Gamification is precisely what it sounds like. It's where concepts often found in video games -- like leveling up, leaderboards, and a narrative -- are incorporated into things that aren't games, with the aim of changing how somebody interacts with that thing.

It's getting big. Now, everything from credit scores to education is being gamified, and it's a trend that shows no sign of stopping.

Here are 3 unlikely everyday things that are being turned into games.

Gamification of Purchase Decisions

One of the most prevalent examples of gamification in ordinary life is found in loyalty schemes, and frequent flyer programs. According to statistics by McKinsey, the number of programs increased by 10% year-on-year between 2008 and 2012. The average household belongs to a colossal 23 loyalty programs, and many of these employ gamification tactics to increase sales and engagement.

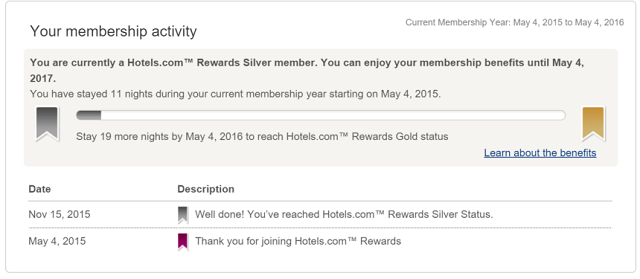

I travel a lot, and I'm often staying in hotel rooms. I use the Hotel Tonight app to book something at the last-minute. But otherwise, I almost exclusively use Hotels.com.

In the cut-throat world of hotel bookings, Hotels.com have created a gamified system where you're incentivized to give them all your business, because the more you spend with them, the more you "level up".

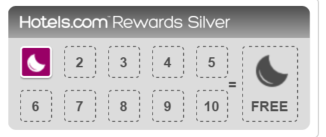

After ten bookings, you "level up" from bronze status to silver status. At this point, you get special access to customer support, and exclusive deals at properties. Later stages confer more perks and privileges, but are harder to reach. Moreover, each ten nights booked are rewarded with a free night's stay.

Your progression to each stage is visualized on something that looks awfully like an XP bar in a fighting game. And like the best games, you can never really "win". Status is something that has to be maintained, and if you fail to do so, your "XP" drops and you lose a level.

This is the basis of how loyalty schemes work. This constant need to "level up" is found everywhere from air mile schemes to hotels. This approach is now even being adopted by bricks-and-mortar establishments like Starbucks, who have incorporated it into their pre-paid payments cards. Repeat purchases allow you to reach higher status levels, which confer benefits. Much like Hotels.com, your progress is visualized like an XP bar, and you have to constantly maintain this status, lest you lose it.

Sometimes, the gamified characteristics are more pronounced.

One of the best examples came from American Airways' AAdvantage Passport Challenge in 2014. This was a Facebook game which gave the user a virtual "passport", and had to be filled with stamps. These could be earned by engaging with the app in a variety of ways, from answering trivia questions, to tracking the travel of members and friends, to even choosing flight paths.

The more stamps earned, the more rewards earned. American Airlines benefited too, with the game producing a ROI (return on investment) of over 500%.

The effectiveness of these schemes varies from implementation to implementation. Personally speaking, Hotels.com's gamified loyalty program has made me less likely to shop around for better deals, lest I lose my status.

Gamification in Education

One of the biggest hurdles to be found in online education is that of engagement. How do you keep people interested in online courses and lectures?

MOOCs (Massively Open Online Courses) are notorious for their unfavorable turnover rates. People will sign up for courses on Udemy and Udacity, and stop attending after two or three lessons, as they gradually lose interest.

One solution to this problem is found in gamification, and has been expertly employed by Duolingo.

Duolingo is a free language learning website that was first launched in 2011. The Internet is no stranger to these kinds of websites, but Duolingo rapidly developed a cadre of enthusiastic users, who delighted in the way it actually explained things.

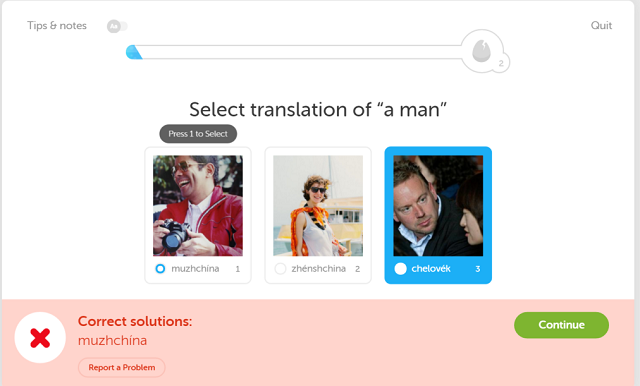

The tedious parts of learning a language – repetition and grammar, namely – have been gamified to the point where it's actually quite fun. Lessons are compartmentalized into five minute lessons, and each time you get a question wrong, you lose a life. Lose too many lives, and you'll have to restart the lesson.

As modules are completed, users level up, and can tackle lessons that are much more complicated. They also have to periodically reinforce their knowledge by completing older lessons, lest the knowledge earned previously fade or be forgotten.

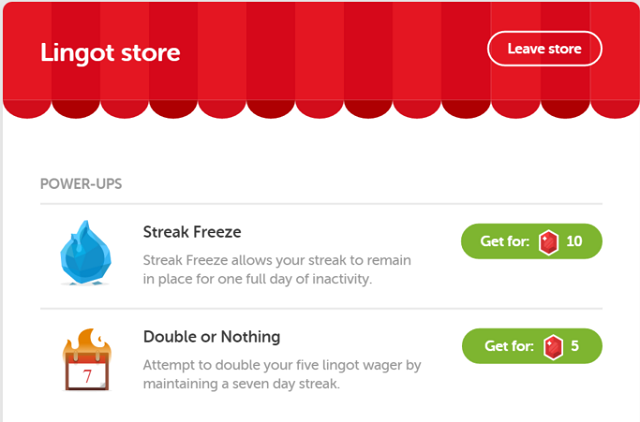

In addition to leveling up, users earn XP for each completed lesson, as well as Lingots, which are the site's official virtual currency. These can be exchanged for in-game power ups, or hoarded for bragging rights.

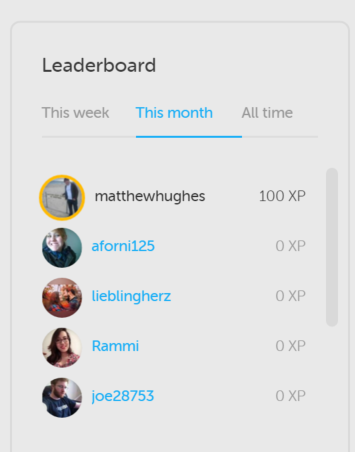

Duolingo also encourages you to compete against your friends. There are leader-boards which show how people have progressed on a daily, monthly, and aggregate basis.

It's a winning formula that's earned Duolingo 70 million users, a Reddit community of over 28 thousand language-learners, and a valuation of around $470 million dollars.

It's not just online education providers who are using gamification as a tool to change user behavior and increase engagement. It's also being used in the classroom, with services like ClassDojo. This is a tool to help teachers manage classroom behavior, by issuing pupils with awards and real-time feedback through an intuitive mobile and web application.

There's also Goalbook, which uses gamification and concepts borrowed from social networking sites, in order to set goals, and help pupils achieve them through positive reinforcement.

https://www.anrdoezrs.net/links/7251228/type/dlg/sid/UUmuoUeUpU50343/https://vimeo.com/27145045

Using Gamification for Credit Scores

If you want to get a loan or rent an apartment, you've got to have a good credit score. In the West, this is determined by a number of factors, such as your repayment history and your credit utilization. Pay your bills on time and don't max out your credit cards, and you'll have a good credit score. Miss payments, and you'll be penalized.

In China, they do it a little bit differently.

The Chinese government is currently working on a system of "social credit", which will attempt to rank citizens based on their trustworthiness. There are eight different companies working on the system, with the most viable being built by Chinese tech giants Alibaba and Tencent, called Sesame Credit (not to be confused with Credit Sesame, which is US-based site offering free access to individual credit scores).

A high score will result in more access to finance, better terms, and a greater ability to travel. Luxembourg and Singapore recently announced that they'd use these scores when it comes to issuing visas. The Luxembourg Visa is especially valuable, as it's a Schengen Agreement signatory. A visa for Luxembourg grants access to France, Germany, Italy, Spain, and the other 21 Schengen Zone countries.

They even make it simpler for people to use hotels. One person speaking to the BBC said that they'd had a deposit waived at a hotel because they had a high Sesame Credit score.

By 2020, the Chinese government will decide upon what system they'll use, and make participation in the system mandatory. Odds are pretty good that they'll end up going with Sesame Credit, simply because of the immense traction it has gained.

The scores themselves are a bit more complicated than they are in the West. They comprise other factors, including whether you faithfully settle your taxi bills, the type of job you hold, and even your purchase history. Buy video games or manga comic books, and Sesame Credit's algorithm will assume you're a lazy person, and lower your credit rating. Spend lots of money on diapers, and it will assume you're a parent and therefore responsible, so will raise your credit rating.

But what makes this system of credit scoring truly unique is that it's utterly gamified.

Users have access to their Sesame Credit score through a convenient mobile app. It's free to see your score, and you're encouraged to show it to others. According to Swedish Pirate Party founder Rick Falkvinge, writing for PrivateInternetAccess.com, almost 100 thousand people have posted their score on Sina Weibo -- the Chinese equivalent of Twitter. There's even a flashy Android app, which allows people to easily view, monitor, and share their score.

But what's more, you can see the score of your friends through the application. This adds a competitive edge. You're encouraged to beat your friends' high score, much like you would in a multiplayer racing game.

This is anathema to how credit scores as treated in the West -- as something private and deeply personal.

But it goes much deeper than that. The score of your friends impacts your score as well. If you've got a close friend who is always buying videogames and posting controversial statuses on social media, you'll see your score drop by association.

This reminded me of what it's like to play a game of Team Deathmatch with someone who isn't that good. It's frustrating, and because of their ineptness, you lost the game, and no longer want them on your team. The real-world consequences of a system like this don't bear thinking about.

Sesame Credit is a great example of how something as benign as gamification can be used in a way that's Machiavellian, and borderline evil.

But could we ever see something similar in the West?

Could our credit scores become a game, where we're incentivized to compete against our friends and relatives? Perhaps. But first, there'd have to be a massive cultural shift when it comes to privacy and finances. That said, there is some headroom, with gamification being used in retail banking as a marketing tool, or to alter the behavior of their customers.

In Singapore, Citigroup released a credit card where social networking and gamification was 'baked-in'. By checking into locations on a Facebook app (that was rather similar to Swarm, formerly known as Foursquare), and using the card, users accumulate points.

In Malaysia, CIMB (Commerce International Merchant Bankers) have released a number of online games in order to teach users about financial literacy. These games are aimed at younger audiences, and include games that teach good saving habits, and even include a virtual stock market ticker. This game has since been retired, and removed from their official website.

And in Australia, the Commonwealth Bank of Australia released a game that teaches the audience how to purchase and own property, and to manage the financial deals. It's almost like a property-owning simulator, but one that's deeply centered around the brand of one of Australia's largest retail banking institutions.

Is your bank or credit card company using any unique gamification ploy that has changed your behavior? Share them in the comments.

Our Brave New Gamified World

Gamification promises to radicalize how we learn things, make purchasing decisions, and in some places, it'll even determine whether you travel abroad, or get a loan. It doesn't stop there. Bloggers are using it to build a following of devoted fans. Some people use it to build good habits with tools like HabitRPG. You can even use gamification to get fit!

Some people question its efficacy. One of its biggest critics has been Ian Bogost, who published a damning piece about it in The Atlantic. But despite that, it's here to stay.

But the question remains, is this a good thing? What do you think. Leave me a comment below, and we'll chat.