The consumer debt spiral is the biggest reason why modern Americans are so unhappy. As of May 2016, the average household had about $5,700 in credit card debt, but if you look only at balance-carrying households, the average spikes up to $16,000. That's jaw-droppingly insane.

Now throw in car loans (average $30,000 for new and $18,500 for used cars) along with student loans ($30,000 for recent undergraduates) and it's clear that we have a debt problem. I'm not blaming the system here. Except under extreme circumstances, we only have ourselves to blame if we take on too much debt to handle.

That being said, there's no use crying over spilled milk. It's time to buckle down, attack our debts, and free ourselves from this burden! My wife and I paid off $70,000 in debt in just under two years with a combined income under $100,000. If we could do it, so can you.

The Two Best Methods of Debt Repayment

Before we talk about debt repayment, you need to determine two important things: your total minimum payment and total available payment.

Total minimum payment is the sum of all minimum monthly payments on all of your current debts. You should never pay less than the minimum on any loan because that will damage your credit score.

Total available payment is how much money you're willing to throw at your debt every month. The greater this number, the faster you'll be debt-free. Ideally, this should include every extra dollar you have left over after meeting your other financial needs like rent, food, and insurance.

Once you've figured out these two figures, you can start thinking about a repayment strategy.

The Debt Snowball Method

The debt snowball aims to kill as many loans as quickly as possible, even if that means paying more in interest over the long run. The steps for the debt snowball are as follow:

- Determine your total available payment.

- Pay all minimum amounts on all of your loans.

- Pay the rest of your total available payment to the smallest balance loan.

- Rinse and repeat as you pay off your loans. Do not change your total available payment as loans are paid off. You want to "roll over" payments from one paid-off loan to the next.

The Debt Avalanche Method

The debt avalanche aims to minimize the amount of interest you pay on your loans, which means you'll save the most money in the long run using this method. The steps for the debt avalanche include:

- Determine your total available payment.

- Pay all minimum amounts on all of your loans.

- Pay the rest of your total available payment to the highest interest loan.

- Rinse and repeat as you pay off your loans. Do not change your total available payment as loans are paid off. You want to "roll over" payments from one paid-off loan to the next.

How Much Money Can You Really Save?

The two methods might sound pretty similar, and they are. The truth is that they're both extremely effective and you can't go wrong with either one because they both drive you towards freedom from debt in record time.

That being said, let's compare the two to see which one is mathematically better.

For this comparison, we're going to use Unbury.us to visualize the differences. You just plug in your loan numbers and it will compare snowball vs. avalanche for you. Other similar tools include Unbury.me, Payoff.io, and MagnifyMoney's calculator. Use whichever one you like best or check out these other debt visualization tools.

Example 1: A Simplified Situation

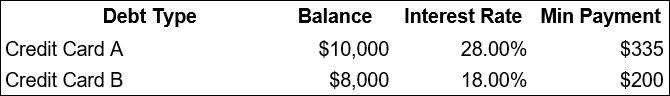

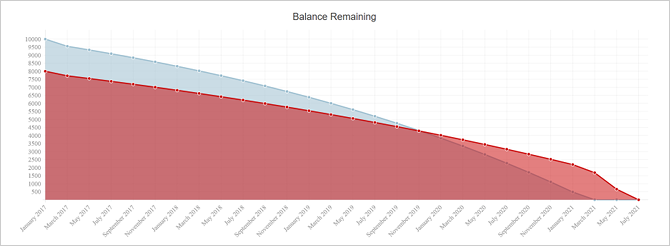

Let's start with a simple but exaggerated situation. We don't have any debt except for two credit cards and we've racked up a lot of consumer debt across both of them.

In this situation, we have a total minimum payment of $535 and a combined debt balance of $18,000. If there weren't any interest, that would take about 2 years and 9 months to pay off. But once we consider interest, it would take 4 years and 6 months and cost us $10,500 in interest!

By paying additional money on top of the minimums, we can reduce the amount of interest we owe over the course of the debt and therefore reduce how long it takes to pay off.

Let's say we can afford to set aside $800 per month (an additional $265 on top of minimums) for tackling the debt. If we plug the numbers into Unbury.us, here's how the two methods compare:

- Using the debt snowball method, it would take 2 years and 6 months to pay off and we would end up paying $5,850 in interest.

- Using the debt avalanche method, it would take 2 years and 5 months to pay off and we would end up paying $4,900 in interest.

Both methods allow you to save a ton of money compared to making only minimum payments, and you cut your time in debt in half. Over two and a half years, using the avalanche method will save you about $1,000 in this scenario.

Example 2: A More Typical Situation

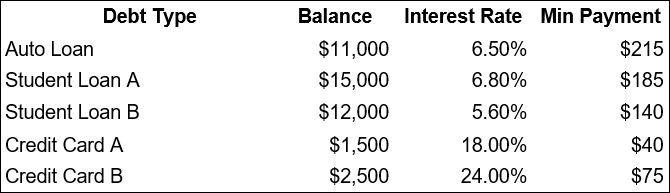

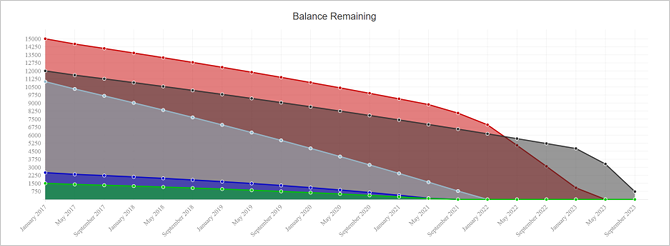

Here's a more well-rounded situation that better represents what most people are facing: a variety of debt balances and interest rates.

In this situation, we have a total minimum payment of $655 and a combined debt balance of $42,000. If interest wasn't an issue, this would be paid off in about 5 years and 4 months. But since interest is an issue, it would take 6 years and 10 months and cost us $11,150 in interest!

Let's say we can afford to set aside $1,000 per month (an additional $365 on top of minimums) for tackling our debt:

- Using the debt snowball method, it would take 3 years and 11 months to pay off and we would end up paying $5,650 in interest.

- Using the debt avalanche method, it would take 3 years and 11 months to pay off and we would end up paying $5,450 in interest.

What's interesting about this "typical scenario" is that the snowball and avalanche methods have almost identical performances. The avalanche method is still optimal, but you only save an additional $200 over four years.

3 Reasons Why the Debt Snowball Wins

The avalanche method will always save you the most on interest payments. If you're a 100% logic-driven person, then that method is perfect for you. But the snowball method has a number of advantages that can prove more valuable than the interest savings.

- The snowball method is psychologically rewarding. A recent study in the Journal of Consumer Research found that people who use the debt snowball method are more likely to succeed at getting out of debt because the act of paying off a debt feels good and motivates one to keep going.

- The snowball method is faster at increasing cash flow. Eliminating a debt also means eliminating the minimum payment obligation for that debt, which reduces your total minimum payment. If your budget is extremely tight, this extra bit of breathing room can increase security and reduce anxiety in case you need extra cash one month.

- Balance transfers can take interest out of the equation. Some credit cards will grant you a 6-, 12-, or even 18-month period of 0% APR if you transfer over the balance of another card (sometimes for free, sometimes for a small fee). Turning your high-interest credit card debt into interest-free credit card debt while you snowball can be a winning move for a lot of people.

So What's the Best Way to Pay Off Debt?

With all things taken into consideration, here's what I recommend:

- If you have loans with over 10% APR, tackle them first but order them according to the debt snowball method. Debts with interest rates that high are considered emergencies.

- Once you've eliminated those loans, tackle the rest of your loans according to the debt snowball method.

This is a good middle ground between the two methods. However, feel free to adapt and adjust according to your own needs and desires. If you can go full avalanche, do it! If not, that's fine. As long as you're paying more than your total minimum payment, you'll come out ahead.

For more help, check out our guide to destroying your debt ASAP.

Are you struggling with debt? What kind of tips, tricks, and tactics are you using to climb your way out to freedom? Share your thoughts and experiences with us down below in the comments!