Accounting is tricky for anyone, but it's especially tough for freelancers. There are so many taxes to pay, taxes to reclaim, forms, credits, and equations to consider... it's a minefield of complexity.

Worst of all, running afoul of the rules can be expensive, stressful, and sometimes even a crime.

Luckily, we no longer need to rely on manual bookkeeping. Instead, there are lots of accounting apps vying for your attention. In this article, we round up some of the best. Each app we cover has at least one unique strength.

1. Xero

"The most intuitive professional-grade app on the market."

If you're a freelancer who's just starting to research accounting software, you will undoubtedly see the same two names popping up over and over: Xero and QuickBooks. The two apps are direct competitors and have broadly similar feature sets. Let's take a closer look at Xero.

The cloud-based company offers three price points; Starter for $9 per month, Standard for $30 per month, and Premium for $70 per month. The right plan for you depends on the scale and scope of your freelancing enterprise.

For people who only have to send a couple of invoices a month, the Starter plan is adequate. It restricts you to five invoices and/or quotes, five bills, and 20 reconciled bank transactions. The Standard and Premium plans offer unlimited invoices, bills, and reconciliations. Premium is the only plan to support multiple currencies.

From a features standpoint, it's hard to think of anything freelancers will want that's not already included. The app lets you accept payments, manage contacts, control inventory, pay bills, create purchase orders, track timesheets, and a whole lot more. Unfortunately, payroll management is not yet available in every U.S. state.

It's also great from a tax perspective. You can calculate tax on-the-go as you perform jobs and can create and submit W2 and 1099 forms from within the app.

Finally, the software can easily connect with other apps that form part of your freelancing life, including Expensify, PayPal, SquareSpace, Stripe, and Deputy.

Oh, and it's worth mentioning that Xero has a handy tool to import your data if you're making the switch from QuickBooks.

2. Wave

"A powerful free app for new freelancers."

If you're just starting out on your freelancing journey, Xero's $9 Starter package might seem like an unnecessary luxury.

Instead, way not try Wave? The multi-faceted software specializes in accounting, invoicing, payments, payroll, reoccurring billing, and receipt management. And the best part? The accounting, invoicing, and receipt management parts of the app are entirely free to download and use.

The app offers additional services that it charges on a pay-as-you-go basis. If you're in the United States, these add-ons include credit card processing, bank payment processing, and payroll management. Most European countries can only utilize bank payments.

The accounting part of Wave is managed through an intuitive dashboard. It'll do everything from handle your tax situation in real-time to provide charts and graphs about your current finances. You can also use the dashboard to generate instant reports about profit and loss, sales tax, and account balances.

And even though the app is free, it still boasts high-quality security measures. They include 256-bit encryption and PCI Level-1 certification.

3. FreeAgent

"An app tailored to non-expert British and American users."

Although Xero offers an excellent series of tutorials and help files, there's no denying that the near-endless features can be a bit overwhelming for non-experts. If you're a freelancer, you don't want to be bogged down for days fiddling with your accounting app -- it's lost time and money.

FreeAgent positions itself as a beginners app. That doesn't mean it's short on features, but the language and the layout of the app are explicitly geared towards people who can't tell a balance sheet from an invoice.

For example, there's no hint of accounting terms like "Accounts Receivable" or "Accounts Payable." Instead, you'll see headers like "Work" and "Expenses."

Like most cloud-based accounting apps, the headline information is delivered via a dashboard. It gives you tax deadlines, real-time reporting, timesheet overviews, and more.

The entry-level package is £14.50/month in the United Kingdom and $12/month in the United States.

4. VT Cash Book

"Free no-frills accounting with no cloud features."

Every app we've looked at so far is feature-rich, but that doesn't suit everyone. If you just want a simple way to track your income and expenditure, VT Cash Book is the app for you.

The app only has five functions:

- Recording day-to-day transactions

- Support for multiple bank accounts

- Bank reconciliation features

- Tax calculations

- Three reports (profit and loss, balances, and ledger sheets)

It's rudimentary, but it's efficient. And it's entirely free. If you're running a simple freelance operation, an app as basic as VT Cash Book could be all you need.

5. QuickBooks

"A good alternative to Xero, but more confusing."

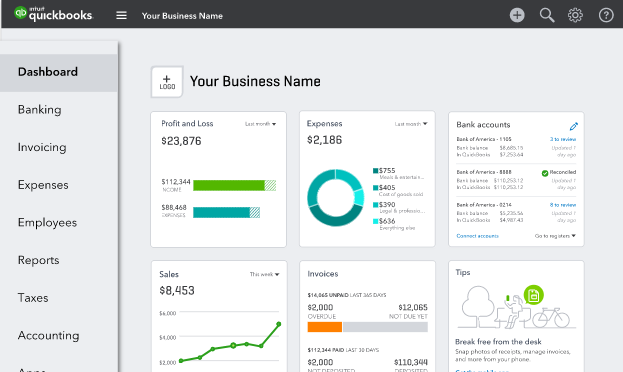

We referred to QuickBooks earlier in the article and we've covered the app in detail elsewhere on the site. It battles with Xero for the number one spot in the world of cloud-based accounting apps. The app debuted in 2002 with an online version following two years later. Both the desktop and online versions are still available.

The software is impressively powerful. It boasts customizable invoices, double-entry accounting, inventory management, payroll support, and multiple currencies.

A recent upgrade saw the arrival of a much-requested project management system, though many users were disgruntled to discover it came at the expense of a trimmed back timesheet management function.

Long-time users also criticize the user interface. QuickBooks was built on its reputation for being intuitive and easy-to-use, but it's no longer the case. If you've never used accounting software before, the app is daunting.

Like Xero, QuickBooks comes with three pricing tiers. It'll cost you $15/month for Simple Start up to $50/month for the Plus package. Simple Start doesn't let you create reoccurring invoices or manage bills from vendors.

6. FreshBooks

"A happy compromise between complexity and features."

FreshBooks probably occupies third-place in the list of best software. It's not as popular or as feature-rich as Xero and QuickBooks, but thanks to a 2016 redesign, it's definitely easier to use than the two market leaders.

The redesign wasn't without its downsides. The company focused heavily on an improved interface and ease-of-use, and had to make some sacrifices. As such, if you need features like estimates, inventory management, extensive financial reports, client portals, and detailed time tracking capabilities, this probably isn't the app for you.

The old features are still available in the classic interface, but support for them is slowly winding down.

From a pure accounting point of view, it also lags behind Xero and QuickBooks. It doesn't offer double-entry accounting and only supports limited bank reconciliation services. Its strengths lie in invoicing, billing, and client management.

The entry-level Lite package costs $15/month, but you can only bill five active clients. The top-end Premium plan for $50/month increases the limit to 500.

Which Accounting Software Do You Use?

The six apps we've covered each have their own strengths and weaknesses. More importantly, each is geared towards a different type of user.

Luckily, all the paid apps offer free trials. Make sure you test a few of them before committing to a payment plan.

Which accounting apps would add to this list? What unique features make them so special? As always, you can leave all your opinions and suggestions in the comments below.

Image Credit: avemario/Depositphotos