Sometimes, the best app in the world isn't the right app for you. Mint is the best budgeting app out there, but not if you are new to the idea of making a budget and saving your money. For that, you'll probably find it easier to use EveryDollar.

EveryDollar is made by personal finance guru Dave Ramsey and incorporates his philosophies on money. For any budget beginner, it's best to start with Ramsey's favorite and most-repeated line: "Give every dollar a name, every month." It's the cornerstone of creating a budget.

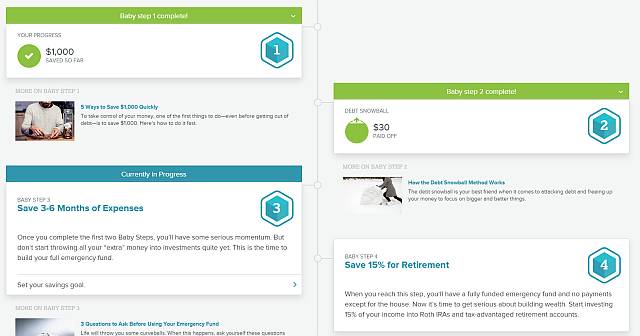

Ramsey also propagates what he calls the "seven baby steps" of creating a budget, and that's made easier through this app as it encourages you to take those steps.

Getting Started With EveryDollar

While there is an EveryDollar iOS app, we recommend starting with the web app. Sign up, follow the steps, and you will be ready to start.

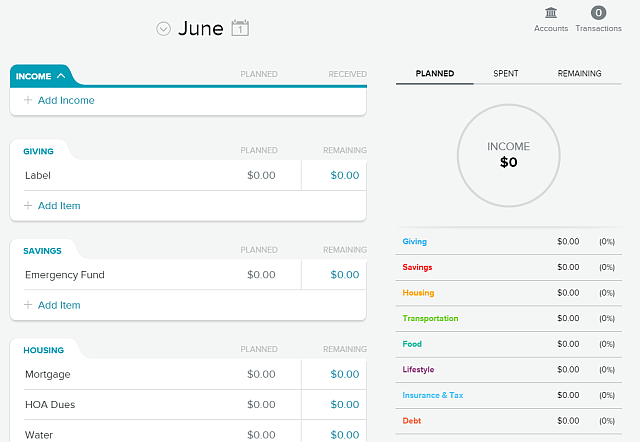

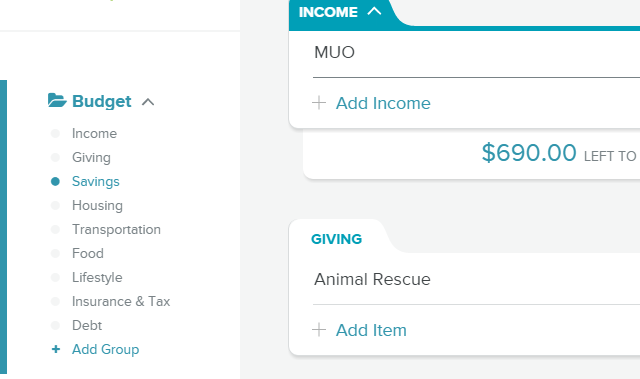

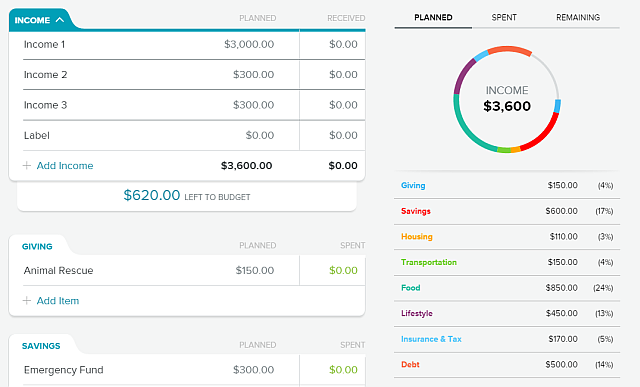

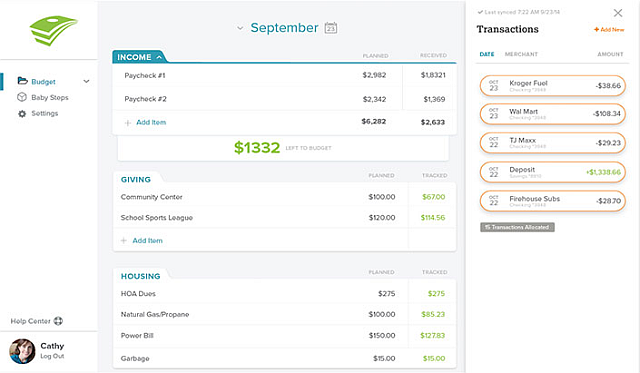

The first thing is to note down all your incoming and outgoing money, starting with your income. You can just add your monthly salary, or add several fields for each source of income.

Next, add your intended savings, expenditures, and pending debts into the budget. One thing to remember, which Ramsey says in his lectures as well, is to be honest with yourself. It's your personal budget and no one is going to judge you but you. It's meant for your eyes only.

Everything is divided into Budget Categories like Giving, Savings, Housing, Transportation, Food, Lifestyle, Insurance & Tax, and Debt; each with multiple fields. You can also create your own categories and custom fields where you see fit. Remember, this budget is about you.

There are plenty of tools to develop a solid financial plan, but what makes EveryDollar special is Ramsey's principles like the seven baby steps.

The 7 Baby Steps of Budgeting

Ramsey has written about the seven baby steps in detail, but here's a brief overview:

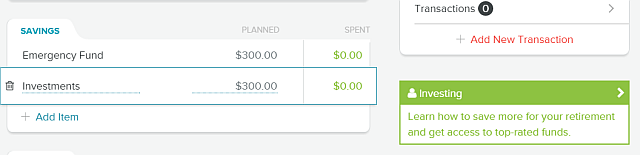

- Start an Emergency Fund by saving $1000

- Pay off debt using the Debt Snowball

- Save 3 to 6 months of expenses

- Invest 15% of income into retirement

- Save for your kids' college fund

- Pay off the house

- Build wealth and give to charity

It is recommended to go through these baby steps in the order determined. What that means is that you don't start on the next step before finishing the previous one. And you continue doing the previous step too.

The visual representation of all your money, along with a single clear goal at all times, is a great idea. Budgeting and saving seems complex if you are new to it because there is a tendency to do too much. You think, "Yes, I should save a bit for retirement. And I should invest my money too. Oh hey, what about the kids' college fund?" Instead, Ramsey gives you one thing to focus on at a time.

So you start with an emergency fund of $1000, which is sound advice echoed by everyone. In fact, The Simple Dollar says emergency funds are necessary for any budget. Otherwise, you might end up creating a budget and have it fall through when an unexpected expense crops up.

Once you've got your Emergency Fund set up, you move on to paying off your debts with the Debt Snowball method. One crucial thing here is to exclude your mortgage or house loan from this step. Typically, mortgages have lower interest rates than any other loans. And it's likely your biggest debt too. As Ramsey states, "Personal finance is 20% head knowledge and 80% behavior. When you start knocking off the easier debts, you will see results and you will stay motivated to dump your debt."

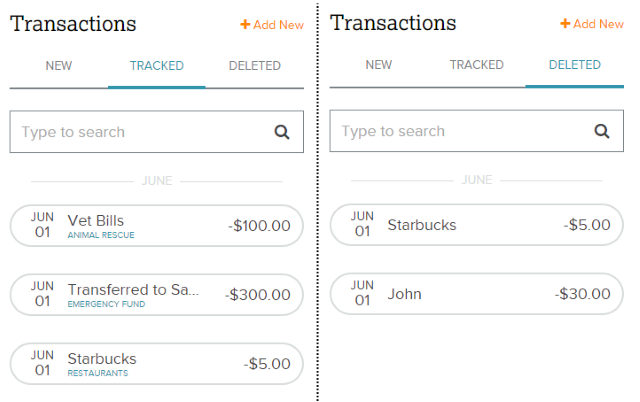

The rest of the steps have similar logic behind them. EveryDollar is about creating a visual representation of where each dollar is coming from and where each dollar is going. Meanwhile, it tracks all these and presents your progress in the "Baby Step" goals so you always know where you stand.

Tracking Your Expenditure

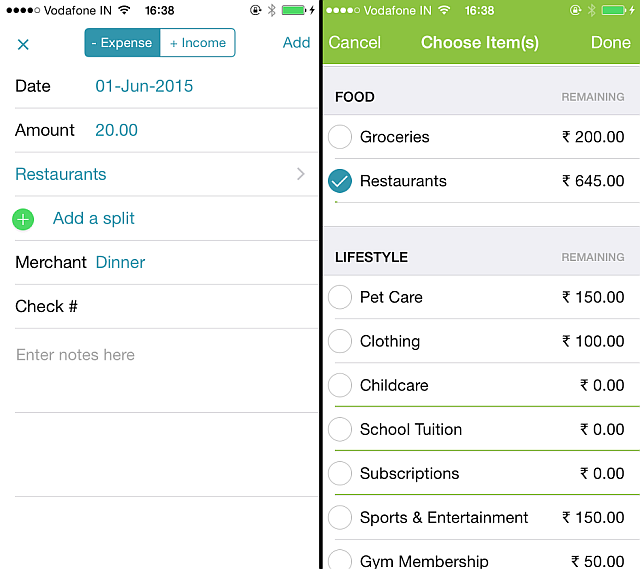

Your budget is only as good as how well you can keep a track of your expenditure. EveryDollar's iOS app is a huge help in that, but if you're an Android user, you will be quite irritated.

In the course of testing, it became clear how important it is to have the app installed on your phone. As a beginner budgeter, you will simply not be used to the discipline required to come home at the end of the day and enter all of your expenses throughout the day, appropriately tagging them.

Instead, the iOS app makes it much simpler. When you spend on anything, open the app, add the amount, and move on. You'll actually track your expenditure this way, so get the app as soon as you are done setting up your monthly budget. The company is working on an Android app, but right now, it's a pain to update EveryDollar as an Android user.

Where EveryDollar Falls Short

Right now, you can't escape the feeling that EveryDollar is mainly talking to US-based users. There are only dollar signs, no other currency is available; but of course, you can just ignore the dollar sign and use numbers you are more comfortable with.

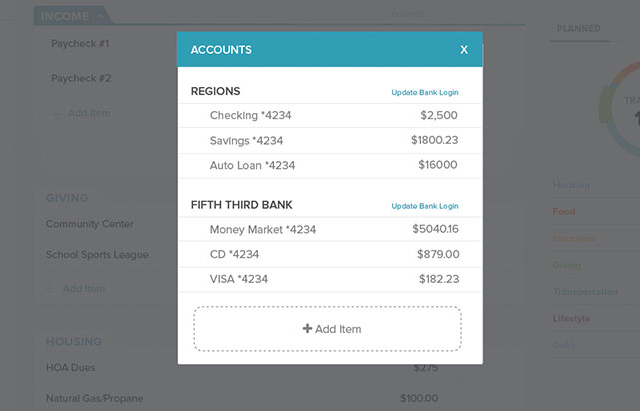

EveryDollar's premium Plus account ($99/year) also has special advisors on call for US-based citizens, and even links up to US-based bank accounts so that you can keep a track of your balance directly. We do worry about the security implications of such a move though, since an EveryDollar hack could leave your precious assets exposed.

Apart from the US focus, EveryDollar has one big missing feature: you can't save photos of your receipts. Having to manually enter the receipt number or adding a note seems ridiculous when you can go paperless by scanning and managing receipts.

Should You Use EveryDollar?

If you are new to creating a budget and saving money, then EveryDollar is definitely worth it. Just following Ramsey's seven baby steps, with that one clear goal at all times, is a good way to get into the saving habit.

If you are a seasoned budgeter, EveryDollar is probably going to seem a little under-powered to you. Instead, you can use an app like the aforementioned Mint or even create your personal budgeting system with Google tools. In fact, there are plenty of great money management templates for Google Drive that you can avail of.

Go to EveryDollar

Download: EveryDollar for iPhone/iPad (Free)

Do You Link Bank Accounts to Apps?

I have my reservations about linking my bank account to any app, simply because I would not want to risk a hack. The short step of manually updating my account details is worth it for the security, for me. What about you? Have you linked your bank account to a third-party app?

Image Credits: Sergey Nivens / Shutterstock.com, EveryDollar