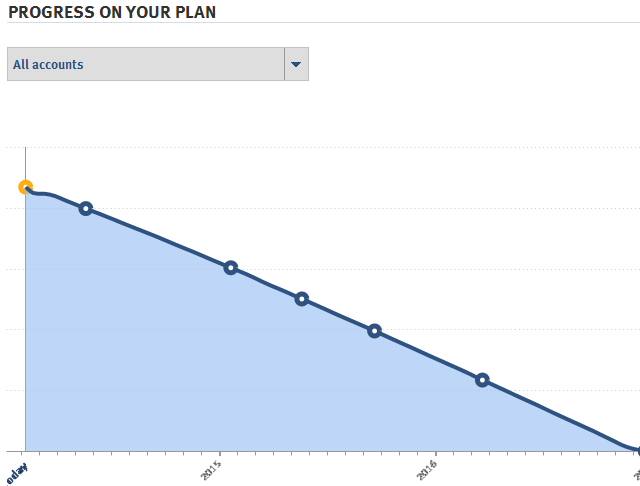

There's also a "progress on your plan" chart, which provides a prediction of how you'll do from now to your target date if you maintain your payment promise. As time goes on, a golden line highlights the progress you've made and where you are along this predicted path to zero debt.

Making Payments and Next Steps

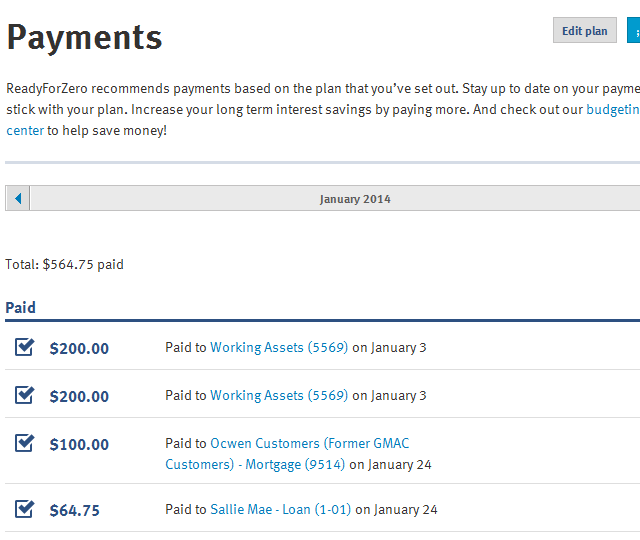

If you click on the Payments menu, you'll see a breakdown of how ReadyForZero has recommended your payment breakdown for each credit card or loan account.

You can make those payments manually as scheduled, or for a small monthly fee, you can upgrade your ReadyForZero account to schedule payments electronically directly from the site. This is probably the easiest way to make sure you maintain your plan, because you won't have to worry about forgetting to make payments (and incurring late fees).

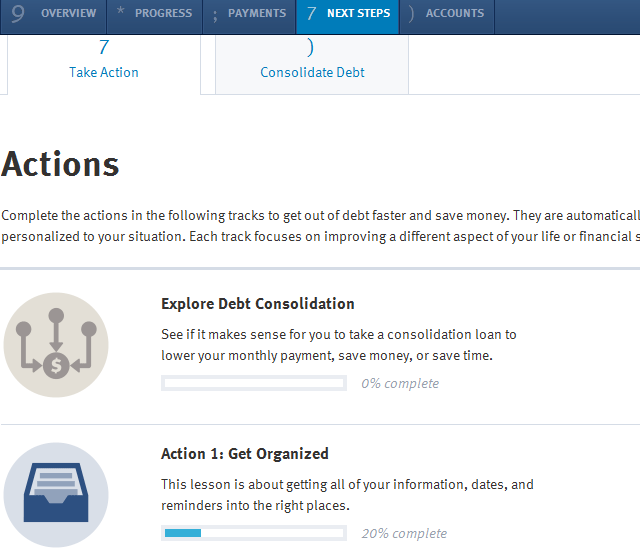

Sometimes, having a payoff plan may not be enough. If you're far enough over your head with debt, some additional steps like Debt Consolidation may make sense. ReadyForZero even has a tool to consolidate debt where it'll recommend how much you should apply for when you get a debt consolidation loan, and which accounts you should pay off immediately with the loan.

ReadyForZero also gives you really helpful tips on how to get your financial information and data organized in an easy way, and it offers some pretty insightful tips on how to change your environment so you don't have to deal with the sort of triggers that have made you overspend so much up to this point in your life. You can also arm yourself with the iOS app that is read-only for now -- you can see all the information and your progress, but you cannot modify it from the app.

A comprehensive finance management tool it is not. ReadyForZero is for focusing in on the area of your budget that's dragging you down the most -- your debt. It's about taking an inventory of the problems there, and making the changes necessary to overcome that burden and take back control of your life. The sooner you sign up and make your plan on the site, the closer you'll be to finally enjoying a totally debt free life.