With so much to learn about cryptocurrencies, it's easy to forget about the problems of real-world money. If you've ever sent money internationally you'll know it's a potential minefield of hidden charges, security concerns, and paperwork. If you need to send money regularly -- perhaps to pay a mortgage on a second home or to family members who live abroad -- then there are some tips you should always remember to keep your experience as cheap, smooth, and hassle-free as possible.

Find the Best Exchange Rates

The first place that most people think of when they need to send money internationally is their high street bank.

This is a mistake -- banks never offer the best exchange rates. It's understandable, banks primary business focus is not on foreign exchange, but it means that lots of people are losing out on significant sums of money for no reason. This is especially true if you need to transfer a large lump sum.

Instead, you should you use a foreign exchange expert. There are lots to choose from, but some of the market leaders are Moneycorp, TorFX, and Currencies Direct.

By way of comparison, let's compare today's (11th June 2014) exchange rates of one of the UK's leading banks -- the Royal Bank of Scotland (RBS), with the aforementioned Moneycorp. If you use RBS to make a transfer of $100,000 into GBP you would get £54,684, whereas with Moneycorp you would receive £59,530 -- thus leaving you almost £5,000 better off.

Find the Cheapest Fees

If you need to send money on a regular basis for a mortgage or pension, then the transfer fees are as equally dangerous as the poor exchange rates.

Although intra-EU transfers are always free thanks to the Single Euro Payments Area (SEPA), RBS charges £40 to send a transfer from the UK to a non-European country. This is fairly typical of most banks, you can expect to pay a minimum transfer fee of £25 regardless of which high street bank you choose to use. If you are transferring money on a monthly basis, RBS's fees would add up to an eye-watering £480 over the course of a year.

Moneycorp charge £4 for the same service, meaning that over a year you would only pay £48 – a saving of £436 per annum.

Depending on your needs, some foreign transfer specialists will even offer free transfers in exchange for a monthly or annual account fee. If you need to send money more than once per month, this option could work out to be even cheaper for you.

Time the Market

Experienced investors will know that one of the golden rules of investing is to not time the market. Instead, the preferred strategy is to take advantage of unit cost averaging and drip-feed your investment into your desired fund or stock basket over a prolonged period of time.

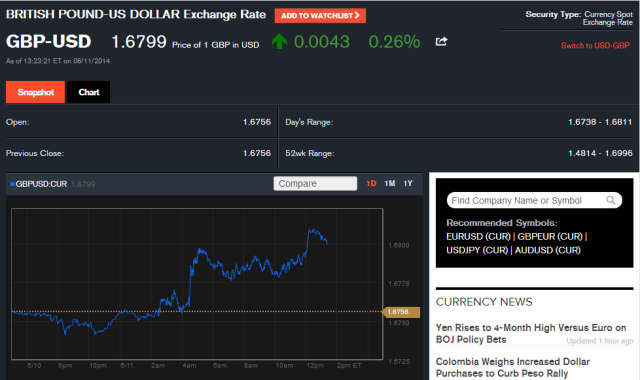

In the case of international transfers, it doesn't necessarily hold true. Instead, use a website to keep your eye on whether the currency you wish to transfer your money into is strengthening or weakening in relation to the currency in which you currently hold your capital. Good websites to do this are Bloomberg, XE.com, and CNBC. XE.com also have a great smartphone app on both Android and iOS, whereas if you just want a simple converter try using a Chrome add-on like Currency Converter.

Of course, you shouldn't be looking at the volatile individual daily prices, but rather the overall trend of the market. If the market is heading upwards then perhaps it makes sense to wait a few more weeks, whereas if the market is on a downward spiral then it's best to send the money immediately.

For an example, let's consider the situation between the British Pound Sterling and the Euro. In January 2013, £1 would buy you €1.23, but by mid-March the pound had dropped to €1.14. That means in January it would have cost you £40,650 to purchase €50,000, whereas in March it would have cost you £43,860 -- a difference of £3,210.

Naturally, personal circumstances dictate this tip. If you urgently need to send the money you might not be afforded the luxury of monitoring the market.

Is Your Service Regulated?

With any international transfer, safety and security should be at the forefront of your mind. One of the best ways to ensure you are covered from a security standpoint is to ensure the service you are using is fully regulated, insured, and licensed to carry out foreign exchanges.

In the UK that means checking that they are listed on the website of either the Financial Conduct Authority (FCA) or Financial Services Authority (FSA). Unfortunately, the situation in US is rather more complicated -- you need to check they are insured by the Federal Deposit Insurance Corporation (FIDC) if you are using a bank, or the Securities Investor Protection Corporation (SIPC) if you're using a broker's account. Regulation is carried out by either the Securities and Exchange Commission (SEC), the Federal Reserve, or the Office of the Comptroller of the Currency (OCC).

If you're not sure who is the regulatory body in your country you can check with your local citizen's advice bureau.

Get Professional Advice

There's clearly a lot to think about, and in truth this article just gives you an overview of some of the most pertinent things to look out for. The best way to ensure you are doing everything in the best way for your individual circumstances is to speak to your Independent Financial Advisor (IFA). If you don't currently have an IFA and are trying to find one, make sure whoever you choose is not tied to a particular product, is fully regulated, and holds a professional accreditation.

Tell us about your personal process for sending money abroad? Have you shopped around for the best service and settled on one? How do you determine the best value for your money?