News just surfaced of a data breach that affects up to 80 percent of all U.S. credit card users, and the credit reporting giant Equifax is doing a terrible job of reassuring customers. As of this writing, getting through to the company is difficult on the phone and online, and this has many in a panic.

What Data Was Stolen in the Breach?

The Equifax breach revealed what is potentially one of the biggest data breaches in U.S. history, and the company could be facing a $1 billion lawsuit as a result. Though the hack was discovered on July 29, it was only just revealed by the company.

Hackers were able to access sensitive data including names, social security numbers, addresses, dates of birth, phone numbers, and driver's license details for 143 million consumers between May through July 2017. Approximately 209,000 users also had their credit card details stolen, and about 182,000 users had details from their Equifax dispute documents stolen.

The breach mostly affects U.S. residents, along with some U.K. and Canada citizens.

How to Find Out If Your Data Was Stolen

There's been plenty of confusion on how to find out if you were affected.

Equifax has set up an online tool that lets customers check if they were part of the data breach, but it requires entering more personal information and results in vague, inconclusive statements. You may be understandably skeptical about handing over more information to a company who'd find itself on the receiving end of such a large breach.

If you prefer to call the company, you can reach them at 866-447-7559.

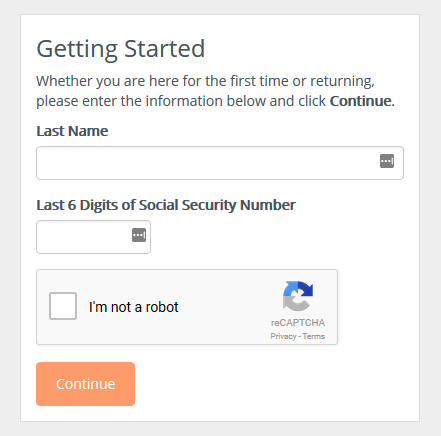

For immediate results, go to the web tool provided by Equifax and click "Begin Enrollment." Do NOT click Continue Enrollment! (According to the terms of service, enrolling in TrustedID will waive your rights to legal representation, including participation in any class-action lawsuits.)

You'll see a screen where you can enter the last six digits of your social security number and your last name.

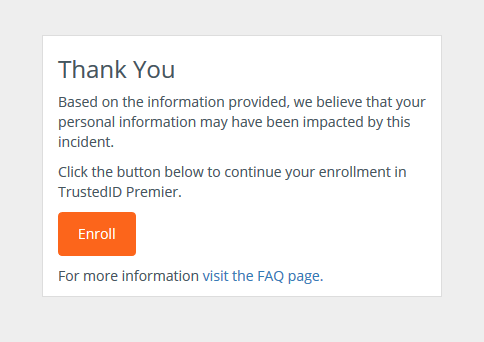

If your data was stolen, you will see the message below. Again, do NOT click the Enroll button!

Up until last night, customers may have seen one of three messages. The one listed above, another saying they were not affected, and a third providing a date on which they could enroll in the company's TrustedID Premier service.

What Should You Do?

Consumer Reports offers some suggestions for those who find that their information may have been compromised.

Equifax Credit Monitoring: You can sign up for Equifax's free TrustedID Premier service which is a credit monitoring service that is currently free. As mentioned above, enrolling does preclude you from participating in a class-action lawsuit against the company.

Credit Security Freeze: One of the most common suggestions from security experts in the wake of the breach is to place a credit security freeze. This will not affect your credit score and will not impact prescreened credit offers.

In order to place a freeze, you must request a security freeze with all three credit bureaus:

- Equifax

- Experian

- Transunion

The catch, however, is that this is not free. The fee varies from state to state, but it shouldn't cost you more than $10 per credit bureau.

The freeze will prevent new lines of credit being opened in your name, which of course means that if you were planning on purchasing or renting a home, financing a car, applying for a job, or getting a new credit card, you will have to lift the freeze first. Lifting may also cost up to $10 per credit bureau.

Stay Vigilant: Keep a vigilant eye on your bank accounts for any suspicious activity. Consumer Reports recommends setting up alerts on your bank accounts for unusual activity: suggested parameters include your balance and the size of transactions. While Consumer Reports does not suggest it, you should also be vigilant when it comes to your online accounts. Set up two-factor authentication, create secure passwords, and don't click on links in emails claiming to be from Equifax.

Equifax has said that it will mail out notices to consumers who credit card numbers or dispute documents with personal identifying information were impacted.

For additional online security, you might consider deleting your personal data from public record websites.

Image Credit: Rawpixel.com via Shutterstock