When it comes to getting your finances in order, making sure you have enough money in savings accounts is absolutely crucial, especially if you're closing in on retirement age or you're planning on helping your kids through college. Evalgorithmic investing programsen if you just want to have enough put away for an emergency, these apps and websites will help you increase the amount of money that you have in your savings account.

Make Saving Automatic with Digit and SavedPlus

"Save money, without thinking about it." Digit's tagline perfectly sums up what this app does—every few days, the app checks the spending patterns on your checking account and takes a few dollars out to put into savings. Exactly how much it takes is determined by an algorithm that takes into account your spending, how much money you have, and how much you can afford at the time.

This is a more realistic system than a monthly bank transfer of an arbitrary amount, which you might be able to afford one month and not the next. Your funds are deposited in a savings account that you open with Digit when you sign up; the account has no fees, but it also doesn't earn any interest (Digit uses the interest to make money). Even so, an automatic transfer of however much you can afford at the time is appealing.

Get more details or sign up for Digit

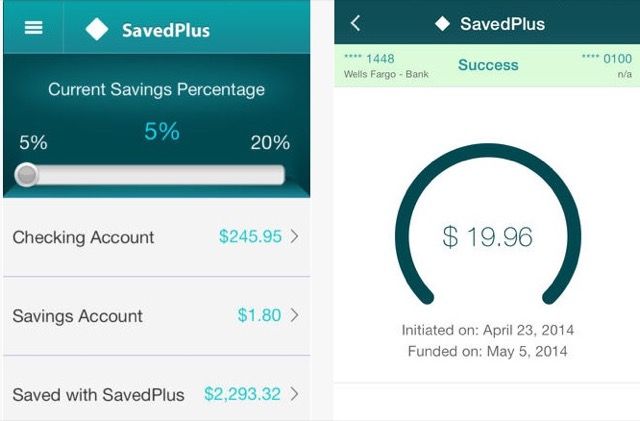

Setting aside a certain percentage of every purchase you make is a great way to rapidly grow your savings, and that's exactly what SavedPlus does. Connect it to your checking and savings accounts, choose a percentage between 5% and 20%, and every time you make a purchase, SavedPlus will move some money into your savings account. You can also add credit cards, so you can continue to get your rewards points while you're saving.

SavedPlus is currently free, but they'll be going to a pricing model soon. They plan on releasing new versions of the app soon with "enhanced functionality [and] fee based features." Whether there will be a cost for the service or just for specific features remains to be seen. Either way, if you're transferring enough to a savings accounts with a decent interest rate, it will still probably be a great deal.

SavedPlus for iOS / Android (free)

Save and Invest Your Spare Change

Putting your savings in the stock market is risky, but if you do it well, you could potentially end up growing them very quickly. Every time you make a purchase, Acorns rounds it up to the next dollar and invests your spare change in low-cost exchange-traded funds (ETFs). You can also create recurring or one-time deposits to kick-start your portfolio.

Using Modern Portfolio Theory as a guide (as many algorithmic investing programs do) and automatically rebalancing your portfolio according to your risk preference, the app helps you develop a solid investment profile with little effort. With low monthly fees ($1 per month for accounts under $5,000 and 0.25% per year for those over), no fees for withdrawing or depositing, and an emphasis on low-cost ETFs, Acorns is a financially efficient way to start (or continue) investing.

Download Acorns for iOS / Android (free)

Acorns isn't the only way you can save by rounding up your purchases to the nearest dollar. There are a number of banks that will do the same thing with purchases on your debit card. Bank of America has a program called Keep the Change, Navigator Credit Union has a Save'N Up debit card, and online bank i-bank has the I-Round Up Savings Program. Ask your bank if there's a similar program you can enroll in to start saving your spare change.

Optimize Your Accounts

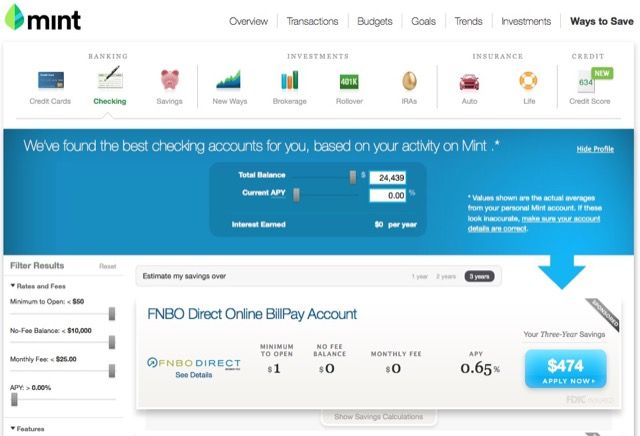

With hundreds of different types of accounts and dozens of different banks—including many banks that don't have physical locations—it can be tough to know which you should open. But if you keep track of all of your finances with Mint, an online financial organizer, the website will take a look at how you spend and save and recommend accounts and credit cards that will give you the highest interest rates and best rewards.

Putting your savings into an account with a higher interest rate might not make much of a difference over the next couple years, but it could make a big difference over 20 or 25 years, especially if you're making regular deposits.

There are also a number of websites that compare the interest rates, fees, and minimum deposits on a wide variety of savings accounts. BankRate, Money Super Market, and NerdWallet all provide resources that will help you find the best interest rate for your savings account (most of which are found in online banks).

Set Goals

Wanting to increase the amount in your savings account is great, but if you set an achievable goal, you'll be much more likely to stick to the plan. There are apps out there that will help—I previously mentioned Mint, which is great for setting and tracking financial goals.

Even an Excel spreadsheet for your finances will do. Anything to keep track of your financial goals and help you stay on track to reaching them will help you stay motivated to grow your savings.

Save More!

Increasing the amount of money that you have put away in savings isn't always easy, but the tools and strategies listed above can be a huge help in getting you closer to your goal, whether it's retirement, college tuition, or just getting your finances in order. Pick a few of these strategies and start today—the earlier you get going, the more you'll be able to put away!

What's your favorite app, website, or strategy for growing your savings? Have you tried any of the ones listed above? Share your thoughts below!

Image credit: Saving money concept (edited) via Shutterstock.