Auto insurance is expensive. Even if you find a nice discount, you'll likely see prices creep up with annual renewals. The tactic is simple: you forget to find a new deal, the renewal document comes in with a slightly higher price, and you're too busy to bother over $5 a month.

Clever tactic, isn't it? And it's not just cars and motorcycles. House, life, and even smartphone insurance is treated in the same way (if you opt to use it, that is).

With comparison tools on your side, you have everything you need to find the best deal for your budget and circumstances. Twelve months ago you were employed as a courier, say; now you have a daily commute to an office. Different insurance is required, and a slow drive to a nearby office park will require a far smaller monthly premium than driving around a city all day long.

In short, there's no reason for you to take the quote from your usual insurance provider at face value. Shop around, find cheaper deals, and you'll save money on your auto insurance.

How to Use an Auto Insurance Comparison Tool

We'll take a look at some of the top comparison tools below. First, though, some of the basics.

To begin with, you'll need to share a lot of personal information. It's important, therefore, that you make sure that the site you're using offers its services over a secure HTTPS connection. You can make doubly sure of security by using a competent and secure browser. If your antivirus solution has a secure browser built in (such as BitDefender), you might try this.

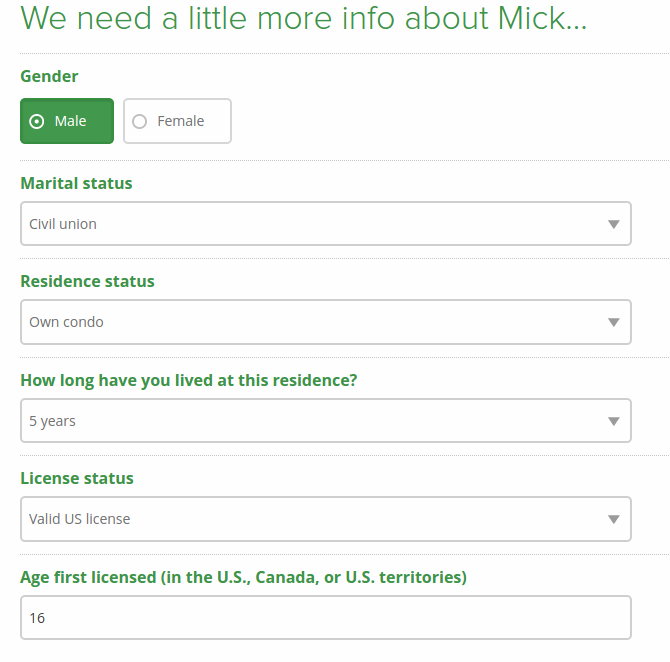

Information you'll need to divulge includes your name, address, date of birth, driving history, employment, and make and model of your vehicle. There is a lot here that could be misused by scammers, which is why it is important to ensure that the price comparison service you're using is legitimate.

Once the details are input, it's a good idea to make sure they're saved to an account with the site. This means you can save time next year. It's also useful if you need to come back to the comparison when you next have free time. With your coverage type selected, the comparison tool will find insurance policies that meet your requirements. To apply, simply click the link and follow the instructions.

While you should remember that being truthful during the application is the best policy, you might find that changing your employment description (from, say, journalist to writer) can give you a better price. Even a slight change of phrase can make a difference. And adding older relatives with a good driving history to your insurance will lower the quote.

Also, consider things like dashcams for lowering insurance.

Auto Insurance Comparison Tools to Try

We've taken a look at three U.S.-focused auto insurance comparison tools that should suit you perfectly.

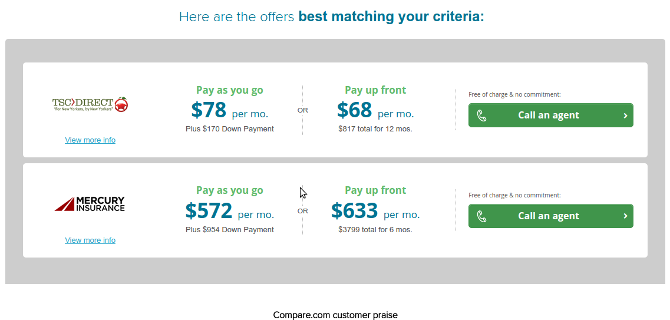

1. Compare.com

Claiming to be the only service accurately comparing auto insurance across the United States, this should be your first choice. It's easy to use, offers the lowest rates, and works with over 50 top insurance providers to find the best policies.

2. TheZebra.com

Also worth a look, this site finds suitable insurance from over 200 providers. Better still, during application you'll see prices update as you add personal information. This can help to show you just how your lifestyle and situation affect the price of the policies available.

3. Insurance.com

This site gives you a great chance of finding a policy that fits your budget. However, the results often aren't available via Insurance.com. Instead, you'll have to follow a link to another site. This is inconvenient, but the prices available are worth checking out.

U.K. Auto Insurance Comparison Tools

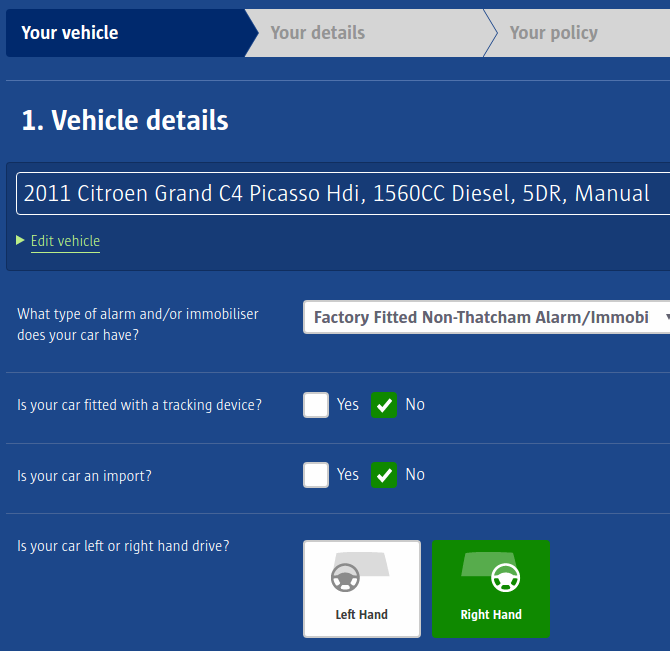

If you have a vehicle in the U.K. that you wish to insure, you'll need to use a British insurance provider. This is the case whether you're based in the U.K. permanently or just travel there regularly.

Here's a collection of price comparison services for auto insurance, each with its own quirky personality.

1. CompareTheMarket.com

This is probably the U.K.'s biggest insurance comparison website. They offer comparison of all types of vehicles for all kinds of drivers.

2. GoCompare.com

This site helps you effortlessly compare quotes from 125 insurance providers. GoCompare has worked hard in recent years to improve its image as being a little more upmarket than CompareTheMarket, and it seems to be paying off.

3. Confused.com

120 providers, including some of the biggest names in UK insurance, can be compared on Confused.com. These are providers who don't appear on other sites, so this is definitely worth checking out.

Getting Quotes Elsewhere

While using price comparison sites is always a good idea, it's worth considering just what it is that these services do. They're essentially automated brokers. As such, you might find that you get better results from speaking directly to a broker or having one visit your home. Better still, they might know about deals from companies that don't appear on price comparison sites -- or low-cost "secret" deals from those that do.

To truly compare auto insurance offers like a pro, look beyond the comparison websites!

Have you found a great auto insurance deal online? How did it work out for you? Perhaps you found a deal by visiting an insurer's website direct? Tell us about it in the comments.