Online shopping is a double-edged sword; on one hand, Amazon is a life-changer, especially once you take advantage of all the benefits of Prime. On the other hand, it makes it too easy to overspend on frivolous items.

That's why we're going to explore a few tricks you can use to beat your bad spending habits. In other words, this is a post for those who have a spending problem. If these tricks seem drastic, it's because they are. But if you're spending too much online, you need to take action. Here's what to do.

1. Kill All Daily Deal Emails

If you're a frequent online shopper, then you've probably signed up to a number of daily deal emails in the past. These emails are useful -- who doesn't love a good deal? -- but they're also manipulative.

Most of us aren't thinking about online shopping every minute of the day. We go to work, we take care of our kids, we hang out with friends. The shopping urge is usually latent. But as soon as we spot a good deal, the urge strikes in full force.

Daily deal emails are awesome, but only if you have the self-control to be judicious about what you buy and how much you spend. Without that self-control, daily deal emails are little more than triggers that spur us to shop, shop, shop.

Unsubscribe from all of those newsletters and notifications. Use a bulk unsubscription tool if you can. In this case, "out of sight, out of mind" is the way to go.

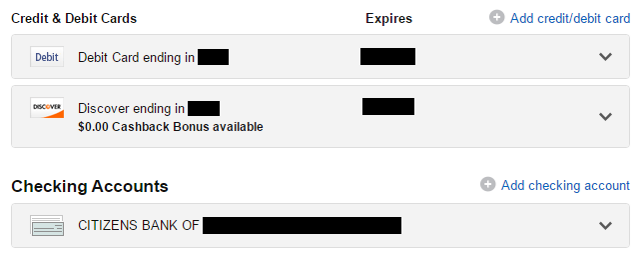

2. Unsave Payment Details

Few innovations have been as damaging to personal bank accounts as the one-click purchase feature that exists on most major shopping sites. Now you can buy things without even thinking about it, and that's simply no good.

Again, these kinds of convenience features are awesome if you can exercise self-control. If you can't, then they're just ways for you to be exploited. Convenience is not worth paying for when it sucks your wallet dry.

Log onto Amazon and eBay and whatever other sites you use and remove all of your saved credit cards and PayPal details. Every extra hurdle to checking out can prove helpful.

3. Always Debit, Never Credit

Credit cards are devils in disguise. Want to have financial peace in your life? Stop spending money you don't have! The lure of credit is one reason why so many people are stressed out and drowning in debt.

If you have an online shopping problem, commit to never using a credit card. This is the online equivalent of only using cash -- you can only spend whatever you have in the bank and nothing more.

You'd be surprised how effective this can be.

To clarify, credit can be a good thing. But as with all good things, it can be abused -- and if it's abused, credit can destroy your life. If you're reading this, then you probably have first-hand experience of what that feels like.

By only using debit and never using credit, you'll never have to worry about struggling to pay off racked-up consumer debt.

Hide your credit cards and stop using them. If the problem is really bad, you can place a freeze on your credit. Or as a last resort, cancel all your cards.

4. Use the Envelope Method

The envelope method is an extension to the "debit only" trick above. Not only do you commit to spending what you have instead of relying on credit, you also limit how much money you have available at any given time.

Imagine you have an envelope with $50 cash. That's all you can spend this month. Once your envelope runs empty, you can't buy anything else until next month when you replenish with another $50. Now instead of a physical envelope, imagine a digital envelope.

You can set up a separate checking account as your spending envelope. Move all of your other money into savings or retirement accounts, and keep enough in your main checking account for bills and such. Only spend from your envelope account.

It's simple but effective.

Set up a digital envelope account and use that as your only source of money when shopping online. Or try kicking it to the next level with a 30-day no-spend challenge!

5. Create a Waiting List

For me, one of the most effective methods for curbing spending is the waiting list method. If you tend to shop impulsively when online, this will open your eyes to how worthless those purchases really are.

All you need is a pen and paper. Any time you think you want to buy something, write down the item and the current date. Wait 30 days. If you still want it after the waiting period, feel free to buy it. That's it!

I can't tell you how many times I've wanted something only to have that desire fade away within a few days. By waiting a while before buying something, you'll never feel buyer's remorse again.

What if you see an item on super sale? Shouldn't you get it now so you don't spend extra later? No. It's better to buy something you actually want for full value than to buy something on sale and end up regretting it. Don't worry about deals.

Start building a waiting list. Over the course of one year, you'll see how much you end up not buying -- and when you add up how much you've saved on impulse purchases, you'll have a huge smile on your face.

6. Swap and Barter

Instead of spending money on new items, why not trade away what you already possess instead? It lacks the instant gratification of buying something new on Amazon, of course, but it's much more cost effective.

All you have to do is find a good site or community that likes to trade, swap, or barter goods. Reddit is fantastic for this sort of thing. In fact, here are a few subreddits you may want to try:

Or you can try other online communities like Freecycle and Swap.com.

Before you buy anything, see if you can find a way to swap for it first. Not only will you save money on your purchases, but you'll also work toward de-cluttering your home (or prevent clutter from building up in the first place).

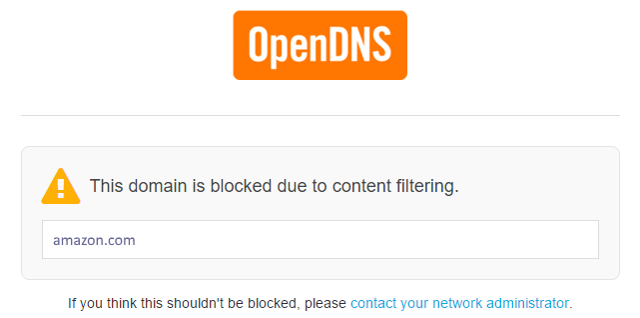

7. Block Online Retailer Sites

If worse comes to worst and you simply can't resist the urge to splurge on Amazon, then maybe it'd be best to outright block the website. If you can't see the site, you can't spend your money, right?

Fortunately, we've outlined several ways to block websites in the past, including everything from using the Windows host file to using a content filter like OpenDNS. You can also use parental control software like K9 Web Protection.

If you install a content filter, the important thing is that you give the admin password to someone else, like your spouse or a trusted long-time friend. That way if you ever want to buy something, they have to approve the purchase.

And no more window shopping! Stop that at all costs. Nothing will unexpectedly drain your wallet faster than that.

Consider blocking the sites where you're likely to recklessly spend money, and give control over to someone you trust to keep you in check. Be honest with yourself when you're thinking about this one!

Don't Let Money Master You

All of these tricks are just stopgaps. They're temporary. If you really want to shop online, you're going to find a way around all of these tips. To change your behavior, you have to go even deeper.

Mainly, you need to start seeing money in a new way, and remembering that buying things won't give you true happiness. They may grant temporary excitement, but if you want real peace, you'll have to look elsewhere.

That being said, you can still enjoy tech and gadgets while being frugal. All you have to do is cultivate good money habits and take advantage of things like smart shipping options.

Do you consider yourself an impulse shopper? What are your biggest struggles with money management? What steps have you taken to spend less money online? Let us know in the comments!

Image Credits: Cash Envelope via Shutterstock, Numbered Pad via Shutterstock.