Accounting can be confusing, time-consuming, and (if you have to pay a professional accountant) expensive.

It is no surprise, therefore, that accounting software has started to increase in popularity among freelancers and small business owners.

Such software is typically tailored to the country in which you are using it, can manage all aspects of the bookkeeping process, and is much more cost-effective than paying a professional.

One of the most popular solutions available is Xero. We'll take a look at what it is and what you can do with it.

What is Xero?

Xero was founded in New Zealand back in 2006 and has since grown to have more than 600,000 users. They offer their product based on the commonly-used "software as a service" (SaaS) model, so you won't need to download anything in order to use it.

They've received lots of industry recognition, including two Webby Awards in 2009 and one in 2010, a Fast Company Innovation by Design Award in 2012, and most impressively, first place in Forbes Magazine's "100 most innovative growth companies" list in 2014.

The product itself is one of the most multi-featured pieces of accounting software on the market today, offering almost everything that either a small business or a freelancer needs to be successful.

Its key features include:

-

- Cashflow management (online accounting, bank reconciliation, budget reports, and inventory management)

Invoicing (sending, paying, and issuing quotes)

- Payment management (expense claims, bills, and purchase orders)

- Payroll management (including timesheets and standard pay runs)

- Tax assistance (W-2s, 1099s, sales tax calculations, and filing returns)

But what are its five most useful features? Let's investigate.

Tax

Ah, tax... Federal 940s, W-2s, 1099s, employment taxes, unemployment taxes – what does it all mean?!

While Xero can't teach you about all the individual federal and state-level tax codes and forms (though they it does have a great basic help guide), it can make calculating them and submitting them a lot easier.

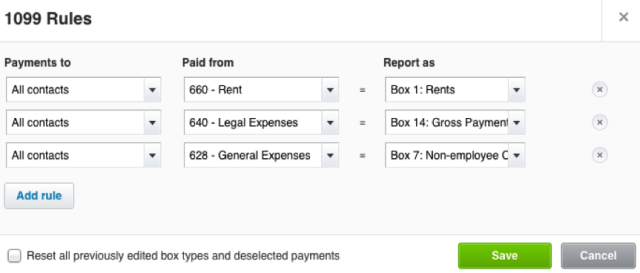

For example, it will let you instantly work out how much should be filed on W-2s and 1099s. It'll even remove the never-ending confusion over 1099 vendor classification by letting you run a report then making any necessary adjustments.

Here's a look at the process:

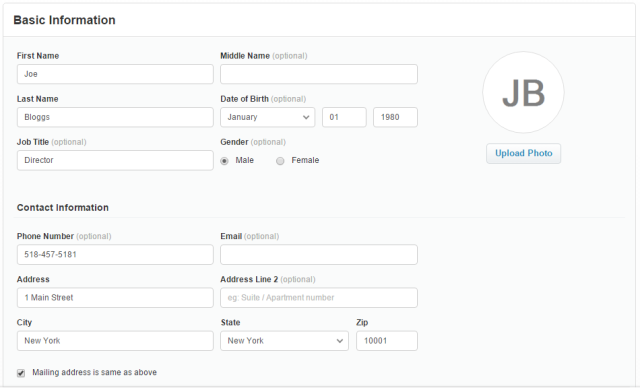

In order to file a W-2 (arguably the most common tax form in the States), you first need to create an employee. Do this by clicking Payroll > Add Employee and filling in the necessary personal details.

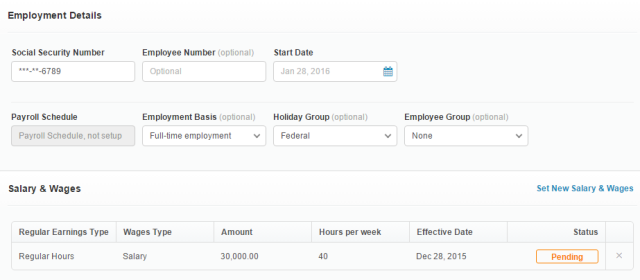

Next, you'll need to fill in their employment details - including salary data and their social security number. Obviously you should already have all your employees' information, but failure to add it here will result in you being unable to add the individual to your payroll.

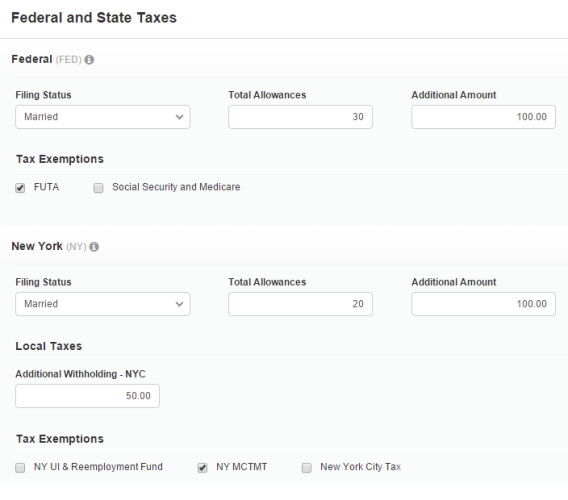

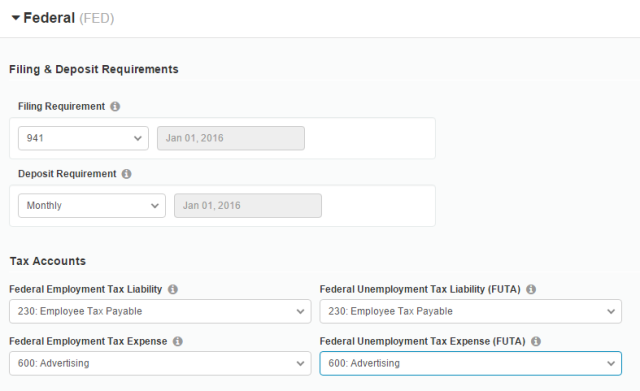

Finally, you can add their individual federal and state tax details. It should be noted that this can still be a potential minefield for non-professionals. It might be wise to pay an accountant to make sure this is all set-up correctly - it's self-managing thereafter, so you'll still save a lot on fees in the long run.

Once you have an employee fully set up, you'll also need to set up your own company's taxes. You won't be able to create a payroll (and thus generate tax return data) until you've done this.

Navigate to Settings > Taxes and fill in both your federal and state information:

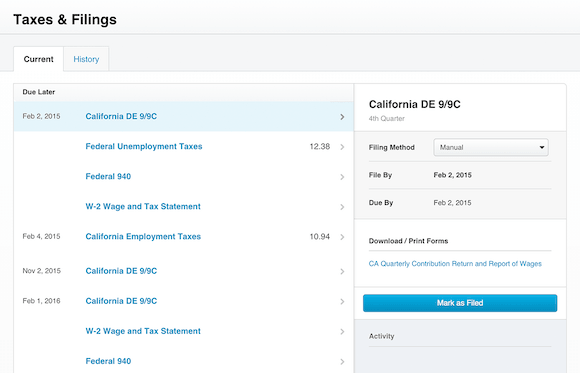

That's it. Just run your payroll each month, and the software will automatically withhold taxes where appropriate and log it all in the system. At the end of each tax year you'll be able to issue the necessary W-2s and any other state forms that may be required.

You can follow exactly the same methodology for independent contractors, only this time you'll need to issue a 1099 form instead.

Best of all, you don't even need to worry about submitting the 1099 tax forms, once you've filled them in you can file them from within the software by using Track1099.

There are actually lots more tax issues that Xero can help you with, aside from IRS forms.

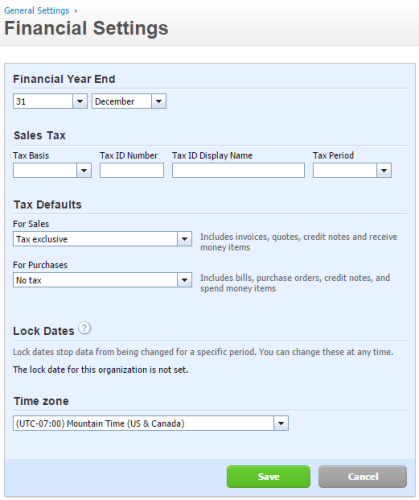

For example, it will automatically calculate sales tax depending on your locale, and Xero's integration with Avalara TrustFile means you can prepare and submit sales tax returns almost instantaneously (go to Settings > General Settings > Financial Settings to enter your information).

You can even export the Xero files into hard copies if you prefer a more "DIY" approach to tax filings.

Payroll

Running payroll on weekly, bi-weekly, or monthly basis can almost be as confusing and time-consuming as working out your taxes!

There are several aspects to Xero that will help make your payrolls less painful.

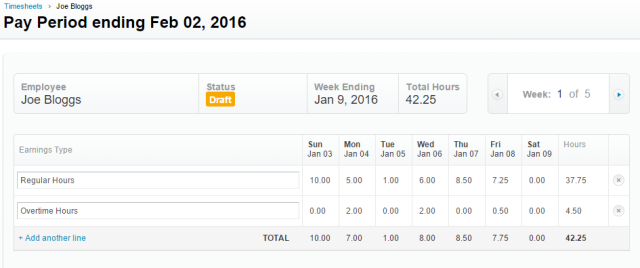

Firstly, it includes employee timesheet software. Employees can enter their own data, or you (or another employee) can do it on their behalf, and it comes with extensive reporting tools that will let you see data based on hourly earnings, income type, and money spent per employee or per time period.

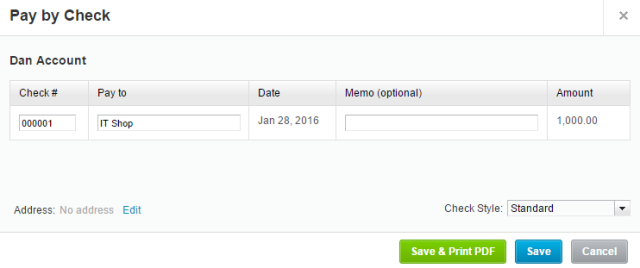

Secondly, it comes with payment software. In practice, this means you can run and approve employee payroll on a fixed date, one-off payrolls mid-cycle, and initiate direct deposits into your employee's bank accounts. You can even print checks and paystubs, both of which can be customized with your own company's branding.

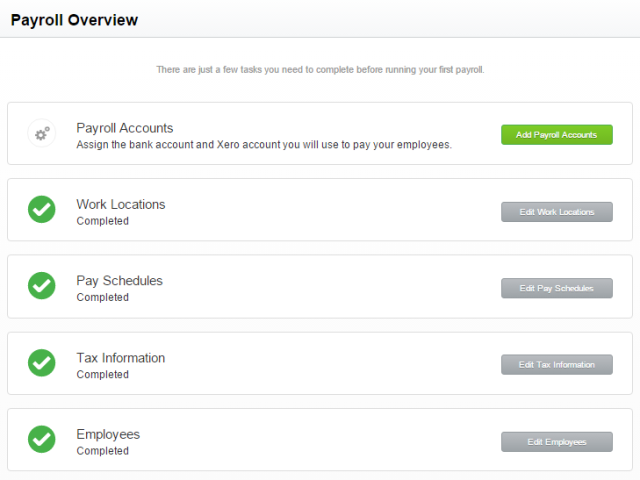

Be aware, you'll need to set up employees, tax information, work locations, pay schedules, and bank account information before you can run full payrolls.

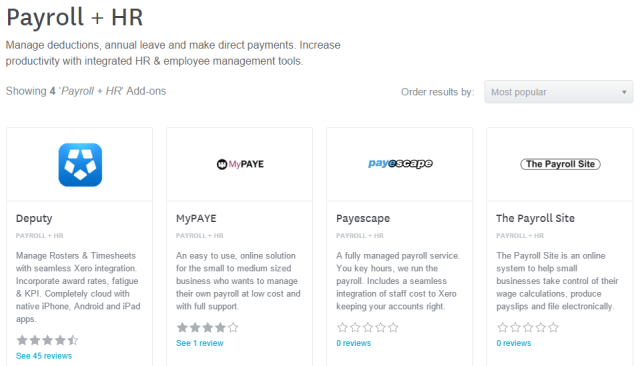

Lastly, there are a whole host of third-party apps that can provide additional functionality. For instance, if you have employees who work in countries that aren't natively covered by Xero, you can use plug-ins so you can still pay them.

Expenses

Okay, so the heyday of using company expense accounts to pay for everything from dinner to exotic vacations might be long gone, but they are still a vital part of a modern business set-up.

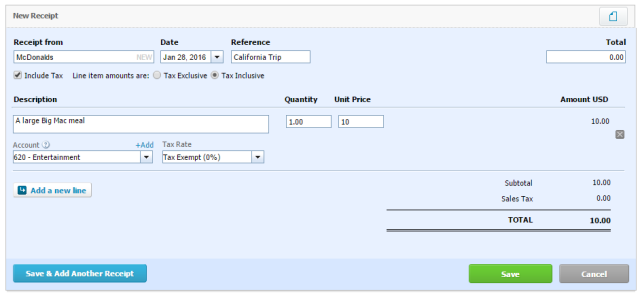

The expense management function of Xero is highly impressive, enabling you to both manage your own personal expenses as well as reimbursing your employees for their costs.

From a user perspective, it will let you (and your employees) add expenses while you're out and about just by taking a photograph of a receipt and submitting it via the mobile app, thus making it less likely that costs will be overlooked.

From a management perspective, receipts from trips are grouped together so you can easily see the total cost, and you can approve and reject claim as you see fit.

All of this data can then be exported to the payroll feature to make payday even more straight-forward.

Freelancers can also stay on top of their expenses (and their wider cashflow situation) by using the bank reconciliation feature.

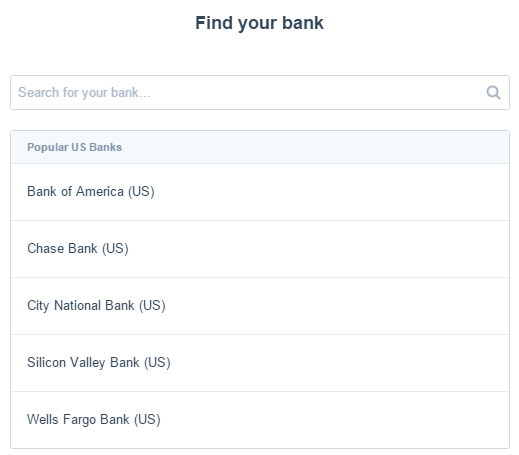

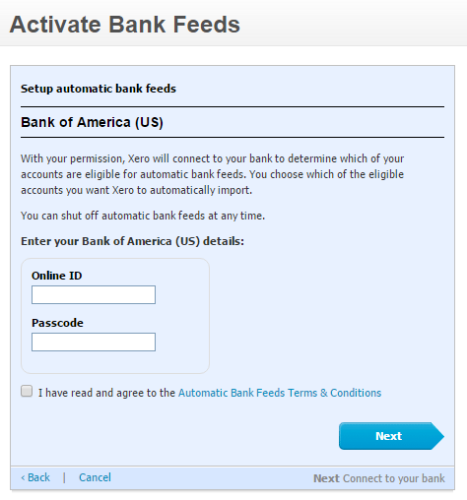

Firstly, you'll need to add a bank account. To do so, navigate to Accounts > Bank Accounts > Add Bank Account. Popular banks are automatically listed, and you can also add services such as PayPal and credit cards.

Fill in your account number and give the account a name, then you'll be presented with a screen that'll let you import all your bank feeds.

Once that's done, you can import all your bank's data and it will automatically reconcile with Xero's. The data can be accessed via the mobile app for on-the-go reconciliation, you can create custom rules to help match more complex transactions, and over 160 currencies are supported.

https://www.anrdoezrs.net/links/7251228/type/dlg/sid/UUmuoUeUpU50482/https://vimeo.com/54886894

Financial Reports

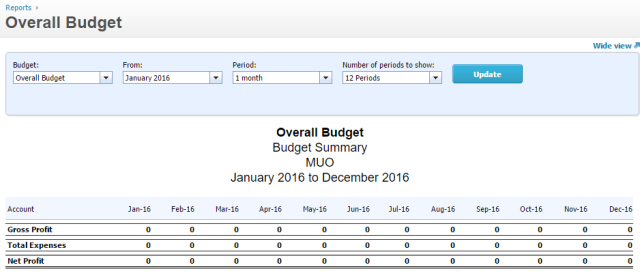

It is very difficult to get a clear understanding of how healthy your business is without clear and effective financial reports.

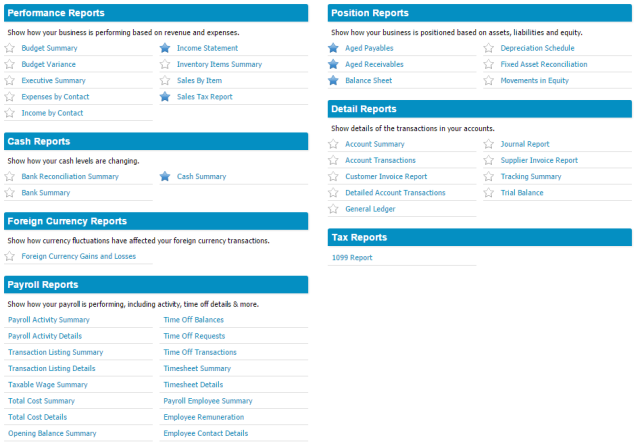

Thankfully, Xero provides more than 40 basic and advanced financial reports. These include all the most common ones, such as profit and loss, sales tax returns, and balance sheets – but also more unusual (but equally useful) ones like foreign currency gains and losses and depreciation schedules.

The reports also offer budget trackers (so you can prepare outlines and compare actual performance against predicted performance), and the ability to add tracking categories (thus giving you an easy way to compare and contrast individual sections of your business).

All these reports can be prepared and printed in a matter of clicks.

Invoicing

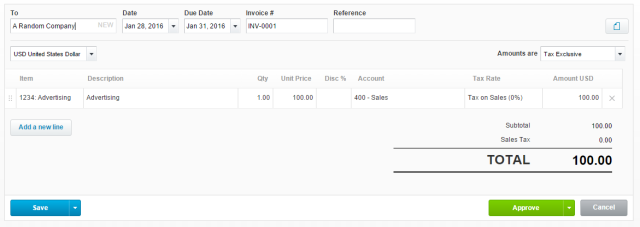

What good are all these fancy features if you cannot easily manage invoices? They are the bread and butter of running a business, but can quickly get complicated if you have a lot of clients.

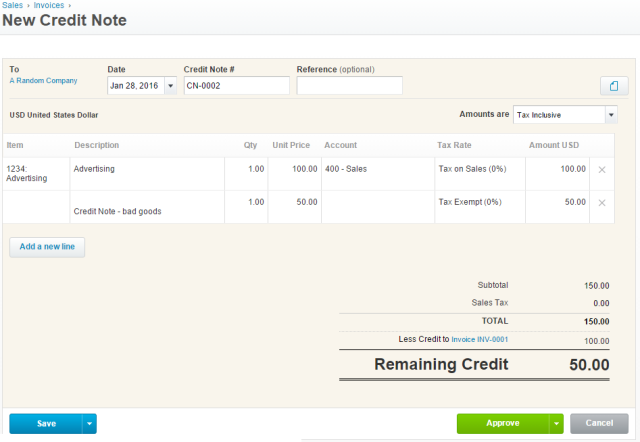

Xero's invoicing function boasts a lot of cool features. For example, you can add credit notes and easily recharge expenses back to clients by using a special tag, and credit notes can be issued where appropriate.

Your customers will also be able to pay your invoices in just a single click via either credit card or PayPal, and you'll be alerted when customers open their invoices (so you know if they are just ignoring you!).

Finally, like the payroll software, you will be able to personalize and customize all your invoices with your own logos and branding.

Have You Used Xero?

Have you used Xero? Which functions and features did you like? Which needed more work? Is there anything missing that you'd like to see the developers introduce?

You can let us know your thoughts and feedback in the comments section below.