Bitcoin set the standard for a decentralized blockchain asset, designed to tackle the centralized monetary policies of the Federal Reserve. By that standard, cryptocurrencies that followed were measured. One of them is Solana (SOL), an alternative to the Ethereum boasting drastically lower fees and faster transaction speeds.However, the price paid for those features is higher centralization, with many crypto users contending that Solana isn't decentralized in the same manner as Bitcoin or Ethereum. So, what's the truth? Is Solana decentralized or not?

1. Private vs. Public Token Allocation

If you were to own an apartment in a residential building, your housing unit would account for your ownership share of the whole building. For example, if the building has nine other apartments, your share would be 10%. The same applies to blockchain networks like Solana, except that ownership share is tokenized.

The first breakdown of Solana's overall token allocation came to light last in May 2021 blockchain research firm, Messari. As you can see from the chart below, nearly 50% of Solana's SOL tokens are held by Venture Capital investors, the developers, and the Solana Labs company, headed by its CEO Anatoly Yakovenko.

Comparatively, Ethereum has over three times fewer tokens held by insiders. This is a similar situation when Binance, the world's largest cryptocurrency exchange, decided to launch its own smart contract platform—Binance Smart Chain. Therefore, although Solana is a public blockchain, it is fair to say it is privately owned.

However, every other blockchain has its own foundation in charge of its development. The question is, what is the stake of the community via the network's tokens? Before answering that, we must understand how blockchains work.

Centralization Creates Vulnerability

Even more important than token allocation is the network's security and stability. With blockchain technology, this is measured through the number of nodes. These are computers bound by the network's consensus protocol. The consensus is the cornerstone of blockchain technology.

Because blockchain is a distributed digital ledger, every cog of the network holds the whole ledger. This means that each cog—a full node—can verify a transaction's authenticity against the other. Therefore, the network's security then relies on who holds the nodes and how many are there.

In the case of Bitcoin, this consensus is called proof of work (PoW), while smart contract platforms like Ethereum or Solana use proof of stake (PoS). PoW full nodes are called miners, while PoS full nodes are called validators. The job of both is to verify transactions and add them as a new data block on the blockchain.

This is how the distributed digital ledger (DLT) is built up, with tokens as economic units of the network.

2. How Many Nodes Does Solana Have?

Now that you understand how blockchain networks work, it is easy to see that validators run the network. To illustrate, only 21 validators run Binance Smart Chain, with a market cap of $63.1 billion. In stark contrast, Ethereum has 2,471 full node validators.

Solana has 70% fewer, at 1,447 nodes. Although this means the network is faster than Ethereum because fewer verifications and confirmations have to be conducted, it also means the network is less decentralized.

Furthermore, Solana doesn't have a slashing mechanism implemented. Because tokens are economic units used to secure the network, staking them yields rewards. However, what prevents validators from behaving maliciously?

Outside their own self-interest to benefit the network, the slashing mechanism is on Solana's roadmap. When malicious behavior is detected, slashing will remove a portion of the validator's stake. Unfortunately, it is yet to be implemented, as per Solana's official roadmap:

"Slashing is a hard problem, and it becomes harder when the goal of the network is to have the lowest possible latency."

What Is Solana's Nakamoto Coefficient?

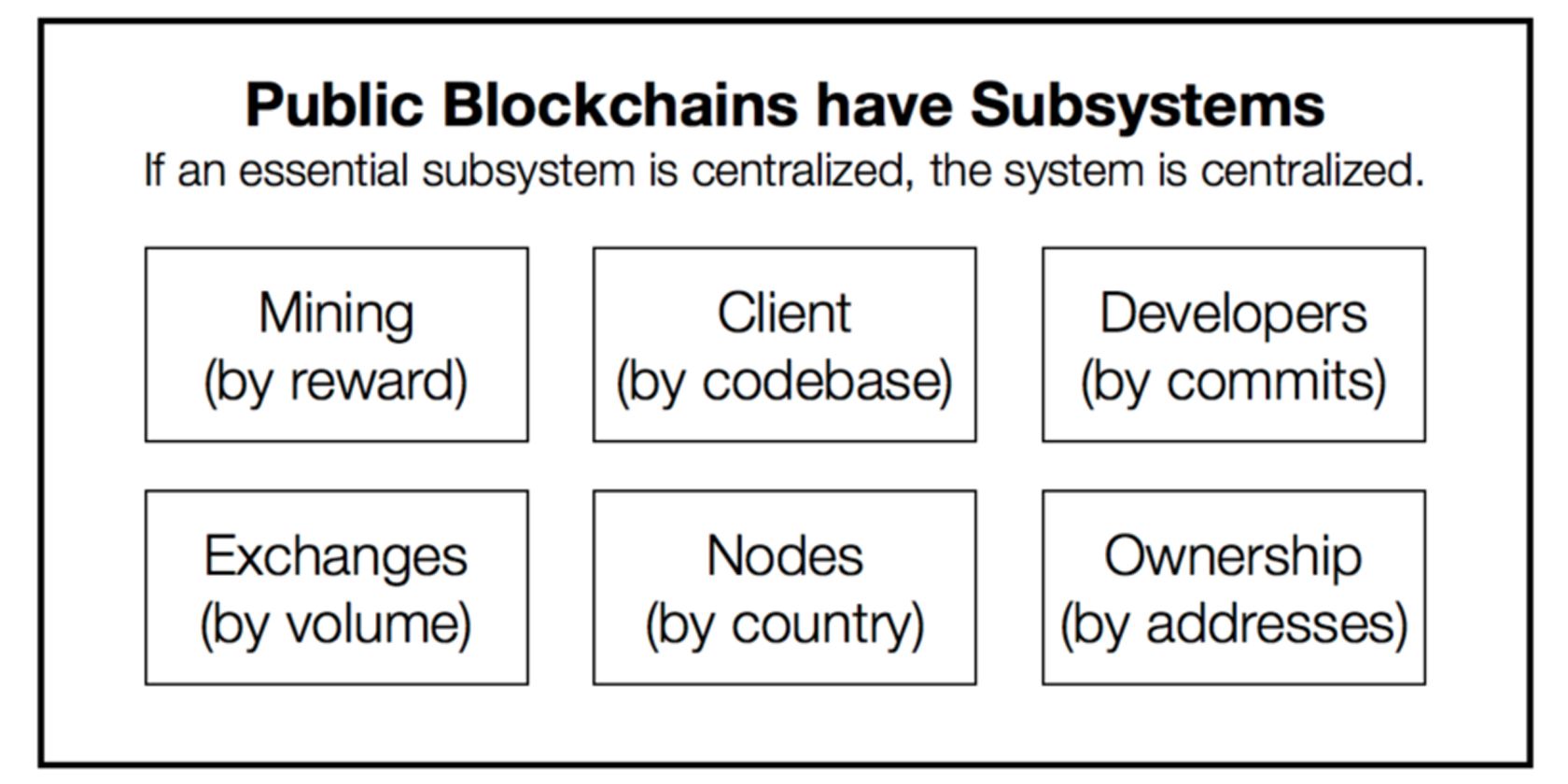

Nakamoto Coefficient is a metric that accounts for all the network's subsystems. Because they make up the control of the network, each share contributes to how centralized a network is. There are six of them.

According to crypto exchange CrossTower, Solana's Nakamoto Coefficient stands at 19. For comparison, the most decentralized blockchain network, Bitcoin, has a coefficient of 7,349. This means it would take that many validators to compromise the security of the network, while it would only take 19 for Solana.

In raw numbers, just the top 10 Solana addresses hold 16% of the circulating supply (314.9 million SOL). To illustrate the disparity, as of December 2021, there are just over 2.3 million active Solana addresses.

3. Solana's Outages

Starting in September 2021, the Solana network has gone down three times, with the entire network down for at least 17 hours on one occasion. Attackers flooded the network with transactions, overloading the network's memory capacity.

Speaking of which, another sign of Solana's high centralization is its partnership with Arweave. Although touted as a "decentralized permanent data storage solution of ledger data," the "decentralized" part refers to storage redundancy, not the community.

After the first major outage, Solana engineers had to restart the network. In its most recent outage (to the time of writing), on 4 January 2022, Solana suffered a distributed denial-of-service (DDoS) attack. Once again, the issue was spam, rendering the network inert for five hours.

Interestingly, when Solana was first flooded in September 2021, Ethereum was also attacked, but it was unsuccessful. More importantly, Ethereum has never been down as a whole network.

The Verdict: Is Solana Centralized?

It seems that Solana achieved its primary goal, taking advantage of Ethereum's enormous fees. It did so by providing a centralized network that can afford low transaction fees. While ETH gas fees can go up as much as $200, Solana charges merely $0.00025 per transaction. However, with the number of network attacks and restarts, more investors are seeing that the price might not be worth it.

This places both blockchains at a disadvantage. The more popular Ethereum gets, the more its network is congested, resulting in higher fees. Likewise, the more popular Solana gets, it attracts more hackers who take advantage of its lack of decentralization.

However, Ethereum can count on Layer 2 solutions to step in, such as Arbitrum, Loopring, Polygon, Optimism, dYdX, and others. With time, perhaps Solana will be able to call upon the same solutions to boost its decentralization and make it more robust. Just like with video games, it's unfair to judge an unfinished product.