Technology has had an incredible impact on how we buy things. In 1958, the Bank of America created the first modern credit card. In 1994, Amazon.com launched, which in turn popularized the concept of online shopping. Now, contactless technologies are making it quicker and more convenient to make small purchases.

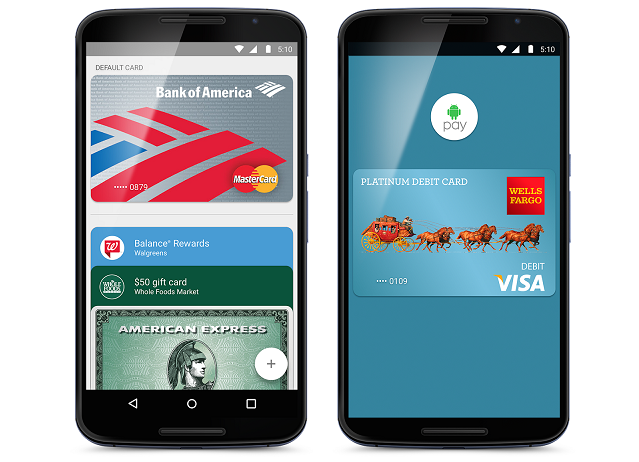

The contactless payments market is incredibly fragmented. On one hand, you have the contactless chips that are increasingly being built into bank-issued cards – Visa PayWave, American Express ExpressPay, and MasterCard PayPass are the three biggest examples. On the other, there are solutions built into mobile devices – Samsung Pay, Apple Pay, and Android Pay.

I'm most excited about Android Pay. In the eight months it's been around, it has penetrated the US mobile payments market and is now making a splash in the UK. But how does it compare? Should you ditch your contactless card for it? Read on for our verdict.

The Security Showdown

Contactless cards and Android Pay are both incredibly new. Perhaps rightly, many people are afraid of them. They're concerned about how easy it is for people to access their banking details and make unauthorized transactions.

On paper, Android Pay comes out on top, as it comes with built-in protections against skimming attacks. For each payment, it generates a unique one-time code, ensuring that bank and card details are not handed over to the vendor. Apple Pay does something very similar.

For large transactions (which by-and-large aren't supported by bank-issued contactless cards), Android Pay also requires that the user verify the transaction by inserting their security code, security pattern, or fingerprint.

For the most part though, contactless cards are pretty secure. This is partially down to the banks themselves limiting the value of the transactions that can be made. Banks regularly perform random checks to ensure the card is being used by the authorized user, where they ask the user to input their PIN to process the payment.

While Android Pay offers greater protections against skimming attacks, users of contactless cards can protect themselves by purchasing an RFID-blocking wallet or card holder. These can be bought cheaply on Amazon for as little as $20.

Availability and Access

Let's be honest. There's no contest here. Contactless cards – like Visa PayWave and Mastercard PayPass – are everywhere.

Banks around the world - from Malaysia and Thailand, to Slovakia and the United States of America - are issuing contactless debit cards, and they're doing it in even greater numbers. Contactless technologies have even found their way into the world of prepaid debit cards.

Acceptance of the technology has similarly soared, especially in Europe and Australia. What was once just limited to a handful of coffee shops and fast food outlets has become commonplace. Retailers that do not welcome it are the exception now, and not the rule.

It'd be unfair to judge Android Pay – which has only been around since September of last year – with something much older. However, it's worth noting that regional and bank availability for Android Pay is nothing compared to traditional contactless cards.

Firstly, it's only available in the UK and the US. Those living elsewhere are out of luck. That said, Google's a very ambitious creature, and it's fair to say its aspirations aren't limited to just those two countries.

Bank availability is similarly limited. In the United States, Chase is yet to embrace the technology, although according to Digital Trends, they will soon do so.

In the UK, the list of banks that are yet to support Android Pay include the Royal Bank of Scotland, Santander, TSB, the Co-operative Bank, American Express, and Tesco Bank. Also absent is Barclays, which is working on its own contactless payments solution, called bPay.

While bank support is sluggish, vendors are more enthusiastic. You can even use Android Pay to pay for your fare when you ride the Tube.

Finally, it's worth noting that contactless cards don't run out of battery, while phones do. If you're worried about your phone dying on you, this may be something to take into consideration.

Value Added Services

What makes Android Pay so compelling is the value added services it offers.

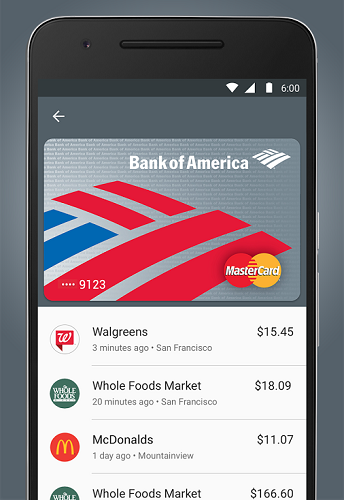

Because it's app-based, it gives users easy access to their transaction history. Users can scroll through and work out what they've been spending, making it easier to budget. They can identify fraudulent transactions. Moreover, Android Pay brings in the possibility of integrated loyalty programs.

When it comes to traditional contactless cards, these value added services are at the discretion of the bank. Mine credits a percentage of my purchases to my account when I shop at certain retailers. Other banks are less generous and offer nothing.

Device Availability

To use Android Pay, you're going to need an NFC-compatible smart phone. Even in 2016, these are few and far between.

Most of the recent Nexus devices will be compatible. They're the flagship Android-phones – it'd be weird if they weren't. Similarly, the more recent high-end devices from LG, Motorola, Sony, and Samsung all support it.

Two recent high-profile devices that lack support for Android Pay include the OnePlus 2 and the Huawei Honor 5X, both of which lack the physical NFC radios necessary for it.

There are also specific software requirements to use Android Pay. It won't work with devices that have been rooted, or those with unlocked bootloaders. If you're using a custom ROM, chances are that it won't work with Android Pay. Finally, you need a smartphone or tablet running Android 4.4 KitKat or above.

If you've bought a phone in the past two years, and you haven't messed around with it, you should be fine.

Contactless or Android Pay: Which Is Better?

Both offerings have their own inherent advantages and disadvantages. Android Pay has better security and allows you to leave your wallet at home. On the flip side, it only works while your phone has power, and there's a chance your bank or device won't support it.

Contactless payments lack the allure of Android Pay, but they make up for that by offering better availability and reliability.

Do you use Android Pay? Like it? Loathe it? Let me know in the comments below.